Provision for Doubtful Debts

Written by Elani

Posted 16 May 2023

Doubtful debts are accounts receivables (monies owed to the company) that will most likely not be repaid.

A Provision for Doubtful Debts is made for the portion of money due by your company's debtors that you expect won't be paid

Capital and Reserves

Written by Elani

Posted 16 May 2023

Capital and Reserves is a line item under the Equity section of the Balance Sheet.

Capital is the initial investment made by the shareholders of the company by means of cash, equipment or property.

Reserves, also known as accumulated profits or retained earnings, is the profit left over after all expenses and taxes have been paid and dividends have been distributed to the shareholders.

In summary, it is the accumulated profits that the company has 'saved' each year, wh...

Read more →

Why is my IRP5 not being imported from eFiling?

Written by Alicia

Updated 15 May 2023

The helpdesk has been inundated with questions asking why TaxTim is unable to import IRP5 details from eFiling and why taxpayers have to manually enter all the data that had usually been imported in previous tax years.

Here's a few reasons, why you may be experiencing this issue:

- The tax season usually opens 1 July each year - if you are trying to complete your tax return early (i.e from 1 March) your data will not be available on eFiling as all instit...

Read more →

Voluntary Disclosure Programme

Written by Elani

Posted 10 May 2023

The Voluntary Disclosure Programme (VDP) is a voluntary opportunity for individuals, companies and trusts who have previously defaulted on their tax affairs, to come forward and disclose their non-compliance to SARS in order to work with SARS to regularise their tax affairs.

There are specific requirements that must be fulfilled to qualify for this relief.

IT14SD

Written by Nicci

Updated 10 May 2023

An IT14SD is required for companies only. It is a schedule which reconciles the business's VAT, PAYE, Income Tax and Customs declarations from the ITR14 to the information submitted to SARS during the year. SARS may request the IT14SD after submission of the ITR14. If it is required, SARS will make it available to the taxpayer via a link in SARS eFiling.

This form was discontinued in September 2022 and is no longer a SARS requirement.

Dormant

Written by Elani

Posted 9 May 2023

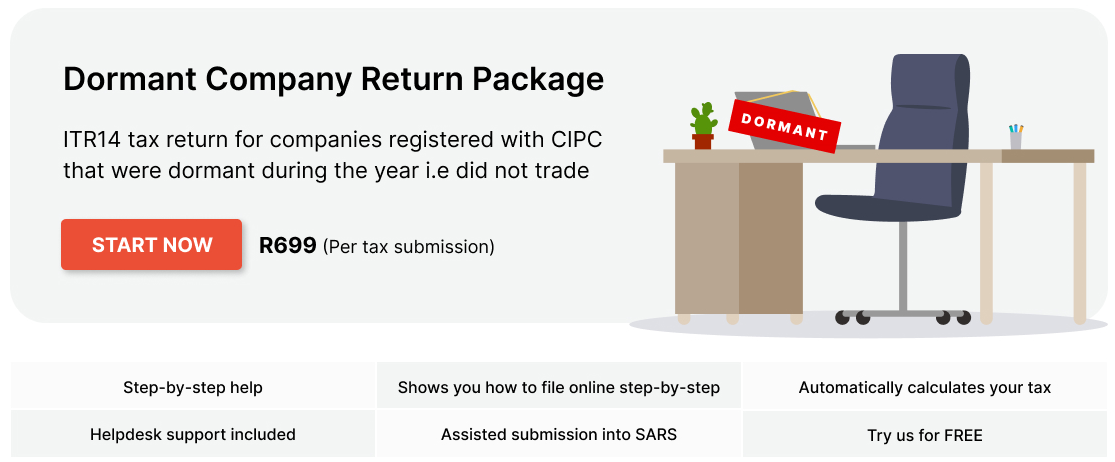

A dormant company is a company that is registered with the CIPC (The Companies and Intellectual Property Commission) but is not actively trading.

Even if the company is not trading, tax returns must be submitted to SARS to avoid unnecessary penalties and interests.

Click here for more information.

Should I file a dormant return?

