Can I reject the SARS auto assessment and fill in my tax forms?

Written by Nicci

Posted 20 July 2020

I received an auto-assessment from SARS and I am not certain how to work around it. What I do know is that I would prefer to complete a tax return as normal, like I usually did in the past years. Would this be possible? If I reject it, what will happen?

Income tax on drop-shipping

Written by Nicci

Posted 3 July 2020

I am currently doing drop-shipping, the products which come from over sea, so I would like to know what income tax would I need to pay. What do I need to know about this if I am doing it for the first time? Could you kindly share tax material with me which I can use to also work my way through this.

2020 Supplementary Budget Speech

Written by Nicci

Posted 30 June 2020

On Wednesday, 24 June 2020, Minister of Finance, Tito Mboweni, addressed parliament to announce the 2020 Emergency Budget Speech.

Read more →

FAQs: Tax Directives

Written by Nicci

Posted 24 June 2020

A tax directive is super useful when you earn commission, variable income or are going to receive a large bonus or a lump sum.

Read more →

How is Commission Taxed? 3 Ways Your Company Taxes Commission

Written by Vee

Posted 23 June 2020

Our helpdesk receives hundreds of questions related to tax where commission is involved. A misconception that comes up time

Read more →

FAQs: Tax Clearance or Tax Compliance Status (TSC)

Written by Nicci

Posted 22 June 2020

1. I need an actual tax clearance certificate, but each time I apply I am sent a PIN. Can you help me print the certificate?

Read more →

Individual Tax Consultation

Written by Nicci

Posted 18 June 2020

In January 2018 I stopped working as a full time employee and for the 2018/2019 tax year I did various things (including foreign travel and work) and earned different kinds of incomes. I did not register as a provisional taxpayer as at that stage I really did not know how the year was going to pan out and if I was going back into full time employment again. I would like to settle any tax I may owe for the 2018/2019 year, however with my different incomes, working out the country for more than 18...

Read more →

What is cut-off date for tax return submissions?

Written by Nicci

Posted 18 June 2020

What is the cut-off date for submitting a tax return this year? I am struggling to get a hold of my IRP5 from my previous employer and I am therefore concerned that I will miss the submissions cut off date.

FAQs: Retrenchment

Written by Nicci

Posted 15 June 2020

Thousands of people have lost their jobs as a result of the Covid-19 pandemic and the nationwide lockdown to slow the spread of the disease.

Read more →

Tax deductions exceeds the tax paid

Written by Nicci

Posted 28 May 2020

What happens if my Allowable Tax Deductions exceeds the tax paid in the same year. Logically I should only be able to claim back the actual tax paid? It will be Additional allowable Medical claims which will not be covered by the medical aid. These amounts plus smaller deductions will push the claims to over and above the tax payable amount.

First business tax submission date?

Written by Nicci

Posted 28 May 2020

I have a Pty Ltd that was registered in February, the Provisional Tax payments must be made in April and October. SARS says I must make tax payments from the 2021 period. The date of liability for provisional tax: 2020/05. When, according to that, is the first time I have to submit tax reports, was it this past April 2020 already? Also, when is the "major" tax submission due, not the provisional one, but the annual one? I would like to do it with TaxTim as my company is small.

I was...

Read more →

How to check available funds at SARS

Written by Nicci

Posted 28 May 2020

If you have never filed for a tax return before, how do you go about checking if there are funds owed to you at SARS? I would like to start filing my tax return for this year as I have been unemployed for a long period, but now I am back in the workforce.

Learning disablity claimable from SARS

Written by Nicci

Posted 28 May 2020

I pay for a scriber to assist my daughter that has a learning disability, I would like to know whether I will be able to claim this expense from SARS. I did not register my daughter with SARS or SASSA. So, I do not know what process to follow regarding this matter would be.

Voluntary sequestration and eFiling profile

Written by Nicci

Posted 22 May 2020

I just had my voluntary sequestration of estate approved by the high court on the 24th of March 2020 and I now need a new tax number. SARS say I can do that through SARS eFiling and I would like to know how I can do this? The problem I have experienced with trying to register a new SARS eFiling profile is that after I input my name and ID number the system tells me to login with my existing profile number.

