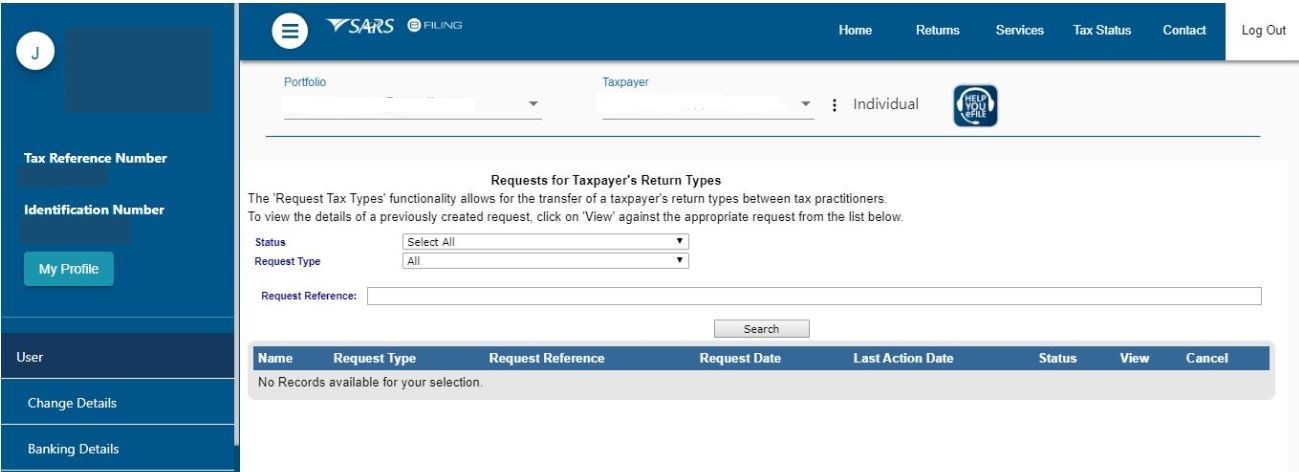

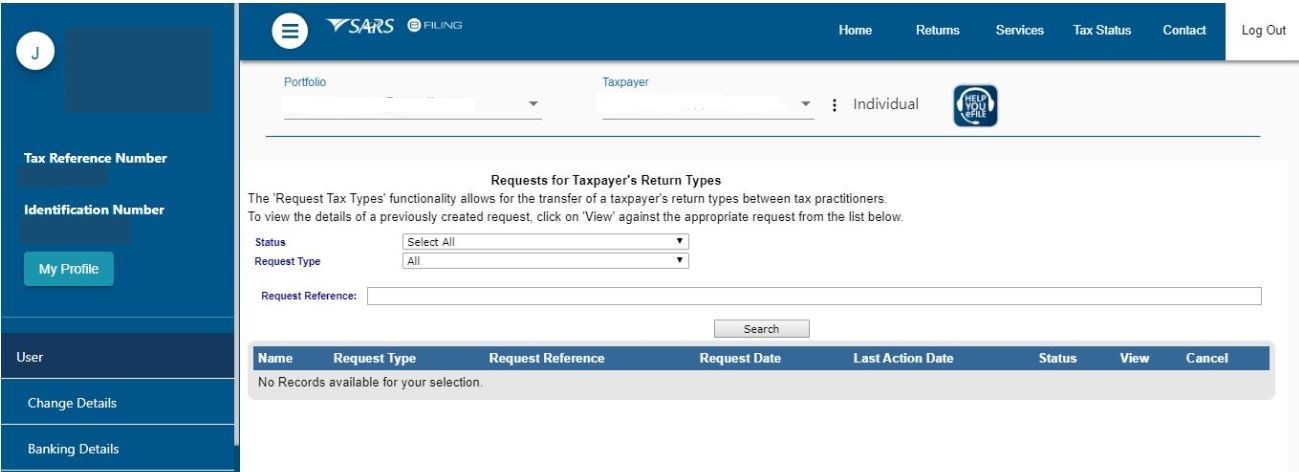

The recent changes to eFiling have made the registration for a SARS eFiling profile a little easier, however the verification process to allow a tax practitioner to share access to the taxpayer’s tax types has become a bit more complicated.

The sharing of the taxpayer’s profile to the Tax Practitioner should work easily if the tax number is linked and if you have a banking details setup to make a payment to SARS.