Written by Alicia

Posted 26 April 2023

Are you confused about whether your company should file a dormant return or a normal ITR14 for companies? It's understandable - dormancy can be a tricky concept to navigate. It's important to understand that the type of tax return you need to file depends on when your company became dormant. But don't worry, we're here to help you figure it out!

First things first, what is a dormant company?

A dormant company is a company which is registered with the ...

Read more →

Dormant Company Tax Returns

Written by Patrick

Posted 26 April 2023

If you've registered a company with CIPC some time ago and forgot about it, that company could land you in hot water with SARS. Even if the company is not actively trading and has no assets or liabilities, you still have a duty to submit its tax returns to SARS. Failure to do so can result in administrative penalties that ...

Read more →

11 Types of Tax Directives

Written by Nicci

Updated 14 April 2023

Imagine you’re an estate agent or luxury car salesman. Chances are that you don’t earn much (if anything) as a basic salary and you rely on a few big deals and commission payments to keep you afloat during quieter months.

Read more →

Everything you need to know about tax-free savings

Written by Patrick

Posted 10 March 2023

The South African government introduced tax-free savings back in 2015 to encourage household savings. As the name suggests, all of the proceeds from tax-free savings accounts (TFSAs), including interest, capital gains and dividends are exempt from tax. This makes these types of investments extremely attractive for South African taxpayers.

How tax-free savings work

Tax-free savings are an investment vehicle created to help South Africans reduce their tax liab...

Read more →

Budget 2023: New Energy Tax Incentives

Written by Nicci

Posted 22 February 2023

Finance Minister, Enoch Godongwana, delivered his second budget speech to South Africans yesterday. The energy crisis played centre stage with the minister announcing that the government will take over a large part of Eskom's debt. He also outlined two major tax incentives to encourage individuals and businesses to invest in renewable energy and independent electricity generation. Much to everyone's relief, he went on further to announce that there would be no major tax proposals for the year...

Read more →

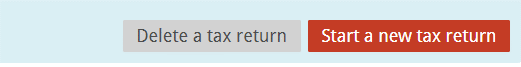

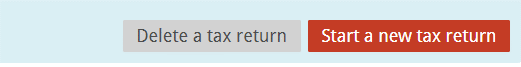

Can I delete a tax return on eFiling?

Written by Alicia

Posted 21 February 2023

Did you start a wrong tax return on eFiling by mistake? This could happen for example, if you selected the wrong tax year.

Can you delete the tax return and start again?

Unfortunately not - once a return has been requested on SARS eFiling, there is no way to delete it. It will show under Returns Issued as a ‘Saved’ version on your SARS profile. You don’t need to worry about it though. As long as it is not submitted, SARS will ignore it.

Read more →

How do I delete a tax return on TaxTim?

Written by Evan

Updated 20 February 2023

1. Login to your TaxTim profile.

2. Click the My Returns button in the top header menu.

3. Click on Delete a tax return.

4. Then click on the tax return you wish to delete.

Read more →

Provisional Taxpayers

Written by Elani

Updated 11 February 2023

Click here to find out if you are a provisional taxpayer.

Provisional taxpayers are people who earn income other than a salary / remuneration. If you earn any of the following income, you may be a provisional taxpayer even if you also earn a salary:

- Rental Income

- Interest and investment income

- Freelance/business Income

- Othe...

Read more →

How to cash out your retirement annuity after emigrating from South Africa

Written by Patrick

Posted 31 January 2023

Retirement annuities are tax-smart investments that help you to save for life after your nine-to-five. You generally can’t withdraw these funds before you turn 55, but you may be able to do so if you’ve emigrated from South Africa.

What is a retirement annuity?

A retirement annuity – or RA for short – is an investment vehicle designed to help people living and working in South Africa save towards retirement. It can be used as a...

Read more →

I need to pay SARS

Written by Alicia

Posted 8 December 2022

When should I pay SARS

You’ve received your assessment, sent SARS your supporting documents but owe SARS on the initial assessment, what should you do?

As soon as you receive your assessment and it confirms that you need to pay SARS an amount, you can make the payment to SARS. You can do this even if there’s a first and second due date on your assessment to make the payment, if you are able to make the payment before the second due date, we suggest you pay SARS to ...

