Tax Round Up: Top 5 Weekly Questions

Written by Nicci

Posted 11 February 2019

We have identified the top five most-asked questions from our users on our TaxTim help-desk this past week. Take a look below to see what has been confusing taxpayers the most.

- Which provisional return (IRP6) is due now?

The provisional tax return for the 2019 second period, which covers your income from 1 March 2018 to 28 February 2019, is due on Thursday the 28th of February 2019. Try to submit your return and make ...

Read more →

Relocation expenses

Written by Nicci

Posted 11 February 2019

I got a new job and the new company is paying me one month's salary as relocation allowance. I understand that this is taxed, but can I have any tax deductions if I can prove actual relocation expenses?

Movement of assets

Written by Nicci

Posted 9 February 2019

What does movement of assets mean?

This query relates to question 7680 "What was the movement in Assets, Liabilities and/or Reserves?" in the Dormant Companies section.

Black Friday Survival Tips

Written by Nicci

Posted 22 November 2018

It's that time of the year again - Black Friday!

We'd like to assume that you've probably been inundated with nothing but sale specials in your inbox . While others have managed to plan ahead to ensure a pleasant shopping experience, other consumers will shop wildly and randomly during this highly anticipated sale bonanza. With so little time to spare we've put together 3 important things to remember this Black Friday:

1. Compare your options

Sometimes brand loyalism should be left at home...

Read more →

I still have source code 3697 and 3698 on my IRP5 for 2018

Written by Marc

Posted 23 October 2018

Question: Where can I input source code 3697 or 3698 from my IRP5? I do not see a place for this anywhere?

Answer: Those codes are no longer applicable for 2018 IRP5s, if you have 3697 and 3698, add them together and include that total amount for source code 3699.

I have more than one employer / multiple IRP5s

Written by Evan

Posted 12 October 2018

If you worked for multiple employers and/or have several IRP5/IT3a documents, please take note of below.

Make sure that all of your documents relate to the tax year you are busy with. Any IRP5s from previous (or future) years do not get entered in the same tax return. The document will usually state the tax year clearly, and the employment dates will fit within the tax year opening and closing dates.

You can not add multiple IRP5 documents together. They need to be entered one by one, one after the other. The sequence is not important....

Read more →

FAQs on TaxTim

Written by Nicci

Posted 11 October 2018

We’ve put together a few FAQs which have come from many of our users. These questions vary from the filing process on TaxTim as well as the generic tax questions which can often be quite unclear. With the tax filing season deadline being just around the corner, we’d like to ensure you’ve got the correct information and tools to help you navigate your way around the processes. Knowing exactly what to do when it comes to your taxes during this final stretch. After all, according to SARS, filing a tax return is your responsibility and not your employers'....

Read more →

File by 31 October or face heavy fines and potential legal action!

Written by Nicci

Posted 11 October 2018

With the tax season shortened this year by 3 weeks, the deadline to file by 31 October is just around the corner. SARS announced that it will be clamping down on taxpayers who miss the deadline to submit their tax return. Besides stating that they will impose monthly fines for late tax returns, they have even gone so far as threatening criminal prosecution and time behind bars for unpaid tax debt, just as many of us have witnessed with the recent celebrity headlines....

Read more →

I started a tax return for the wrong year

Written by Evan

Posted 27 September 2018

If you started a tax return for the wrong year, please follow the steps below:

1. Login to your TaxTim profile.

2. Click on My Returns in the top menu bar.

3. Click the x button next to the tax return that you do not need any more.

4. Click Start new return to start a new tax return that relates to the year you need.

Please send a message to ou...

Read more →

Why have I received a smaller tax refund from SARS this year?

Written by Marc

Posted 23 July 2018

We receive many queries from confused taxpayers who are disappointed to see their tax refunds are smaller than the refund received last year.

Read more →

Why does SARS / TaxTim say my supporting document is password protected when it isn't?

Written by Evan

Posted 5 July 2018

Why is this happening?

You may be using TaxTim to submit your tax return and receive an email back from us saying that your supporting document upload was rejected by SARS due to password protection.

You may also be using SARS eFiling directly and wonder why an error message says "the document can not be converted".

You might be confused because the PDF has no password-protection, or none that you can see when you open up the PDF document in Adobe.

This error occurs most often with IT3b's, bank statements and Retirement Annuity Fund PDFs supplied by certain funds or banks...

Read more →

Get your digital tax health score to help you pay less tax

Written by Nicci

Posted 3 July 2018

TaxTim, which helps you to complete and file your tax returns online with the help of a digital tax expert called Tim, now offers a personalised tax health score report free which could help users pay less tax.

The score is the result of an in depth automated analysis of an individual’s tax return. It makes recommendations on how to improve tax health for maximum tax efficiency.

“For the first time, taxpayers will have a report card reflecting where they can improve their tax affairs and maximise efficiency...