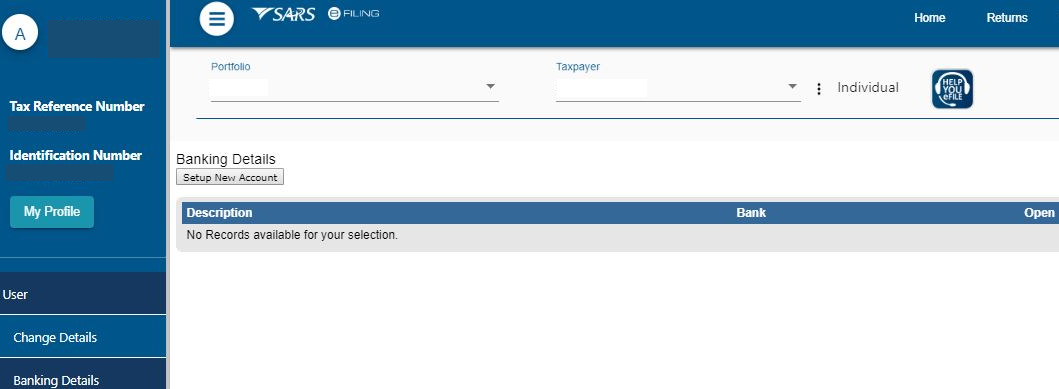

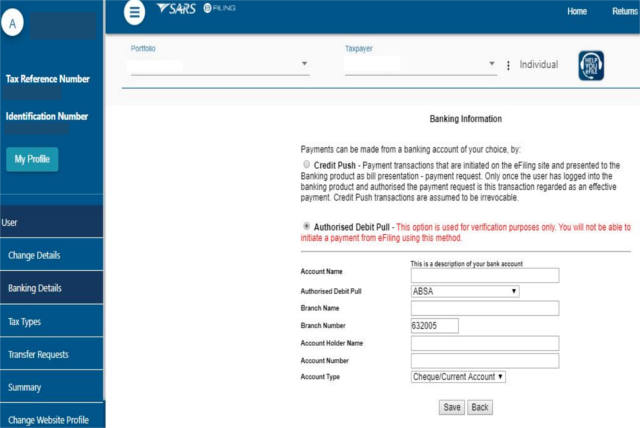

If you receive an error relating to your bank account when you enter your SARS eFiling details to share access to your profile with us, please follow these steps to add a bank account and then retry the connection to our eFiling account on your TaxTim profile.

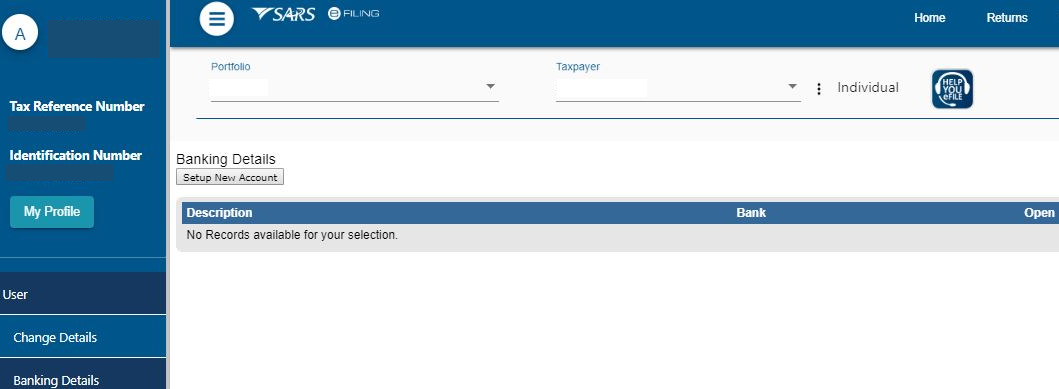

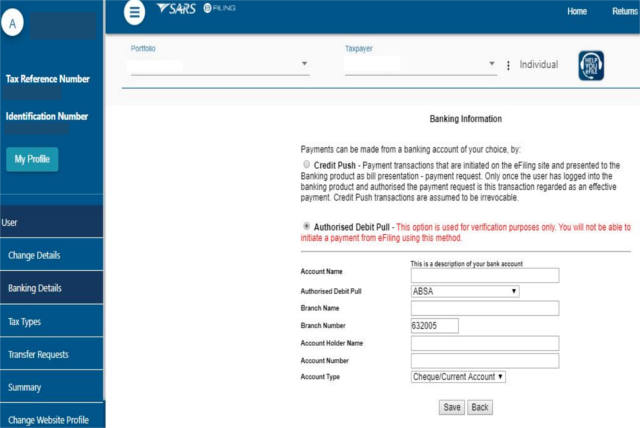

Log into your eFiling profile, click on “Home” then click on “User”, after this please click on “Banking details” then click on “Setup New Account” then select “Authorise Debit Pull” and then enter your banking details. Once you have completed those steps, please click on save and then retry your connection to us.