Read more →

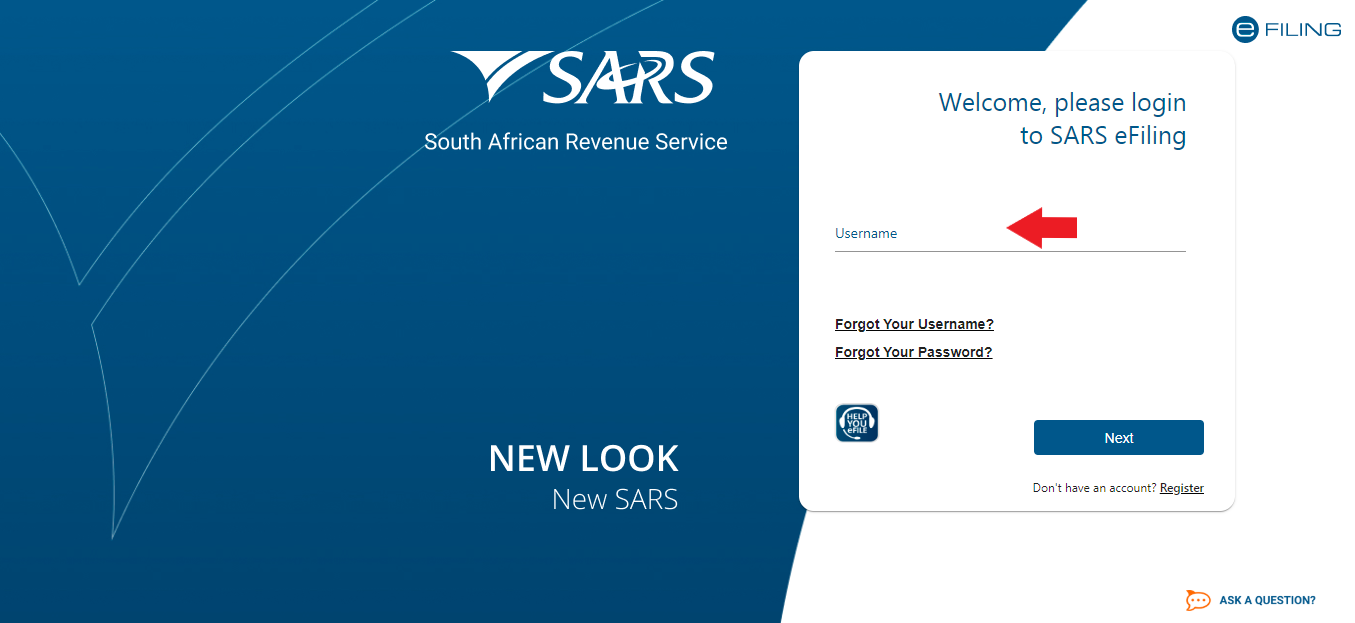

How to draw a statement of account on SARS efiling

Written by Nicci

Updated 1 December 2022

