Written by Alicia

Updated 2 August 2023

Written by Alicia

Updated 2 August 2023

With the end of the tax year looming, SARS tax collectors are on high alert to collect taxes and meet their revenue targets.

If you owe SARS, you should be receiving constant reminders to pay your debt. This may be in the form of SMS's, phone calls or even posted letters.

If the debt is unfamiliar or if you are not in agreement with the debt, you can File a dispute with SARS , however, if you know about the debt but can't pay it all at once, you can set up a payment arrangement with SARS.

Firstly, check that you meet the requirements listed here: Terms to get a payment arrangement. If you are satisfied that you comply, you can follow these steps to set up a payment arrangement with SARS:

- Log into your eFiling profile, click on "SARS Correspondence" and then "Search Correspondence". The page below should appear. "Click on View".

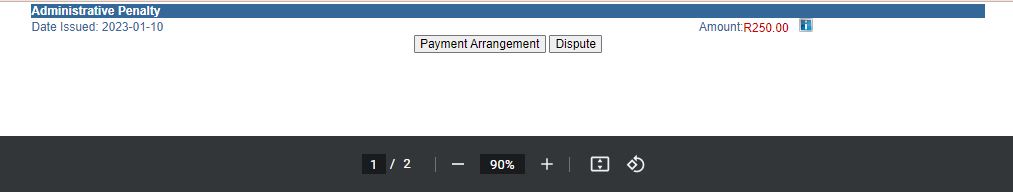

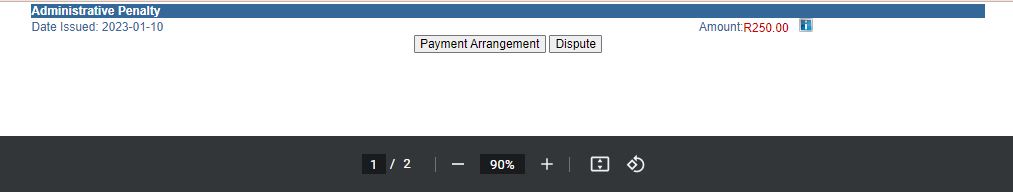

2. The SARS statement should open up. You can review the statement and then click on "Payment Arrangement".

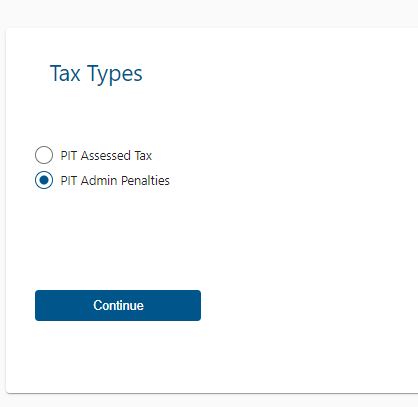

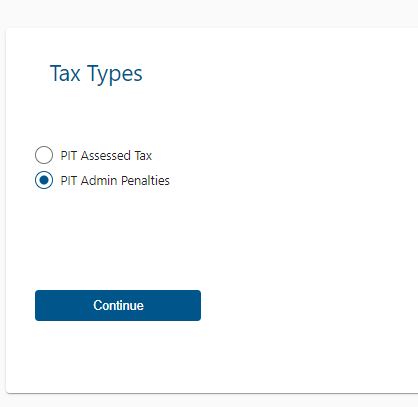

3. If the debt relates to your tax bill, you need to click on "PIT Assessed Tax". If it relates to Admin penalties click on "PIT Admin Penalties" and then click on "Continue":

