Auto-Assessed Taxpayers: Missed the SARS filing deadline?

Written by Nicci

Posted 30 October 2025

If you were auto-assessed by SARS, your deadline to submit a tax return was 20 October 2025. If you still want to submit a Tax return but did not file by this date, don’t panic, you can still sort it out. But you can’t just file late. You first need to request an extension.

Step 1: Request an Extension

Go to SARS eFiling and navigate to your Income Tax Work Page for 2025....

Read more →

Tax Season 2025: opening date and deadlines

Written by Alicia

Posted 3 June 2025

The 2025 filing season opens this year on Monday, 21 July.

This year, the tax season is even shorter than last year (and last year was shorter than the prior year!). This means that SARS are giving you less time to file your tax return.

Important Filing Deadlines

20 October 2025: Salary-only employees, who earn no other signficant income (i.e. non-provisional taxpayers) and ALL auto-assessed ...

Read more →

What you need to know about SARS auto-assessments (ITA34s)

Written by Patrick

Updated 3 June 2025

What is an auto-assessment?

This is an automatic assessment issued by SARS to certain taxpayers.

Read more →

Finding your way around a SARS IRP5

Written by Nicci

Updated 15 April 2025

Consult the image below to find all the tax-related information on your IRP5 that you will need when completing your annual tax return.

- PAYE number

- Income source codes

- Non-taxable income - source code 3696

- Gross Employment Income (taxable) – source code 3699

- Deduction source codes

- PAYE – source code 4102

- PAYE tax on lump sum benefit – source code 4115

- Employee and employer UIF contribution &...

Read more →

SARS Timelines

Written by Alicia

Posted 22 November 2024

SARS Timelines

SARS operates within specific timelines to comply with the rules outlined in the Tax Administration Act and the commitments detailed in their service charter.

However, these timelines are not easily accessible on the SARS website, leaving many of our users needing to contact the helpdesk for updates on their submissions.

To assist you, we’ve compiled a comprehensive list of these timelines:

Auto-Assessment<...

Read more →

What to do if your tax return was rejected by SARS

Written by Alicia

Updated 22 November 2023

If you've received a letter from SARS saying that your tax return has been rejected and you're not sure why, there could be a few reasons why this has happened. Here are some of the most common reasons, along with the corrective steps you need to take:

Reason 1: You were auto-assessed by SARS for the 2020, 2021 or 2022 tax year, but you submitted your tax return after the 40-day period SARS gave you, and you failed to request an extension in time. Please click

here to read more about auto-assessments. ...

Why does SARS require manual intervention to finalise my return?

Written by Marc

Updated 21 November 2023

When a Tax Return is filed usually SARS issues an immediate assessment (ITA34), however sometimes they do need to do a further manual check on their side.

Read more →

TaxTim Refund Policy Explained

Written by Alicia

Updated 21 November 2023

Each time SARS makes changes on eFiling or with their standard operating procedures, TaxTim has to adjust its systems and processes. We usually receive no warning of these technical changes. During this time, some of our users might feel a need to abandon our service and either seek help elsewhere or go and queue at SARS.

We understand this may cause frustration, however we will not refund you in cases where you have worked your way through every section of the TaxTim dialogue a...

Read more →

How do I know if I was auto-assessed?

Written by Alicia

Posted 17 November 2023

During the tax year, SARS issued SMS's to taxpayer whom they chose to auto-assess.

Those selected individuals would typically be taxpayers earning fixed salaries without additional allowances. If they did have medical aid and retirement annuity fund contributions, these details would have already been sent to SARS by their service providers, and SARS should have automatically included them in the assessment.

We've received many questions on our help desk where users say that t...

Read more →

How to Submit a Request for Reduced Assessment via SARS eFiling

Written by Alicia

Posted 6 November 2023

If your 2023 individual income tax return was auto-assessed by SARS earlier this year, and you intended to include extra income or expenses/ deductions but missed the deadline, don't be dismayed, there might still be a way to fix things!

Is SARS rejecting your tax return submission and your dispute too?

Have you requested an extension, but SARS granted it for a day before they replied to you? i.e, you asked for an extension till 10 November 2023, but SARS gave you an extension...

