FAQs: Retrenchment

Written by Nicci

Posted 15 June 2020

Thousands of people have lost their jobs as a result of the Covid-19 pandemic and the nationwide lockdown to slow the spread of the disease.

Read more →

Navigating around your Capital gains tax certificate (IT3C)

Written by Alicia

Posted 15 May 2020

If you have shares (financial instruments) , there is important information on your IT3C tax certificate which needs to be included in your tax return.

This will ensure your taxable income is calculated accurately with the correct capital gain or loss included.

Do you have shares at any of the following institutions?...

Read more →

FAQs: 'Other Deductions' that you may be able to claim in your tax return

Written by Nicci

Posted 13 May 2020

There is a section in the tax return called ‘Other Deductions’ which often causes confusion for taxpayers

Read more →

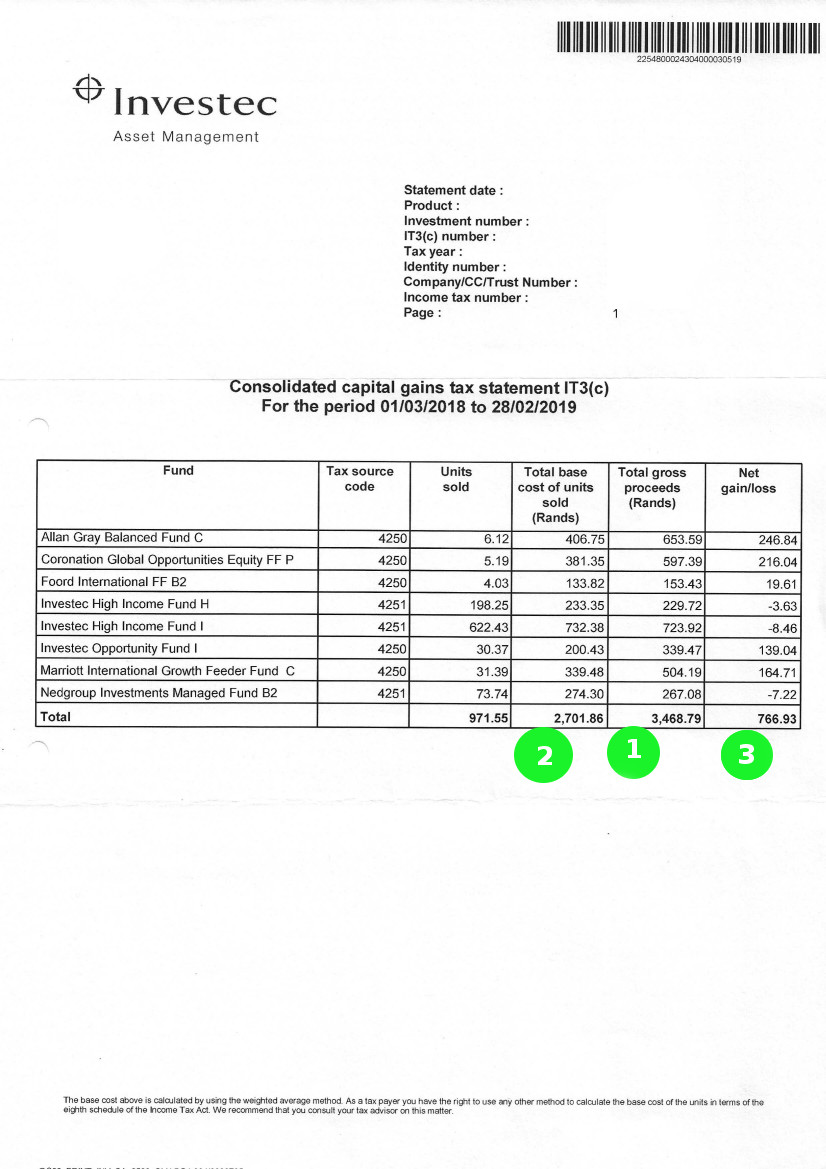

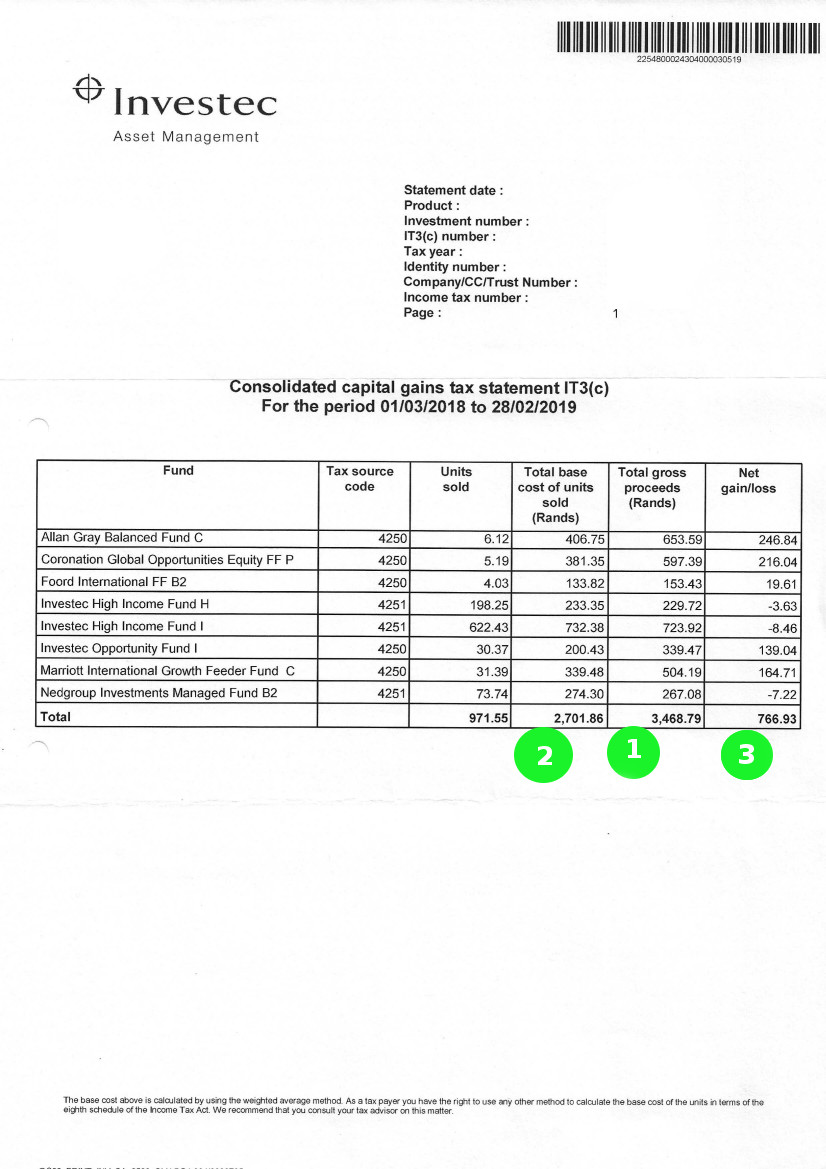

Navigating around your Investec investment tax certificate (IT3c)