Read more →

What to expect after submitting your tax return to SARS

Written by Marc

Posted 23 June 2018

As soon as

tax season opens in July, many taxpayers rush to submit their

ITR12 tax returns as early as possible, eagerly hoping for a nice refund.

Read more →

Letters you may need to provide to SARS

Written by Nicci

Posted 4 June 2018

After submission of your tax return, SARS may request certain documents from you.

These may include a letter if you claimed any of the following deductions:

- Home Office

- Wear and Tear on personal devices used for work e.g laptop or cellphone.

- Foreign Employment Income Exemption...

Read more →

Is my SARS eFiling profile still being verified?

Written by Evan

Posted 30 May 2018

In order to submit tax returns electronically online via TaxTim or via SARS eFiling, you will need a working SARS eFiling profile.

Is my eFiling profile ready to use?

Follow these steps to see if your profile is ready to use, or still being verified:

- Visit the SARS eFiling website.

- Login with your login name and password.

- Look at the opening page after login.

Do you see no checks next to tax types, and no tax reference number filled in? If YES, your profile is still being verified....

Read more →

How Do Taxpayers Feel About The Proposed New Filing Deadline?

Written by Nicci

Posted 28 May 2018

On Monday 21st May, TaxTim conducted a simple survey of taxpayers who make use of the TaxTim services about their opinion on SARS’ proposal to shorten the tax filing season by 3 weeks.

An email was sent out containing the following:

“SARS recently published a Draft Notice of who needs to file a tax return and when tax returns will be due for the 2018 tax season. SARS are planning to move the submission deadline 3 weeks earlier to 31st October 2018 for all non-provisional taxpayers. ...

Read more →

Be smart and save tax when receiving income from an Airbnb

Written by Nicci

Posted 14 May 2018

Taxpayers who earn Airbnb income often don’t know what they need to do when it comes to declaring this income to SARS. Sometimes taxpayers think that they don’t have to declare this extra income, or can hide it from SARS by not entering it on their tax return form - a big mistake!

The truth is that extra income earned from Airbnb income is taxable, and SARS needs to know about it. In some cases - if the amount earned (profit) outside of a salary is larger than R30,000 a y...

Read more →

Budget Speech: VAT rises by 1%, predictions were correct!

Written by Nicci

Posted 21 February 2018

Taxpayers should breathe a sigh of relief as a much lower than expected R36bn in increased taxes was announced by the once-off Minister of Finance. The biggest news amongst the increases was the VAT rise of 1%. For the first time in 25 years, all South Africans will see most goods and services become a little bit more expensive thanks to the Value Added Tax rise. Although controversial, a VAT rise was much needed and will bring in almost R23...

