SARS & eFiling: 10 most popular posts

South Africa may introduce a 20% tax on online gambling, here’s how it could actually work

Written by Patrick

Posted 8 December 2025

There’s been a lot of talk this week about the government's proposal to introduce a national 20% tax on online gambling. The news spread quickly, but most articles stopped at the headline. Very few explained how the tax would actually be calculated, who pays it, how it connects to existing provincial taxes, and what this means for everyday South Africans.

This guide breaks everything down in plain language, with simple examples and real numbers, so you can clearly understand what the proposal is about and how it might impact online betting going forward.

What exactly is being taxed?

The 20% tax does not apply to your personal winnings...

Read more →

Auto-Assessed Taxpayers: Missed the SARS filing deadline?

Written by Nicci

Posted 30 October 2025

If you were auto-assessed by SARS, your deadline to submit a tax return was 20 October 2025. If you still want to submit a Tax return but did not file by this date, don’t panic, you can still sort it out. But you can’t just file late. You first need to request an extension.

Step 1: Request an Extension

Go to SARS eFiling and navigate to your Income Tax Work Page for 2025....

Read more →

How to update your contact details on eFiling

Written by Alicia

Updated 15 September 2025

Please read the steps below to update your contact details on your SARS eFilng profile:

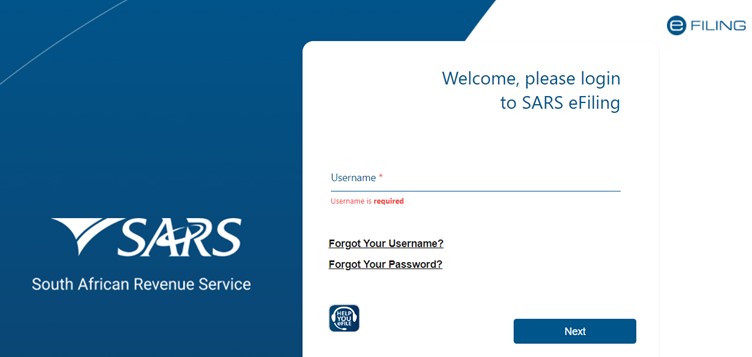

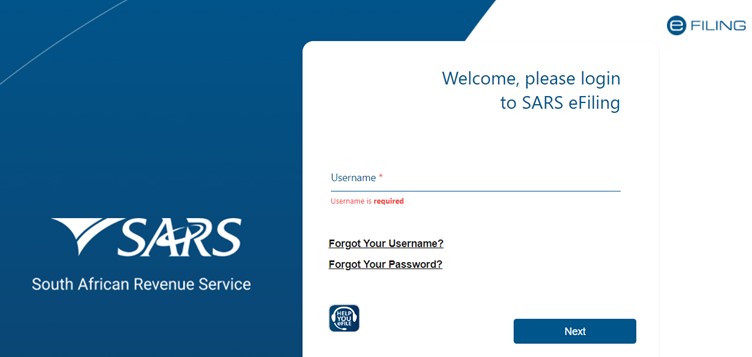

1. Go to www.sarsefiling.co.za

2. Log into your eFiling profile:

3. Click on

Read more →

Tax Directive Error Affecting Certain Retirement Fund Transfers

Written by Nicci

Posted 12 August 2025

TaxTim is aware of a tax directive issue between SARS and certain retirement funds where some fund transfers are incorrectly being treated as taxable events. One of the funds affected, Alexander Forbes, has confirmed that it is aware of the error and is working with SARS to resolve it.

The problem arises when retirement funds are transferred from one fund to another. These should not be taxed, but the error ha...

Read more →

Foreign Nationals and Non-Residents: Important SARS Update for this Tax Season

Written by Alicia

Posted 29 July 2025

SARS (the South African Revenue Service) has made recent changes regarding how foreign nationals and some non-resident taxpayers are handled in the tax system. These changes affect both current tax residents without SA ID numbers and individuals who have since left South Africa.

What's Changed?

Previously, SARS assessed taxpayers based on their location while earning income. This allowed many foreign nationals living and worki...

