Written by Alicia

Posted 27 October 2022

Written by Alicia

Posted 27 October 2022

If you received another email from TaxTim requesting SARS supporting documents, but you already sent these to SARS more than 21 business days ago, one of these four scenarios might be the reason you are still waiting:

Scenario 1:

You submitted the documents directly on SARS eFiling yourself, but you did not inform TaxTim. In this case, our system needs to be updated to reflect that you already submitted your documents.

Please log into your TaxTim profile, select the tax return in question and then select the button “I have submitted the documents myself”. This will stop the reminders to send your documents.

Scenario 2:

SARS has requested additional supporting documents.

Please check your email or your SARS eFiling profile under the SARS correspondence option (to the left of your screen) and then select “Search Correspondence” on the drop down. You will then view all the letters that SARS has sent you.

If the SARS letter is exactly the same as requested before, please go through each document to make sure you have not left off anything that SARS has requested, and then resubmit the documents.

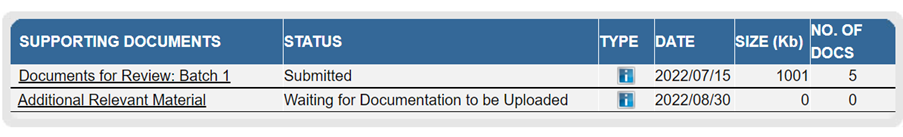

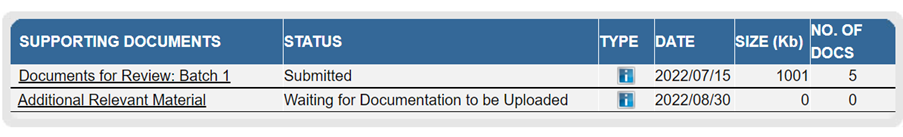

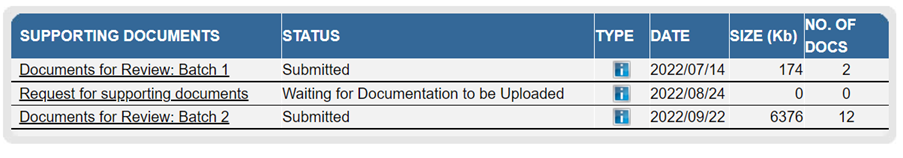

Your efiling profile will show the following screen, if additional supporting documents needs to be submitted:

Scenario 3:

If you received a letter from SARS requesting supporting documents, but there is no link open on TaxTim or eFiling for you to upload the documents, you can follow the steps in our blog to submit your documents to SARS.

Make sure you use the case number which appears on your letter from SARS.

Scenario 4:

You have re-submitted your tax return (i.e requested a correction) either on SARS eFiling or on TaxTim, and SARS opened a second link for you to submit supporting documents, but did not close the first link.

This could be that their system needs you to resubmit your documents which you sent initially, or the auditor might have sent you a letter directly asking for specific documents. If there's no additional SARS letter and you did not add a deduction or income to your revised tax return, please resend the documents you initially submitted in order to close the open link.

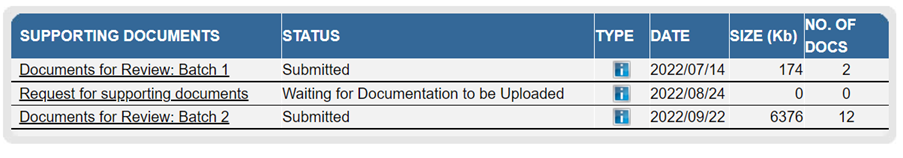

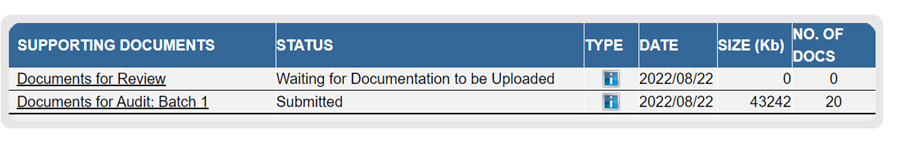

Your efiling profile will show the following screen if this happened:

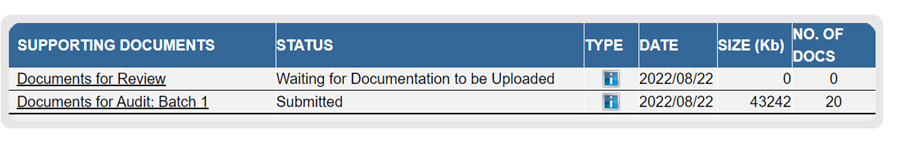

Or this one:

Important: If you are unable to access your SARS efiling profile, please follow the steps in our blog to obtain shared access.

This entry was posted in TaxTim's Blog

and tagged Audit / Verification, SARS & eFiling, technical.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Alicia

Written by Alicia