How to update your contact details on eFiling

Written by Alicia

Updated 15 September 2025

Please read the steps below to update your contact details on your SARS eFilng profile:

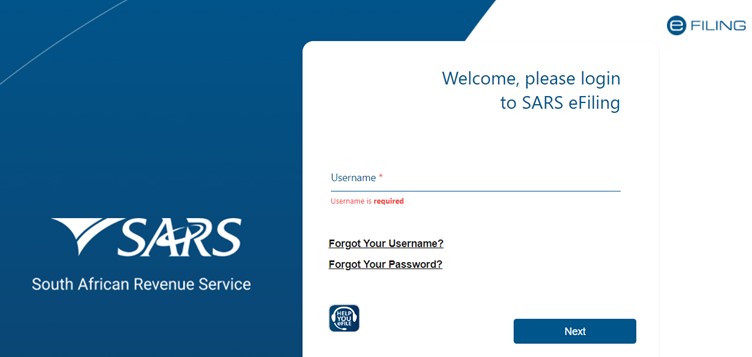

1. Go to www.sarsefiling.co.za

2. Log into your eFiling profile:

3. Click on

Read more →

SARS eFiling profile hacking

Written by Alicia

Posted 25 April 2024

SARS has reported a rise in eFiling profile hijacking, involving various methods such as altering security details, creating, or modifying taxpayer profiles, and executing SIM swaps.

The hijackers’ objectives are to redirect tax refunds to fraudulent bank accounts, which they are setting up for this purpose. There are certain banks which appear to feature more frequently.

If you are the victim of such profile hacking, you must immediately report this fraud via the

Read more →

How to add your Company Tax Number to your eFiling profile

Written by Patrick

Updated 7 March 2024

As part of SARS’ mission to simplify the eFiling system, the Tax Type Transfer process was updated in 2020 for all Tax products in a bid to offer users complete control of their eFiling profiles.

What's new on eFiling?

Overall, you can expect to see the following key changes introduced to eFiling from the end of April 2021:

- Changes to adding taxpayers to a profile (Organisations, Practitioners & individuals)

- The removal of multiple capture fields to simplify the process

- Validation requirements for captured information to ensure alignment to SARS records, e.g...

Read more →

SARS repeat reminders for supporting documents

Written by Alicia

Posted 27 October 2022

If you received another email from TaxTim requesting SARS supporting documents, but you already sent these to SARS more than 21 business days ago, one of these four scenarios might be the reason you are still waiting:

Scenario 1:

You submitted the documents directly on SARS eFiling yourself, but you did not inform TaxTim. In this case, our system needs to be updated to reflect that you already submitted your documents.

Please log into your TaxTim profi...

Read more →

Technical Issues for Tax Season 2021

Written by Nicci

Posted 31 January 2022

1. SARS eFiling connection issue: Resolved

Problem description

When TaxTim tries to connect to individual taxpayers' profiles, eFiling is returning an 'unexpected system error'. This is affecting all Tax Practitioners.

How taxpayers are affected

TaxTim cannot connect to the taxpayer's eF...

Read more →

Written by Alicia

Written by Alicia

Written by Patrick

Written by Patrick

Written by Nicci

Written by Nicci