Written by Nicci

Posted 28 November 2019

Written by Nicci

Posted 28 November 2019

There seem to be many confused taxpayers who have received a letter from SARS titled ‘Rejection of Revised ITR12’ which goes on to say that their revised return cannot be finalised because their assessment has already been finalised. This letter is usually sent by SARS when a revised return (correction) is submitted.

On further investigation, we can confirm that all of these taxpayers:

- submitted their original return a while ago (1 -4 months)

- their assessment (ITA34) was received at the time of their original submission

- they have all received a Completion Letter and been paid out where a refund was due

- Neither they, nor TaxTim, submitted a revised return.

If we look at eFiling, the situation looks very confusing indeed.

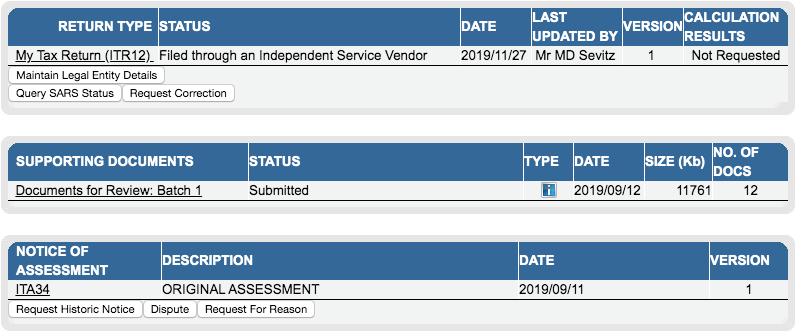

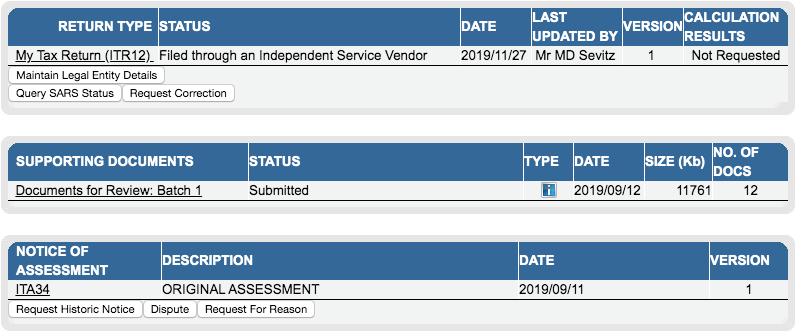

In the example below, you can see that the original return (should be 11 Sep 2019) is no longer showing in eFiling, and in its place is the latest ‘revised return’ dated 27 November 2019 which is dated long after the Completion Letter was issued (7 October 2019).

So even though it looks like the return below was submitted on 27 November by Mr MD Sevitz (TaxTim’s designated practitioner) this is certainly not the case and we at TaxTim are as confused as you!

Continuing with the above example, if we look at this taxpayer’s profile in TaxTim, we see that the return has moved back to an ‘unfiled’ status.

This has happened because the SARS letter and strange sequence of events has confused our system as well.

In summary:

- We can confirm this is not an issue on TaxTim’s side.

- No correction has been filed and your return remains complete and finalised as before.

- We have raised the issue with the technical team at SARS to investigate urgently.

- There is no action required from your side.

- As soon as we get feedback from SARS, we will send an update to those taxpayers that are affected.

This entry was posted in TaxTim's Blog

Bookmark the permalink.

Written by Nicci

Written by Nicci