Written by Nicci

Posted 12 May 2020

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

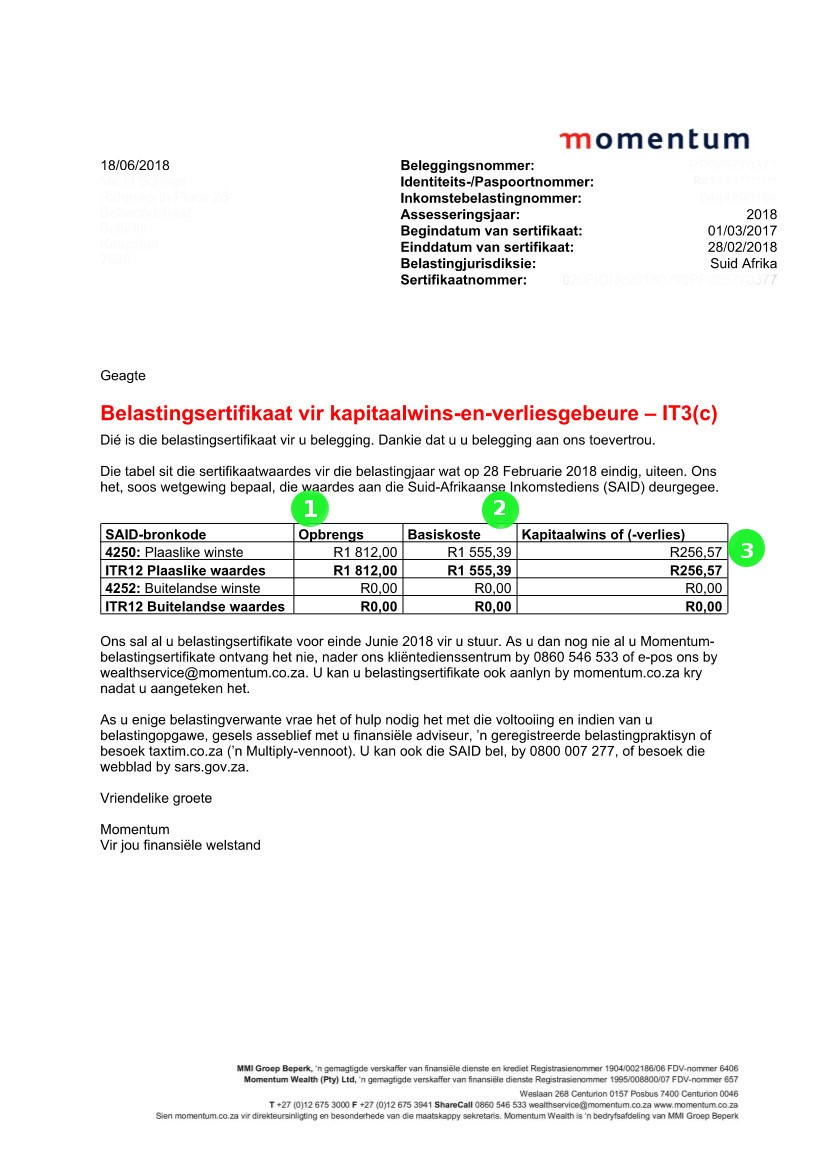

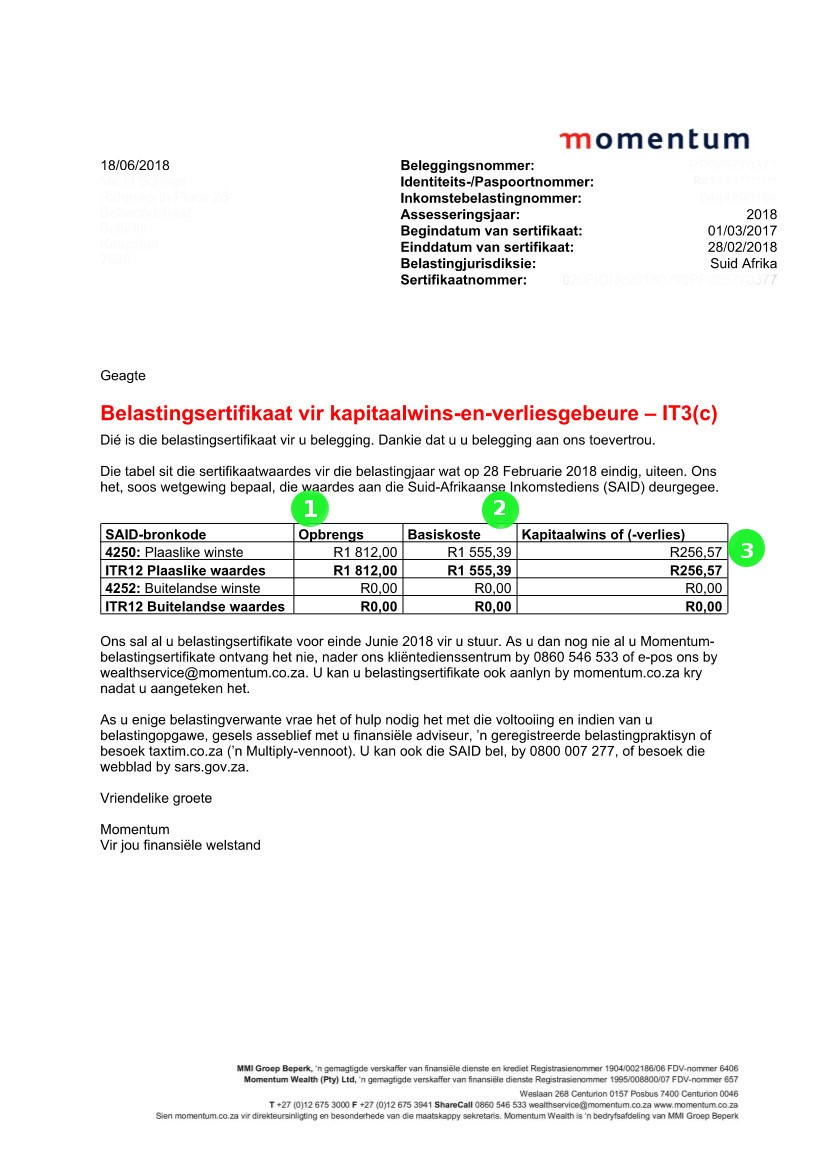

Navigating around your Momentum tax certificate (IT3c)

Written by Nicci

Posted 12 May 2020

1. Opbrengs/Proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. Basiskoste/Base Cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

...

Read more →

News Alert: Tax Season 2020

Written by Nicci

Posted 8 May 2020

On Tuesday evening, the SARS commissioner, Edward Kieswetter, held a media briefing to talk about the challenges that SARS is facing due to Covid-19.

Read more →

Do I earn enough to have to pay tax?

Written by Marc

Posted 23 April 2020

Why must I pay tax, I don’t earn enough! Will I get a penalty if I don’t disclose all my income to SARS?

Read more →

Tax Breaks For All

Written by Nicci

Posted 21 April 2020

What?

1.Rebates

Who?

Everybody

Primary, secondary, and tertiary rebates – depending on your age.