TaxTim Filing before tax season

Written by Nicci

Posted 22 May 2020

I have registered on TaxTim and have also granted you permission to get my information from SARS. Should I wait till tax season begins before I complete all the questions on TaxTim? I am however still waiting for my IRP5 from my employer. I also have property that I am renting out and have a logbook. Please advise.

Contract worker and Tax

Written by Nicci

Posted 22 May 2020

I was retrenched at the end of 2017. My last Tax Return was done in the year 2018. Since April 2019 I have been receiving income for work done on a contract basis and the company indicated that I need to see to my own tax affairs. How do I go about filing my tax return for 2020? Your assistance is highly appreciated.

Do I qualify for the Covid-19 provisional tax deferral?

Written by Nicci

Posted 19 May 2020

Yes, my business qualifies for this tax relief measure

The 1st provisional payment must be based on 15% of the total estimated tax liability.

The 2nd provisional payment must be based on 65% of the total estimated tax liability. Remember to deduct the 1st payment that you made.

No, my business does not qualify for this tax relief measure

Unfortunately, your business does not meet the criteria to qualify for the provisional t...

Read more →

Navigating around your Capital gains tax certificate (IT3C)

Written by Alicia

Posted 15 May 2020

If you have shares (financial instruments) , there is important information on your IT3C tax certificate which needs to be included in your tax return.

This will ensure your taxable income is calculated accurately with the correct capital gain or loss included.

Do you have shares at any of the following institutions?...

Read more →

FAQs: 'Other Deductions' that you may be able to claim in your tax return

Written by Nicci

Posted 13 May 2020

There is a section in the tax return called ‘Other Deductions’ which often causes confusion for taxpayers