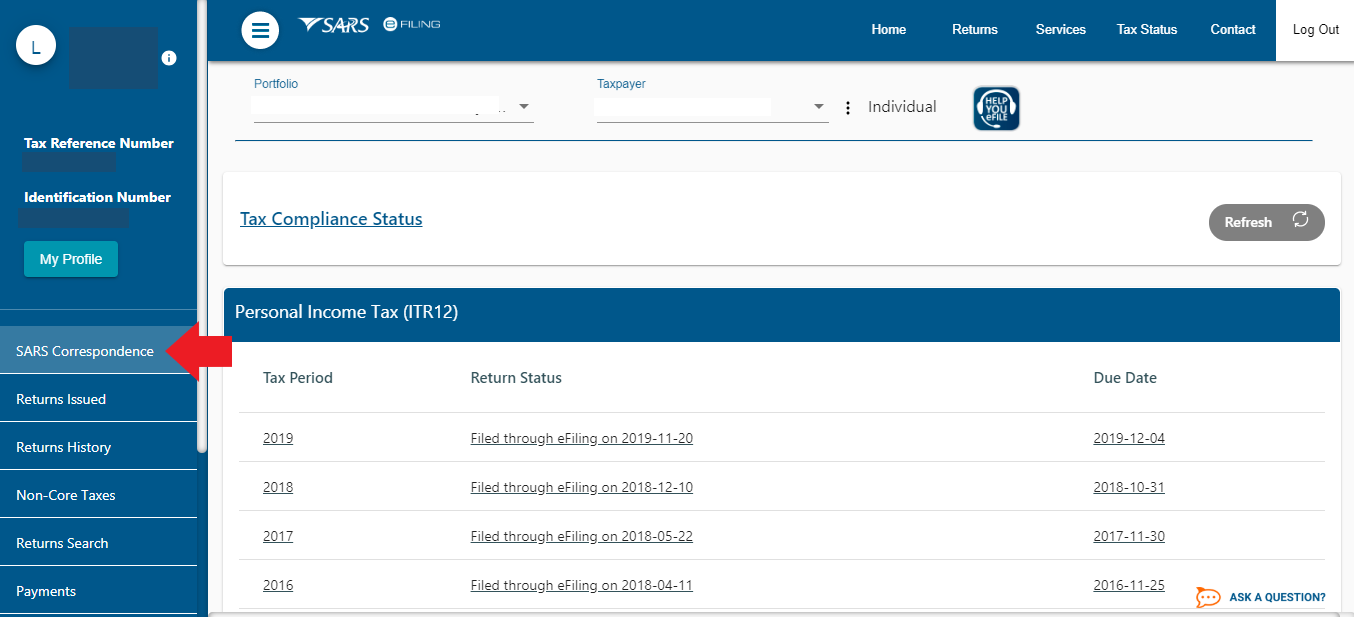

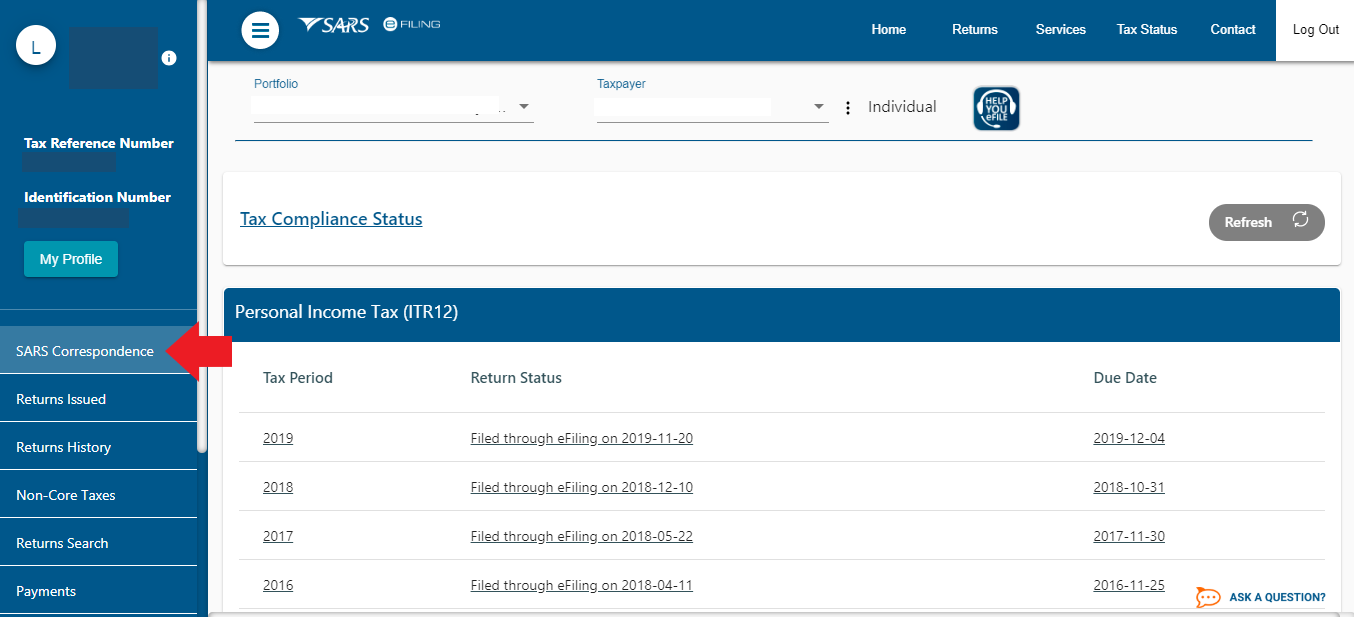

7 Steps on how to draw a statement of account on SARS efiling:

Step 1.

