Written by Nicci

Posted 14 June 2021

Written by Nicci

Posted 14 June 2021

If SARS have issued you an Auto Assessment, you will need to follow these steps to reject it so that we can help you to complete and submit your return to SARS.

1. Log into your eFiling profile.

2. You will see a message which says you have been Auto-Assessed. Click the green button to 'view' the Auto Assessment.

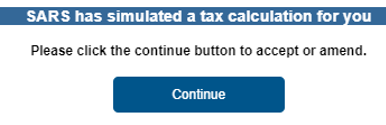

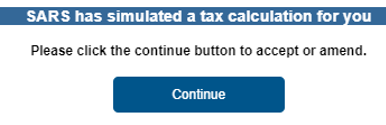

3. Once you have done this, you will receive a message saying: “SARS has simulated a tax calculation for you….” Please click on Continue.

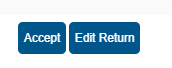

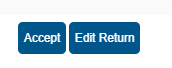

4. Now click on “Edit Return” which will reject the SARS estimate.

5. Come back to TaxTim and proceed as normal. We'll help you to get your maximum possible tax refund the easy way.

Please read our FAQ on Auto Assessments for further clarification.

Feel free to contact our team of experts if you have any questions or need further help

Image by congerdesign from Pixabay

This entry was posted in TaxTim's Blog

and tagged SARS & eFiling, Auto-Assessments.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Nicci

Written by Nicci