Read more →

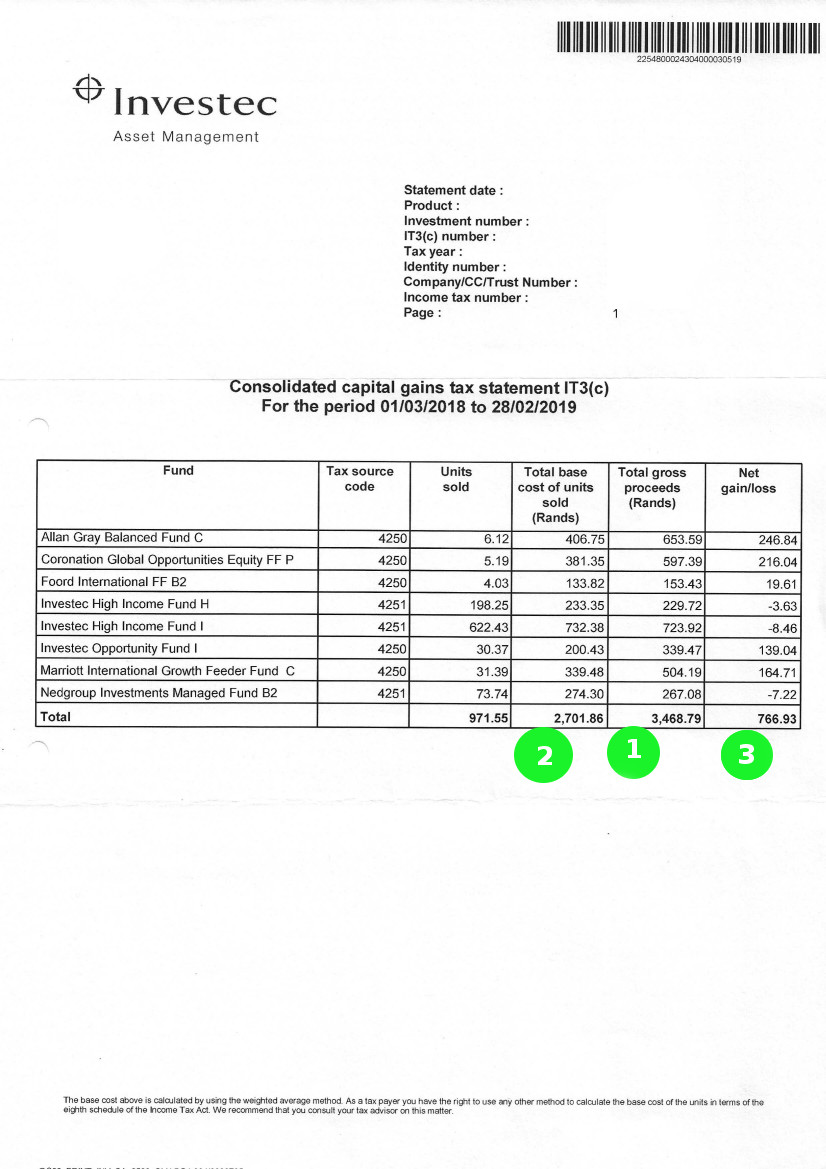

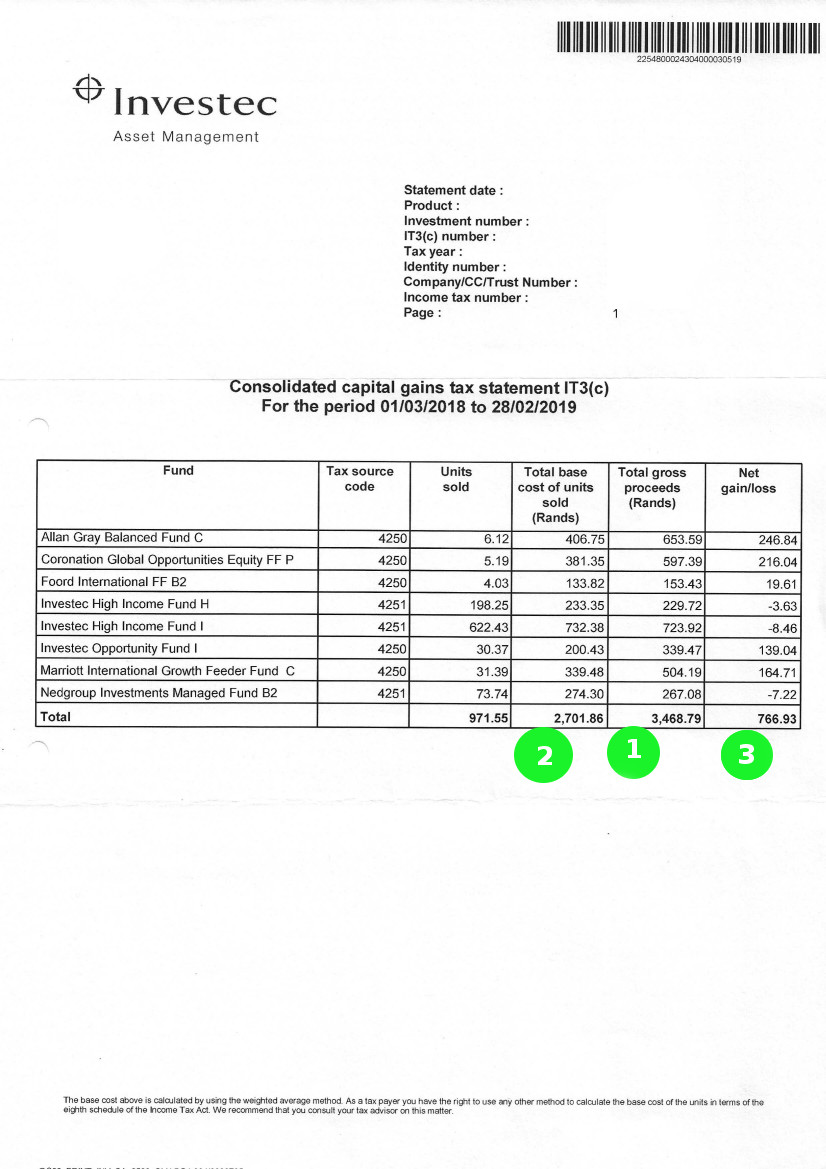

Navigating around your Investec investment tax certificate (IT3c)