Read more →

Non-Residents: Please read this before you submit your tax return

Written by Nicci

Posted 23 July 2025

If you are a non-resident for tax purposes but SARS still has you on record as a South African tax resident, you will face unexpected challenges when filing your tax return this season.

In prior years, SARS allowed taxpayers to file as non-residents even if their RAV01 profile still reflected them as residents. However, SARS has introduced changes this tax season: you will ...

Read more →

Why don't I get a tax deduction for Out of Pocket Medical Expenses?

Written by Marc

Updated 13 July 2025

Tax season always throws up some interesting and confusing calculations, but for many, the most confusing of all is how medical aid contributions and Out of Pocket medical expenses are treated.

Read more →

I work for someone, but did not receive an IRP5 - what should I do?

Written by Nicci

Updated 27 June 2025

You may be employed by someone, but for one reason or another- you don't receive an IRP5 and no amount of begging or pleading

Read more →

Have you ceased residency during the tax year?

Written by Nicci

Posted 26 June 2025

SARS has made changes to the 2025 tax return to help taxpayers who ceased South African tax residency during the tax year. If this applies to you, your tax return will now include two parts:

Part 1: While you were still a South African tax resident

Read more →

Why do I owe SARS more money?

Written by Nicci

Updated 19 June 2025

Once you’ve completed filing your tax return, it’s possible to find that instead of getting money back

Read more →

Tax Season 2025: opening date and deadlines

Written by Alicia

Posted 3 June 2025

The 2025 filing season opens this year on Monday, 21 July.

This year, the tax season is even shorter than last year (and last year was shorter than the prior year!). This means that SARS are giving you less time to file your tax return.

Important Filing Deadlines

20 October 2025: Salary-only employees, who earn no other signficant income (i.e. non-provisional taxpayers) and ALL auto-assessed ...

Read more →

What you need to know about SARS auto-assessments (ITA34s)

Written by Patrick

Updated 3 June 2025

What is an auto-assessment?

This is an automatic assessment issued by SARS to certain taxpayers.

Read more →

Unpacking the Section 13sex Residential Unit Deduction

Written by Nicci

Posted 23 May 2025

The Section 13sex residential unit deduction is a South African tax break for people who invest in new rental properties. If you build or buy new units to rent out, you can deduct part of the building cost from your taxable income each year. To qualify, you must own at least five new and unused residential units in South Africa that are used for rental.

You can claim 5% of the building cost

Read more →

Can I claim depreciation on a car I bought for my business?

Written by Alicia

Posted 19 May 2025

If I run a small business and buy an asset like a vehicle for R200,000 (paid in full and not financed), can I deduct the full amount from my taxable income in the same year? Or do I only deduct the depreciation amount each year?

Also, do vehicles qualify for the 50/30/20% depreciation rule over three years like other small business assets?

Read more →

Why You May Owe Tax on Two-Pot Withdrawals

Written by Nicci

Posted 14 May 2025

South Africa introduced the Two-Pot Retirement System to help people access part of their retirement savings before retirement age, while keeping the rest for retirement. It's a helpful system – but it comes with tax rules that can surprise some people.

If you withdrew from your Two-Pot in the tax year, you need to include the details of this withdrawal in your annual tax return. The fund should have issued you an IRP5/IT3a tax certificate which reflects the withdrawal amount (source code 3926), related tax as well as the tax directive number issued by SARS...

Read more →

Understanding the Assets and Liabilities Section in Your Tax Return

Written by Alicia

Updated 7 May 2025

The assets and liabilities section in the annual tax return (ITR12) needs to be completed if you:

- earn self-employment income or are an independent contractor

- earn foreign income (e.g foreign rental income or foreign business income)

- are a Director of a company or a member of a Close Corporation

Each asset should be reported at its original cost — the amount you paid at the time of purchase or investment. According to SARS, these entrie...

Read more →

Why your estimated provisional tax may differ from your SARS Statement of Account

Written by Alicia

Updated 22 April 2025

TaxTim uses the financial information which you entered to work out the payment due on your provisional tax return (also called an IRP6). However, there may be some information we don’t have access to, which won’t be included in the estimate of your provisional tax payment. To see what SARS has on record, you will need to request a Provisio...

