Crypto Gains? Don’t Risk a SARS Surprise in February

Written by Patrick

Posted 19 January 2026

Between year-end deadlines and the December break, crypto is easy to ignore, until SARS doesn’t ignore it.

If you’re a South African provisional taxpayer who trades, stakes, farms, or flips cryptocurrencies or NFTs, your crypto activity from 1 March 2025 to 28 February 2026 forms part of your 2026 year of assessment. Your second provisional payment due in February 2026 must already reflect that income, or you risk penaltie...

Read more →

New SARS Crypto Rules: The Big Shift Coming in 2026

Written by Patrick

Posted 15 December 2025

“South Africa is proposing new international reporting rules that will give SARS significantly greater visibility into your crypto transactions beginning 1 March 2026, with the first domestic reporting submissions in 2027 and international exchanges expected around September 2027.. Crypto platforms will be required to report your trades, transfers and wallet activity.”

South Africa is getting ready for one of the biggest shifts in how crypto is taxed...

Read more →

South Africa may introduce a 20% tax on online gambling, here’s how it could actually work

Written by Patrick

Posted 8 December 2025

There’s been a lot of talk this week about the government's proposal to introduce a national 20% tax on online gambling. The news spread quickly, but most articles stopped at the headline. Very few explained how the tax would actually be calculated, who pays it, how it connects to existing provincial taxes, and what this means for everyday South Africans.

This guide breaks everything down in plain language, with simple examples and real numbers, so you can clearly understand what the proposal is about and how it might impact online betting going forward.

What exactly is being taxed?

The 20% tax does not apply to your personal winnings...

Read more →

How to inform SARS that you ceased to be a South African Tax Resident

Written by Elani

Updated 11 November 2025

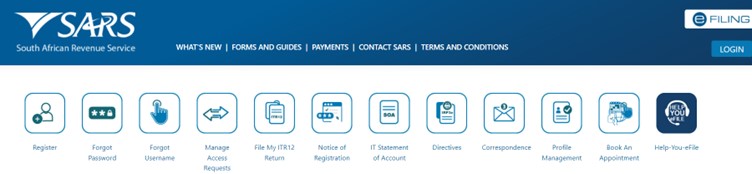

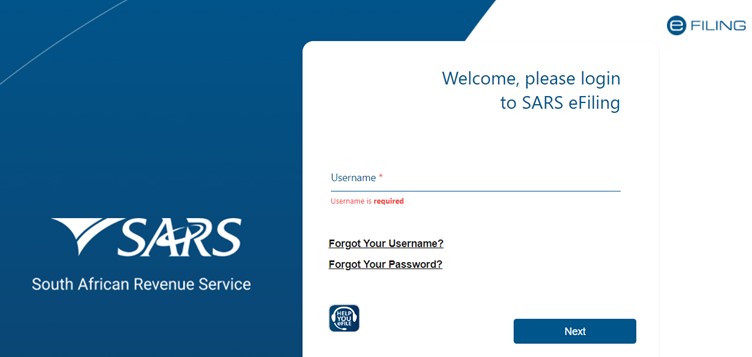

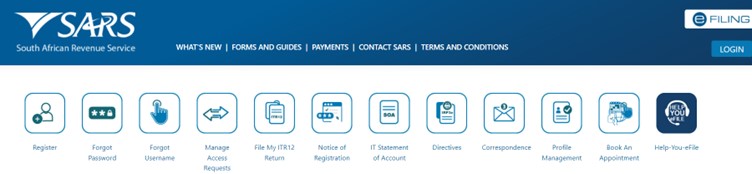

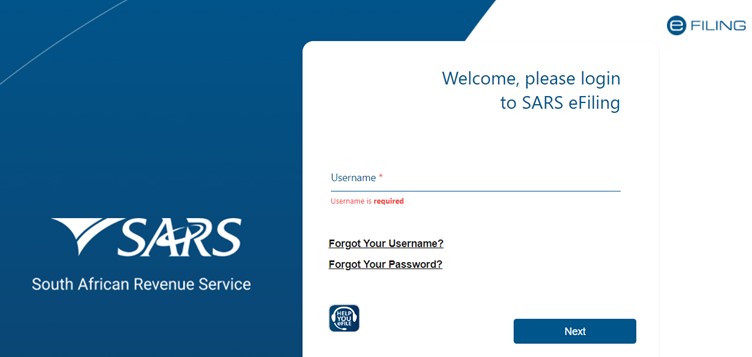

Step 1: Please log into your SARS eFiling profile

Step 2: Click on "Home" on the top menu

Step 3: Click on "SARS Registered Details" and then on "Maintain SARS Registered Details" on the l...

