Written by Alicia

Updated 15 September 2025

Written by Alicia

Updated 15 September 2025

Please read the steps below to update your contact details on your SARS eFilng profile:

1. Go to www.sarsefiling.co.za

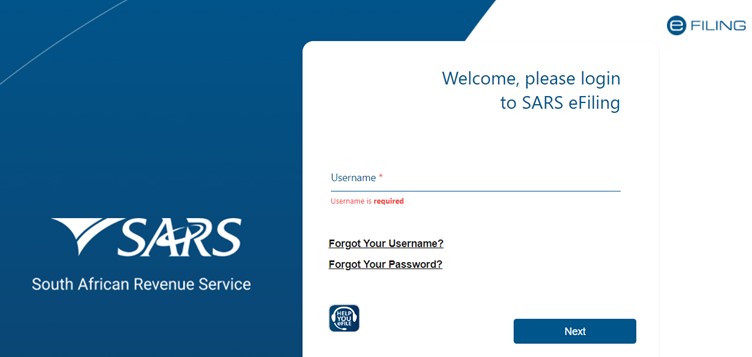

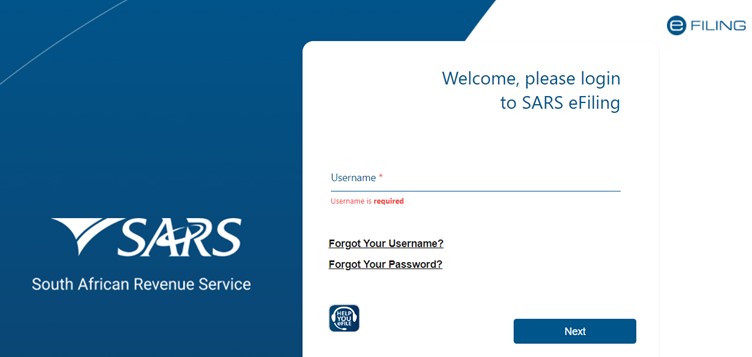

2. Log into your eFiling profile:

3. Click on "Home"

4. Click on "User" then click on "Maintain SARS Registered Details"

5. Tick the "I Agree" box and then click on "Continue"

6. As an extra security step, SARS has added this question. If you are registered for any other taxes, please click on it otherwise click on "None of the above" then click on "Continue"

7. Select "My Registration Details"

8. Click on "Edit" then enter / change the details you wish to update.

9. Once done, please click on "Done" and then scroll up and click on "Submit form"

10. If your updates are accepted by SARS, you can click on "Continue". Note, if the email address, cellphone number or bank branch code is invalid, the system might not allow you to submit the form.

These changes won't take effect immediately. All changes made on eFiling are assigned to a SARS consultant for review first and it could take them anything from a few hours to 21 business days to update.

If you are adding new banking details, you will need to send SARS certain documents for them to verify your request. For further details, please click here.

SARS might require that you enter an OTP once you add new details. This is most likely to happen if you are adding new bank details. Please ensure that you have access to your cellphone or email address to retrieve the OTP details.

This entry was posted in TaxTim's Blog

and tagged SARS & eFiling, technical.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Alicia

Written by Alicia