Read more →

The Tax Refund Myth: Why aren't I getting anything back?

Written by Marc

Posted 20 April 2020

Every year there arises a misconception amongst taxpayers that a tax refund or 'tax rebate', as it is incorrectly known to many,

Read more →

7 Types of Tax Directives

Written by Vee

Posted 19 April 2020

Imagine you’re an estate agent or luxury car salesman. Chances are that you don’t earn much (if anything) as a basic salary

Read more →

Promised a Guaranteed Tax Refund? Be Afraid - Be Very Afraid

Written by Vee

Posted 16 April 2020

Guarantees are pretty powerful – they’re used by leading manufacturers and retailers to gain our confidence and trust.

Read more →

How to know if an email from SARS is safe or scam

Written by Nicci

Posted 15 April 2020

Recently we have noticed emails that appear to have been sent from SARS, and that might look like legitimate SARS correspondence, but are not.

Read more →

Who's (Legally) Allowed to File Your Tax Return?

Written by Vee

Posted 12 April 2020

Tax isn’t the easiest of subjects to navigate. Besides the long list of legalese to master, there’s the fact that tax legislation

Read more →

How does Pay-As-You-Earn (PAYE) work?

Written by Marc

Posted 10 April 2020

You may have seen the word PAYE on your IRP5 payslip or heard it mentioned by your employer, but have no idea of its meaning.

Read more →

I worked for less than a year: Do I still need to submit a tax return?

Written by Nicci

Posted 10 April 2020

If you worked for less than a year, you may be confused as to whether or not you are required to submit a tax return.

Read more →

Multiple Employers, Multiple PAYE payments. Yet I still owe SARS?

Written by Nicci

Posted 9 April 2020

We receive many questions to our Helpdesk from taxpayers who are faced with the following scenario:

Read more →

10 Ways to Spend Your Tax Refund

Written by Vee

Posted 8 April 2020

It’s tax season, and one of the most compelling reasons to file a tax return (besides the fact that it’s the law, of course) is the chance that you’ve

Read more →

Provisional Tax FAQs

Written by Nicci

Posted 6 April 2020

What is a provisional tax?

Provisional tax is paid by people who earn income other than a salary / traditional remuneration paid by an employer.

How do I convert from a provisional taxpayer to a regular taxpayer? OR How do I de-register as a Provisional Taxpayer?

Your tax number stays the same, just make sure that it has not been deactivated. This has happened in some cases. You will also need to de-register as a Provisional Taxpayer (this won’t affect your tax number) You can do this on eFiling by going to the Home Tab and clicking Tax Types and de-registering there. This will mean you are only a "regular" taxpayer...

Read more →

Medical Aid contributions paid on behalf of a dependent

Written by Nicci

Posted 4 April 2020

Date

Taxpayer's Full Name

Address

Read more →

Special Economic Zones

Written by Nicci

Posted 3 April 2020

Special Economic Zones (SEZ’s) are certain designated areas of a country demarcated by the government for special targeted economic activities. These are generally areas where business and trade laws are different from that of the rest of the country. The aim of these zones is to encourage increased foreign investment and trade, as well as job creation. This done by way of several tax incentives which are available to business which operate in SEZ’s.

They include the following:...

Read more →

FAQs: Retirement funds and tax

Written by Nicci

Posted 2 April 2020

At TaxTim, we receive many questions from taxpayers about retirement funds and tax.

One of the biggest benefits of contributing towards a retirement fund is the tax break.

Read more →

Covid 19: Unpacking the Tax Relief for Small Businesses

Written by Nicci

Posted 1 April 2020

The national lockdown due to the Covid-19 virus is undoubtedly wreaking havoc on the economy. Small businesses have been hard hit – many not knowing if they will have sufficient cash flow to resume operations when things eventually return to normal.

Read more →

FAQ's: Medical Expenses and Taxes

Written by Nicci

Posted 31 March 2020

It’s not all doom and gloom when it comes to the rising costs of medical expenses. You can expect some tax relief if you contribute to a medical aid and if you spend a certain amount on ‘out of pocket’ expenses.

Read more →

Covid 19: What to do when you have to go to a SARS branch?

Written by Nicci

Posted 23 March 2020

Quarantine. Self-isolation. Coronavirus. These are the buzzwords for 2020, and once it is all over, words we’ll probably never want to hear again. In light of Covid-19, TaxTim offers the safest way to handle your taxes - online.

Read more →

Budget 2020: Unexpected Relief for Taxpayers!

Written by Nicci

Posted 27 February 2020

The Minister delivered some good news to South Africans yesterday when he announced there would be no significant tax hikes

Read more →

Older posts →← Newer posts

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Written by Nicci

Written by Nicci

Written by Alicia

Written by Alicia

Written by Marc

Written by Marc

Written by Vee

Written by Vee