Read more →

The new SARS auto-assessment

Written by Alicia

Updated 10 July 2023

Step 1:

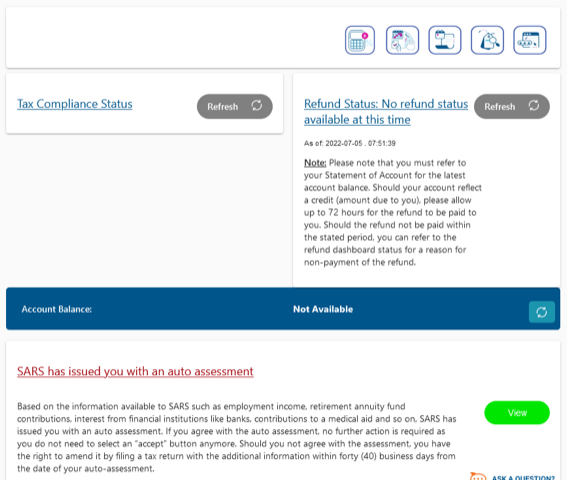

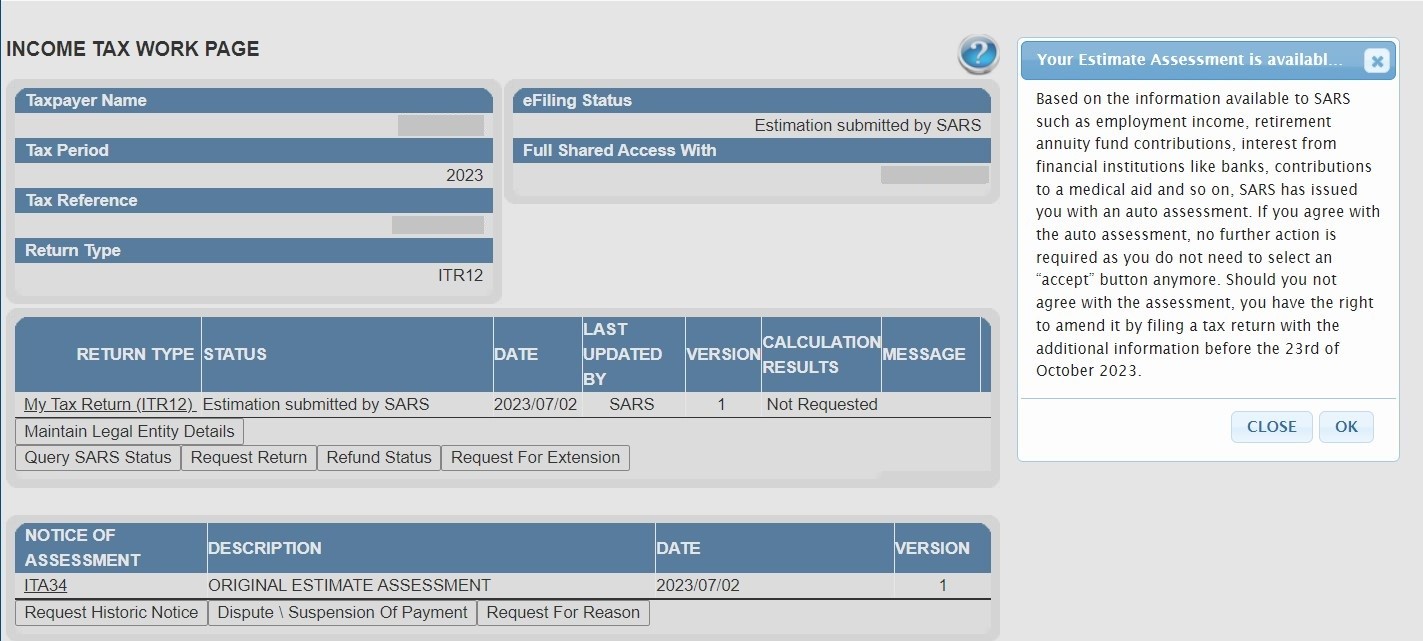

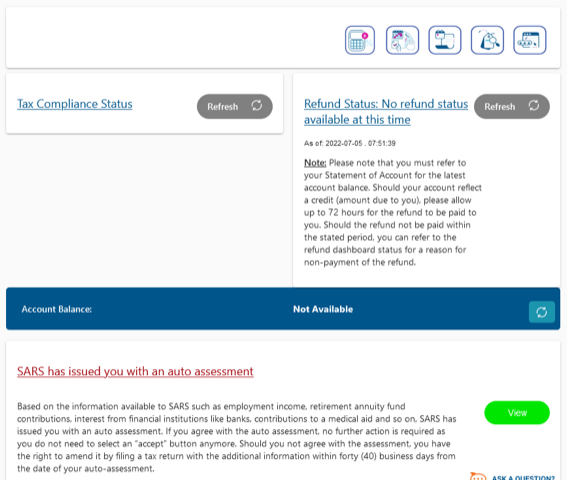

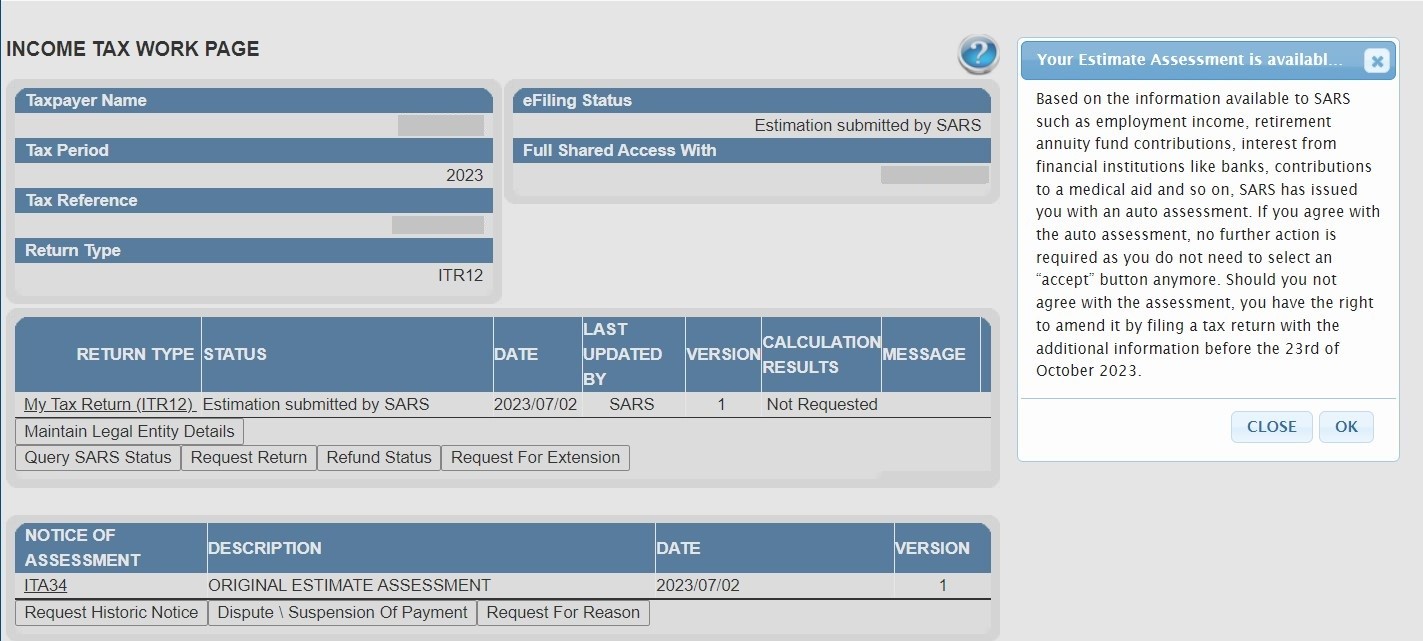

If you have been auto-assessed by SARS, you may see the screen below when you log into SARS eFiling.

Please click on "View".

You may also see this screen:

If you ...

Read more →

Auto-Assessed Taxpayers Alert

Written by Nicci

Updated 22 May 2023

SARS has given you just 40 working days to submit your tax return. If you received your auto-assessment at the beginning of July, your time to submit has already expired. Auto-assessments issued on 4 July 2022, expired on 30 August 2022. Count your work days carefully. SARS is applying this rule very strictly. If you do nothing, your auto-assessment will very soon become FINAL.

For more on auto-assessments and their deadlines, please read

Read more →

Why have I received a SARS refund, before filing my tax return?

Written by Nicci

Updated 24 November 2022

This year, SARS has once again ‘auto-assessed’ a large number of taxpayers. They have done this using data that they have received from 3rd parties, such as employers, financial institutions, medical schemes and retirement fund administrators.