Read more →

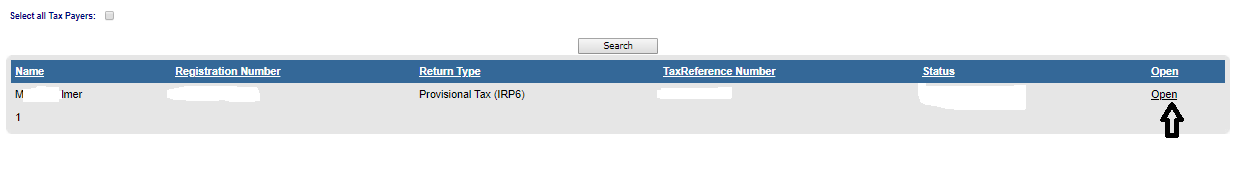

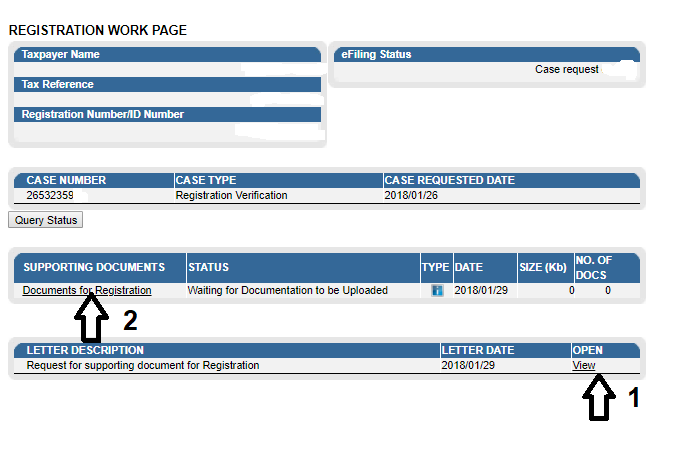

How to upload supporting documents to verify your eFiling account

Written by Nicci

Posted 20 February 2018

1. Log into your eFiling profile

2. Click on Home

3. Click User

4. Then select “Pending registration”

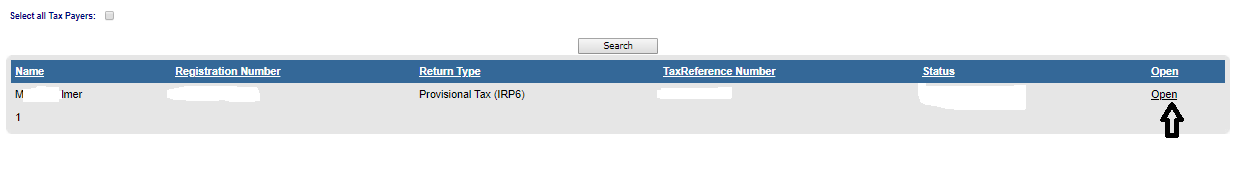

5. Thereafter click on “Open” in the middle of the page

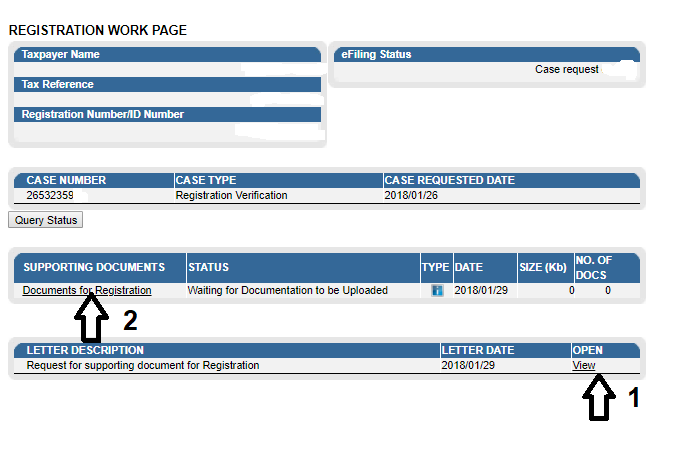

5. This will take you to the “Registration work page”

...

...

Read more →

Mirror Mirror on the Wall, Where Do We Look to Plug the Shortfall?

Written by Nicci

Posted 19 February 2018

By now we are all aware that it is more than likely that SARS will miss its 2018 revenue collection target that it set a year ago by R51bn. The budget deficit (i.e. the gap between government expenditure and income) for the first eight months of the tax year from April to November 2017 widened to a record R195 billion as tax collections lagged due to a slowing economy, low business confidence and a possible slippage in compliance by taxpayers. Sadly, there’s no light at the end of the tunn...

Read more →

I've raised a dispute: Do I need to pay?

Written by Nicci

Posted 14 February 2018

Many disgruntled taxpayers are receiving SMS’s from SARS who threaten legal action if they don’t pay their outstanding tax debt.

However, these same taxpayers raised a dispute/lodged an objection because they didn’t agree with the SARS assessment and are still waiting for the dispute to be resolved.

This can take up to 60 working days and in many cases, even longer. In fact if the dispute was raised at the end of last year, SARS will take even longer because the period 15 December to 15 Janaury is excluded from the 60 day review period!...

Read more →

Latest SARS Guide: Tax treatment of retrenchment benefits

Written by Nicci

Posted 8 February 2018

In the past, taxpayers who received a severance payment benefitted from the favourable tax treatment applied to it. It didn’t matter if the retrenchment was ‘voluntary’ or ‘involuntary’ (i.e. forced). If it was their first such lump sum, R500,000 was exempt from tax and the balance was taxed according to special tax tables.

For the first time last year, SARS issued a guide on Tax Directives, which distinguished, between ‘voluntary’ and ‘involuntary’ retrenchments as follows:...

Read more →

Disposal of Small Business Assets

Written by Nicci

Posted 5 February 2018

If you have reached the age of 55 years, and are thinking of selling your small business, read on to find out more about the special capital gains exclusion of R1,800,000 which may apply to you.

Before getting into the detail, let’s first highlight the three different scenarios where this exclusion may apply:

1. You are selling your business, which you operate as a sole proprietor.

2. You are selling your share of a business, which you run through a partnership....

Read more →

Do I qualify for the small business capital gains exclusion on retirement?

Written by Nicci

Posted 2 February 2018

Yes, you qualify for the Capital Gains Exclusion relating to the disposal of small business assets on retirement.

You can deduct a once-off cumulative R1,8m exclusion from the capital gain you have made on the sale of your small business.

Please read our blog for further details.

No, you don't qualify for the Capital Gains Exclusion relating to the disposal of small business assets on retirement....

Read more →

Navigating around your Momentum tax certificate (IT3b)

Written by Nicci

Posted 29 January 2018

1. Local interest - source code 4201

Older posts →← Newer posts

15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35

Written by Nicci

Written by Nicci

Written by Marc

Written by Marc

Written by Evan

Written by Evan

...

...