Written by Nicci

Posted 12 May 2020

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

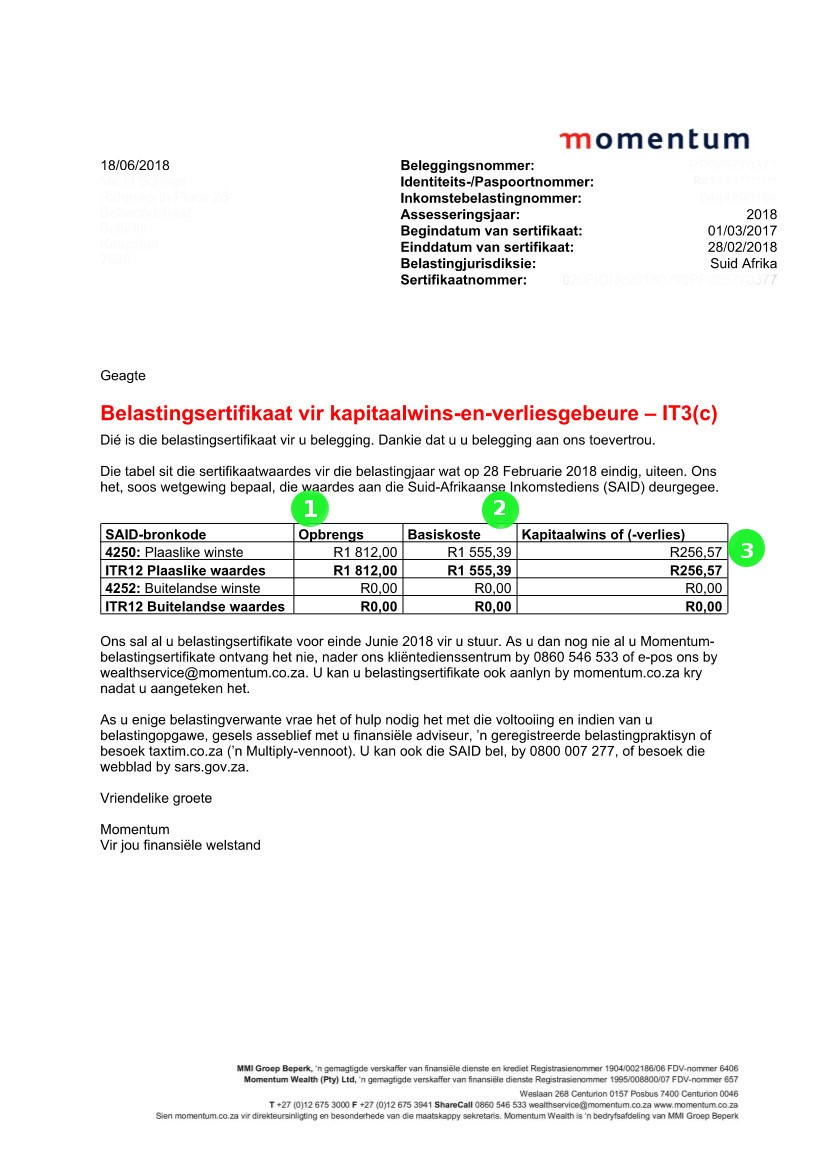

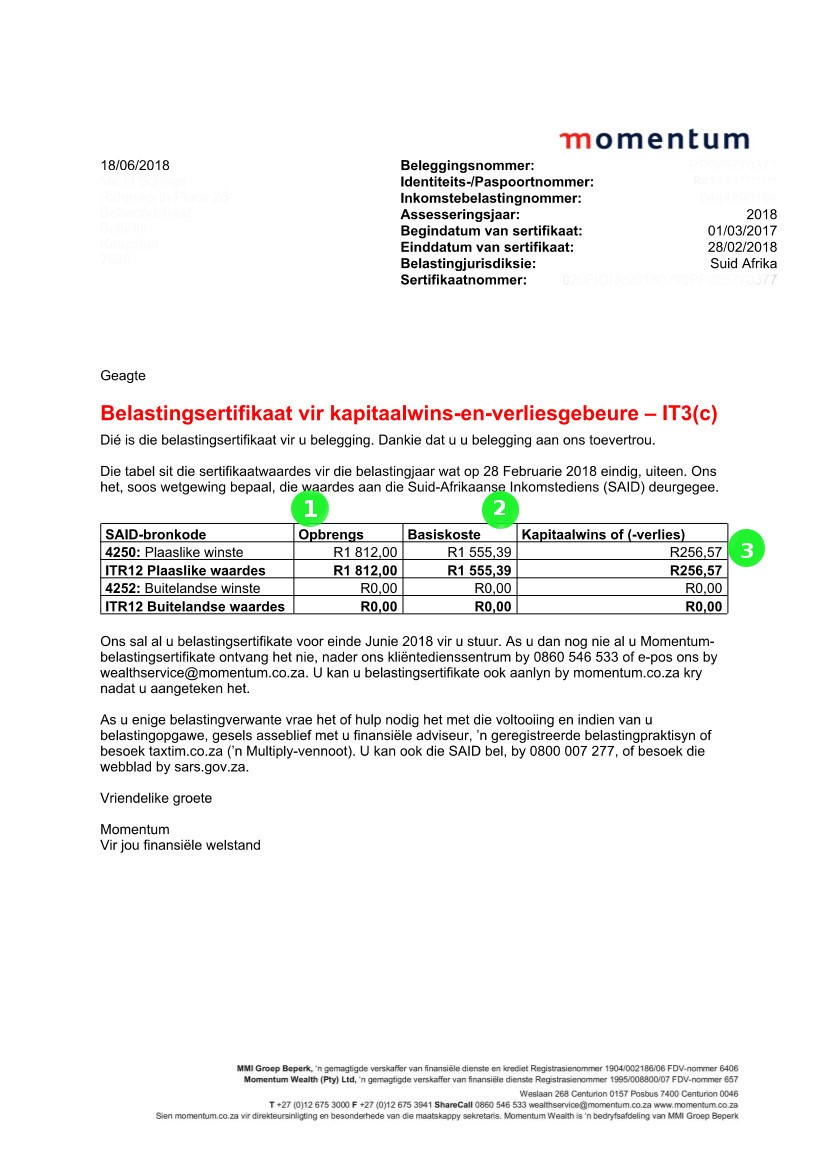

Navigating around your Momentum tax certificate (IT3c)

Written by Nicci

Posted 12 May 2020

1. Opbrengs/Proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. Basiskoste/Base Cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

...

Read more →

News Alert: Tax Season 2020

Written by Nicci

Posted 8 May 2020

On Tuesday evening, the SARS commissioner, Edward Kieswetter, held a media briefing to talk about the challenges that SARS is facing due to Covid-19.

Read more →

IRP5s and companies paying RA for employees

Written by Nicci

Posted 7 May 2020

If a company is paying into a Retirement Annuity (RA) for employees when preparing an IRP5, using source code 3828 as income, would we then need to use source code 4006 for the same amount? In other words, source code 3828 for the amount paid by company on behalf of employee (this amount will be added to the income total) and code 4475 for the same amount. If an employee has not contributed anything code 4006 will be 0, but will still have to appear on the IRP5?

Financial Emigration

Written by Nicci

Posted 7 May 2020

I have recently moved to the United States. I am now living and working there. I would like to financially emigrate. However, I also still have to file taxes for the year 2019, but as soon as this has been finalised I would like to become a non-tax resident in South Africa. Would TaxTim be able to assist me with this process or would you please be able to recommend some avenues I could utilise to complete financial emigration process, as soon as possible?

Foreign Employment and Tax Implications

Written by Nicci

Posted 29 April 2020

I am a South African resident currently employed full time. I earn a monthly salary of R23000 (before tax). I have recently started consulting part time for a foreign company that will pay me in dollars. On average $2000 every 3 months.

Older posts →← Newer posts

Written by Nicci

Written by Nicci

Written by Vee

Written by Vee

Written by Alicia

Written by Alicia