If you have been auto-assessed, you should receive an email or SMS from SARS within the first few weeks of July. If your auto-assessment shows that you are due a tax refund, we are seeing SARS pay out these refu...

Read more →

Provisional Taxpayers: Unpacking Your Tax Season Deadline

Written by Nicci

Posted 19 October 2022

Tick-tock, time is running out for non-provisional taxpayers to submit their 2022 tax return. The filing deadline of 24 October 2022 is just around the corner.

Provisional Taxpayers: your tax return filing deadline is 23 January 2023. Breathe easy.

If you ‘think’ you are a Provisional Taxpayer, we strongly suggest you make 100% sure you me...

Read more →

New SARS Deadlines for Auto-Assessments

Written by Nicci

Posted 24 June 2022

From 1 July to 4 July, SARS aims to issue auto-assessments to taxpayers who are due a refund.

The rest will be issued in batches up to 24 July.

Timing is Everything

If you receive an auto-assessment, you will have just 40 working days to request a tax return on TaxTim (or eFiling), complete and submit it. If you take no action within the ...

Read more →

How to reject the SARS Auto Assessment

Written by Nicci

Posted 14 June 2021

If SARS have issued you an Auto Assessment, you will need to follow these steps to reject it so that we can help you to complete and submit your return to SARS.

Read more →

Written by Nicci

Written by Nicci

Written by Alicia

Written by Alicia

Written by Patrick

Written by Patrick

Written by Marc

Written by Marc