Log into your SARS efiling profile:

Step 2.

To the left select: "SARS Correspondence"

Step 3. ...

Read more →

Why have I received a SARS refund, before filing my tax return?

Written by Nicci

Updated 24 November 2022

This year, SARS has once again ‘auto-assessed’ a large number of taxpayers. They have done this using data that they have received from 3rd parties, such as employers, financial institutions, medical schemes and retirement fund administrators.

If you have been auto-assessed, you should receive an email or SMS from SARS within the first few weeks of July. If your auto-assessment shows that you are due a tax refund, we are seeing SARS pay out these refu...

Read more →

Why can't I see my return on eFiling after TaxTim submitted it for me?

Written by Marc

Updated 29 October 2022

Why can’t I see my return on eFiling after TaxTim submitted it for me?

If you don’t see your tax return immediately on eFiling after we’ve confirmed that it’s been sent to SARS, you needn’t panic. SARS usually processes it around 6pm on the day we submit and then it should appear in eFiling shortly thereafter.

We will then send you the assessment as soon as we receive it from SARS.

SARS repeat reminders for supporting documents

Written by Alicia

Posted 27 October 2022

If you received another email from TaxTim requesting SARS supporting documents, but you already sent these to SARS more than 21 business days ago, one of these four scenarios might be the reason you are still waiting:

Scenario 1:

You submitted the documents directly on SARS eFiling yourself, but you did not inform TaxTim. In this case, our system needs to be updated to reflect that you already submitted your documents.

Please log into your TaxTim profi...

Read more →

Provisional Taxpayers: Unpacking Your Tax Season Deadline

Written by Nicci

Posted 19 October 2022

Tick-tock, time is running out for non-provisional taxpayers to submit their 2022 tax return. The filing deadline of 24 October 2022 is just around the corner.

Provisional Taxpayers: your tax return filing deadline is 23 January 2023. Breathe easy.

If you ‘think’ you are a Provisional Taxpayer, we strongly suggest you make 100% sure you me...

Read more →

SARS has introduced a new online travel declaration system for South Africans & its residents.

Written by Patrick

Posted 18 October 2022

The South African Revenue Service (SARS) says it will implement an "online traveller declaration system" that will go into effect on November 1, 2022. According to SARS, the new system will be applicable to all South Africans travelling abroad and says that it will simplify passenger movement at South African airports.

According to SARS, the system's goal is to collect travel information and in exchange, grant a traveller pass via email. It requires that all South Africans and residen...

Read more →

How do I review my tax return before submitting?

Written by Evan

Updated 26 September 2022

1. Finish answering all of Tim's questions in the animated chat.

2. Click Continue.

3. Continue through the return checking system and/or payment steps.

4. When you are asked how you wish to file your tax return, click on the manual filing option.

5. You will see instructions for filing on eFiling with your fully completed tax return underneath.

6. Click the Back button to choose how to file again.

How to inform SARS that you ceased to be a South African Tax Resident

Written by Elani

Posted 16 September 2022

Step 1: Please log into your SARS eFiling profile

Step 2: Click on "Home" on the top menu

Step 3: Click on "SARS Registered Details" and then on "Maintain SARS Registered Details" on the l...

Read more →

Am I a Tax Resident of South Africa?

Written by Evan

Updated 14 September 2022

Yes, I am a tax resident of South Africa

This means that you are subject to paying tax on your income earned from South Africa AND from all over the world, and this must be declared in a tax return submitted every year to the South African Revenue Service (SARS). Make use of TaxTim to ensure you are tax compliant and qualify for your maximum allowable tax refund.

No, I am not a tax resident of South Africa...

Read more →

Older posts →← Newer posts

Written by Elani

Written by Elani

Written by Alicia

Written by Alicia

Written by Nicci

Written by Nicci

Written by Patrick

Written by Patrick

Written by Evan

Written by Evan

Written by Marc

Written by Marc