Read more →

How to submit a Request for Extension on eFiling

Written by Nicci

Updated 7 November 2025

Step 1:

Log into your SARS eFiling pofile.

Step 2:

Navigate to your Tax Return which was auto-assessed.

You can do this by clicking "Returns" (top menu), then "Returns History" (side menu), then "Personal Income Tax ITR12" , then select the the relevant ITR12.

You will see the

Read more →

Auto-Assessed Taxpayers: Missed the SARS filing deadline?

Written by Nicci

Posted 30 October 2025

If you were auto-assessed by SARS, your deadline to submit a tax return was 20 October 2025. If you still want to submit a Tax return but did not file by this date, don’t panic, you can still sort it out. But you can’t just file late. You first need to request an extension.

Step 1: Request an Extension

Go to SARS eFiling and navigate to your Income Tax Work Page for 2025....

Read more →

How FNB clients can simplify tax season and save

Written by Patrick

Posted 2 October 2025

At FNB, your financial wellbeing is always a priority. Tax season is an important part of that journey, but it’s also a time that many people find stressful or overwhelming. That’s why FNB has partnered with TaxTim, South Africa’s trusted digital tax assistant, to make filing simpler, faster, and even more rewarding.

Why Filing Correctly Matters

Filing your ta...

Read more →

How to update your contact details on eFiling

Written by Alicia

Updated 15 September 2025

Please read the steps below to update your contact details on your SARS eFilng profile:

1. Go to www.sarsefiling.co.za

2. Log into your eFiling profile:

3. Click on

Read more →

Tax Directive Error Affecting Certain Retirement Fund Transfers

Written by Nicci

Posted 12 August 2025

TaxTim is aware of a tax directive issue between SARS and certain retirement funds where some fund transfers are incorrectly being treated as taxable events. One of the funds affected, Alexander Forbes, has confirmed that it is aware of the error and is working with SARS to resolve it.

The problem arises when retirement funds are transferred from one fund to another. These should not be taxed, but the error ha...

Read more →

How to Estimate Your 1st Provisional Tax Payment

Written by Patrick

Posted 8 August 2025

So, it’s that time of year again and SARS wants a payment. But how much are you actually supposed to pay, and how do you even begin to figure that out? That’s where this guide comes in. We’ll walk you through the full process of estimating your income, calculating what you owe, and understanding what it all means, step by step.

Quick tip: Don’t confuse your total income with your taxable income. You’re only taxed on profit, what’s left after you subtract business expenses.

It’s the amount left after you subtract your business expenses, the actual costs you had to pay to earn that income...

Read more →

Foreign Nationals and Non-Residents: Important SARS Update for this Tax Season

Written by Alicia

Posted 29 July 2025

SARS (the South African Revenue Service) has made recent changes regarding how foreign nationals and some non-resident taxpayers are handled in the tax system. These changes affect both current tax residents without SA ID numbers and individuals who have since left South Africa.

What's Changed?

Previously, SARS assessed taxpayers based on their location while earning income. This allowed many foreign nationals living and worki...

Read more →

Non-Residents: Please read this before you submit your tax return

Written by Nicci

Posted 23 July 2025

If you are a non-resident for tax purposes but SARS still has you on record as a South African tax resident, you will face unexpected challenges when filing your tax return this season.

In prior years, SARS allowed taxpayers to file as non-residents even if their RAV01 profile still reflected them as residents. However, SARS has introduced changes this tax season: you will ...

Read more →

Important Tax Filing Reminder: Don't Miss the Deadline

Written by Nicci

Updated 17 July 2025

If you're a salary-only employee (i.e non-provisional taxpayer), your tax filing deadline is 20 October 2025. But, if you do fall into the provisional taxpayer category, your deadline extends to 19 January 2026.

However, it's super important to note that if you were auto-assessed, then your deadline is 20 October 2025 even if you qualify as a provisional taxpayer.

Now, if you're thinking about waiting until the later deadline next year and consider yourself a ...

Read more →

Why don't I get a tax deduction for Out of Pocket Medical Expenses?

Written by Marc

Updated 13 July 2025

Tax season always throws up some interesting and confusing calculations, but for many, the most confusing of all is how medical aid contributions and Out of Pocket medical expenses are treated.