Read more →

Where can I find my provisional tax payment details?

Written by Alicia

Updated 22 April 2025

During the final days of the provisional tax season, high traffic volumes may cause delays in submitting provisional tax returns to SARS—even after you've clicked 'submit' on our website.

To avoid late payment penalties, we recommend paying the estimated provisional tax amount shown on our website. Once your provisional tax return (IRP6) appears in eFiling and your SARS provisional Statement o...

Read more →

What to do if your SARS document is blank

Written by Elani

Posted 2 April 2025

Unfortunately, some of the SARS documents cannot be viewed online (i.e. from within your internet browser). You can work around this issue by downloading the SARS document to your computer. You will then be able to view the document when opening it directly on your device.

Steps to follow if the SARS document is blank on your browser:

- Choose the option to download the document.

- Open the "Downloads" folder on your computer **.

- Sea...

Read more →

How to request a Provisional Tax Statement of Account on eFiling

Written by Alicia

Posted 27 March 2025

If you're a provisional taxpayer, you can request a statement of your provisional account on eFiling. However, instead of finding it on your Income Tax workpage, you first need to go to the Provisional Tax workpage. This can be tricky if you don't use eFiling often, so we've listed the steps below to help you.

STEP 1: Log into SARS eFiling

Read more →

Sequestration and Tax

Written by Alicia

Updated 2 December 2024

What is Insolvency?

Insolvency is a state of financial distress when a person or business is unable to pay their debts.

What is Sequestration?

Sequestration is a legal process that is used to deal with your financial difficulties and manage your debts. It gives you legal relief from creditors, while the debt recovery efforts of the various companies you owe are put on hold.

Read more →

SARS Timelines

Written by Alicia

Posted 22 November 2024

SARS Timelines

SARS operates within specific timelines to comply with the rules outlined in the Tax Administration Act and the commitments detailed in their service charter.

However, these timelines are not easily accessible on the SARS website, leaving many of our users needing to contact the helpdesk for updates on their submissions.

To assist you, we’ve compiled a comprehensive list of these timelines:

Auto-Assessment<...

Read more →

SARS is not paying my refund, they want my old returns!

Written by Marc

Updated 4 August 2024

Taxpayers this year are facing a new gripe with SARS when it comes to receiving those well-earned refunds. The current two scenarios are:

- NO AUDIT: A taxpayer files a tax return, gets their ITA34 and does not need to submit supporting documents; or

- AUDIT: A taxpayer files a return and in their ITA34 is requested to submit supporting documents, after which they receives a Completion Letter stating "no adjustment made".

In both these cases a refund should be paid out within 72 hours (if the taxpayer is due one), however thousands of taxpayers still have not been paid their refund. Here’s why!...

Read more →

Why is SARS asking me for outstanding tax returns?

Written by Evan

Updated 4 August 2024

In 2024, we have noticed that SARS is withholding refunds from taxpayers with outstanding tax returns, sometimes dating back many years. In some cases, SARS is requesting unfiled returns from as far back as 10-15 years ago, going back to when the taxpayer first registered for a tax number.

Block on eFiling submissions older than 5 years

This year, SARS introduced a change to eFiling that has frustrated many taxpayers. Returns older than five years are now blocked from being submitted on individual profiles, prompting a message that these must be filed at a branch.

Don't worry - TaxTim can help...

Read more →

I have received an Additional Assessment from SARS - what does this mean?

Written by Nicci

Updated 30 July 2024

After you have submitted your supporting documents to SARS, they have 21 working days to review them, assuming all sufficient documents have been received. Once their review is complete, you will either:

- Receive a request for additional documents; or

- Receive a Completion Letter; or,

- Receive an Additional Assessment

Additional Documents Request

If SARS still requires for documents from you, they will either send ...

Read more →

Older posts →

1 2 3 4 5

Written by Patrick

Written by Patrick

Written by Nicci

Written by Nicci

Written by Alicia

Written by Alicia

Written by Marc

Written by Marc

Written by Elani

Written by Elani

Written by Evan

Written by Evan