Read more →

I work for someone, but did not receive an IRP5 - what should I do?

Written by Nicci

Updated 27 June 2025

You may be employed by someone, but for one reason or another- you don't receive an IRP5 and no amount of begging or pleading

Read more →

Have you ceased residency during the tax year?

Written by Nicci

Posted 26 June 2025

SARS has made changes to the 2025 tax return to help taxpayers who ceased South African tax residency during the tax year. If this applies to you, your tax return will now include two parts:

Part 1: While you were still a South African tax resident

Read more →

Why do I owe SARS more money?

Written by Nicci

Updated 19 June 2025

Once you’ve completed filing your tax return, it’s possible to find that instead of getting money back

Read more →

A Directors PAYE and UIF deductions

Written by Nicci

Updated 14 June 2025

As a Director of a Company, your salary is subject to monthly PAYE and UIF deductions. Many small business owners don’t realise that if they operate their business through a company (Pty), the company needs to be registered as an employer with SARS.

This means, the company needs to deduct employee’s tax (PAYE) from the amounts paid to Directors. It’s also required to make monthly EMP201 submissions (this is the PAYE, UIF and SDL return) to SARS. The same applies even in the case of “owner managed” businesses -where there’s only one director and no employees...

Read more →

Top questions on Commission Earners

Written by Nicci

Updated 7 June 2025

Our helpdesk receives hundreds of questions from commission earners about how their tax is calculated. Many are also confused about which expenses they can claim. Hopefully our FAQ will help other taxpayers who might be puzzling over the same issues.

1. I have a salary and earn a small commission; can I claim for my travel to and from work every day? (The commission is based on the sales that my team makes telephonically per month).

Should the commiss...

Read more →

Budget 2025: Tough Times Ahead

Written by Nicci

Updated 6 June 2025

Although the latest budget avoids the steep VAT hike proposed last month, it still puts significant pressure on taxpayers.

All taxpayers will feel the pinch, as tax brackets and rebates have not been adjusted for inflation - for the second year in a row.

VAT is proposed to rise by 0.5 percentage point this year, with another increase planned for 2026, bringing it to 16%...

Read more →

Tax Season 2025: opening date and deadlines

Written by Alicia

Posted 3 June 2025

The 2025 filing season opens this year on Monday, 21 July.

This year, the tax season is even shorter than last year (and last year was shorter than the prior year!). This means that SARS are giving you less time to file your tax return.

Important Filing Deadlines

20 October 2025: Salary-only employees, who earn no other signficant income (i.e. non-provisional taxpayers) and ALL auto-assessed ...

Read more →

What you need to know about SARS auto-assessments (ITA34s)

Written by Patrick

Updated 3 June 2025

What is an auto-assessment?

This is an automatic assessment issued by SARS to certain taxpayers.

Read more →

Unpacking the Section 13sex Residential Unit Deduction

Written by Nicci

Posted 23 May 2025

The Section 13sex residential unit deduction is a South African tax break for people who invest in new rental properties. If you build or buy new units to rent out, you can deduct part of the building cost from your taxable income each year. To qualify, you must own at least five new and unused residential units in South Africa that are used for rental.

You can claim 5% of the building cost

Read more →

What is a Financial Instrument?

Written by Alicia

Posted 23 May 2025

What is a financial instrument according to SARS?

A financial instrument is a contract that represents money or something of value. For one party, it’s an asset (something valuable), and for the other party, it’s a liability (something owed) or equity (ownership).

According to SARS, a financial instrument is defined to include:

“a share, a member’s interest in a company, a debenture, a unit in a unit trust

scheme, a participatory interest in a portfolio of collective investments scheme, a...

Read more →

Why Is My Take-Home Pay Less Than My Gross Salary?

Written by Alicia

Posted 19 May 2025

Have you ever noticed a difference between your contracted salary and the actual amount deposited into your bank account? This Q&A aims to clarify some common reasons for these discrepancies.

How do I know if my employer has deducted tax from my salary?

The monthly deposit into your bank account will likely be less than your gross salary. This is because your employer withholds Pay-As-You-Earn (PAYE) tax and other statutory deductions...

Read more →

Older posts →← Newer posts

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Written by Patrick

Written by Patrick

Written by Elani

Written by Elani

Written by Nicci

Written by Nicci

Written by Alicia

Written by Alicia

Written by Marc

Written by Marc