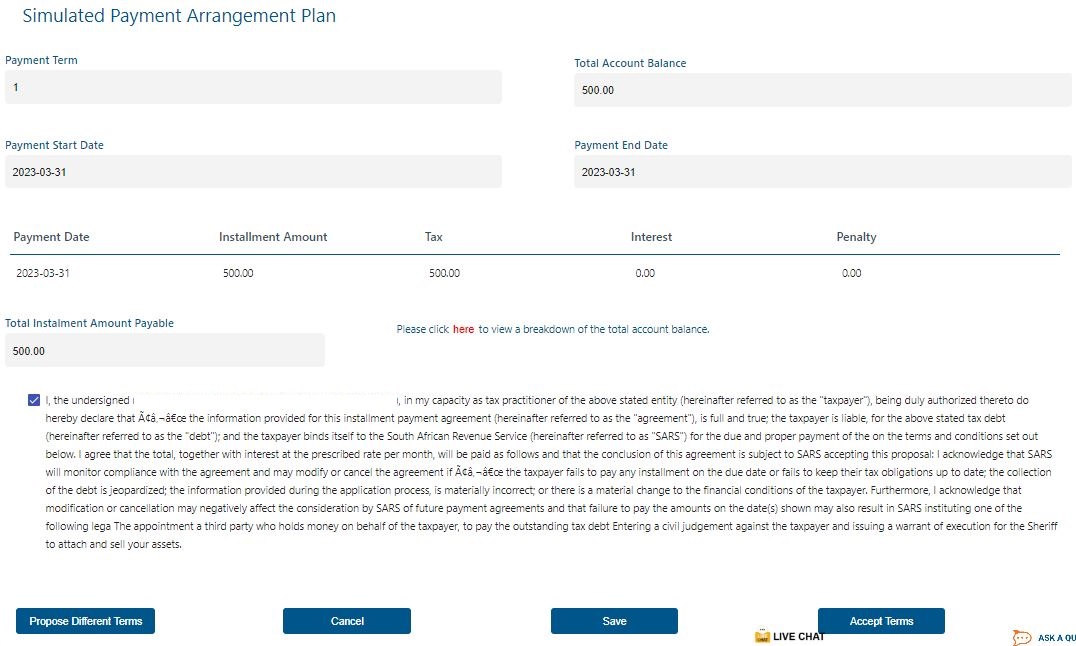

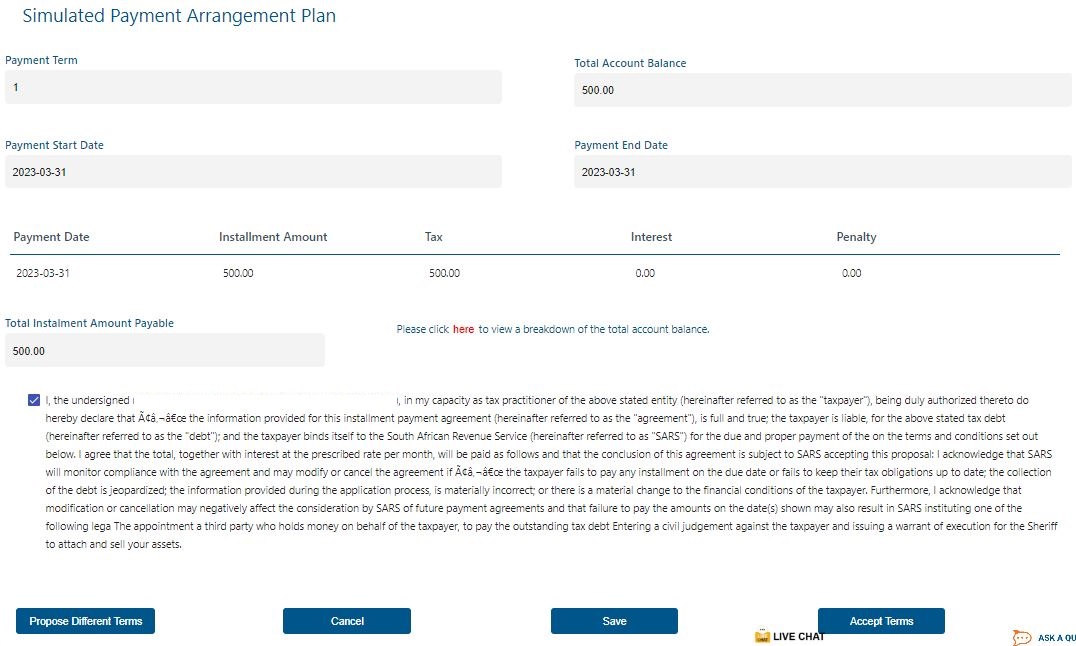

4. You should then see the payment arrangement that SARS proposes. If you want to request a different period (e.g., if you want a longer or shorter period or a lower or higher amount per month) you can click on "Propose Different Terms".

Should you be happy with what SARS suggests you pay and the period to pay the debt off over, you can go ahead and click on "Accept Terms".

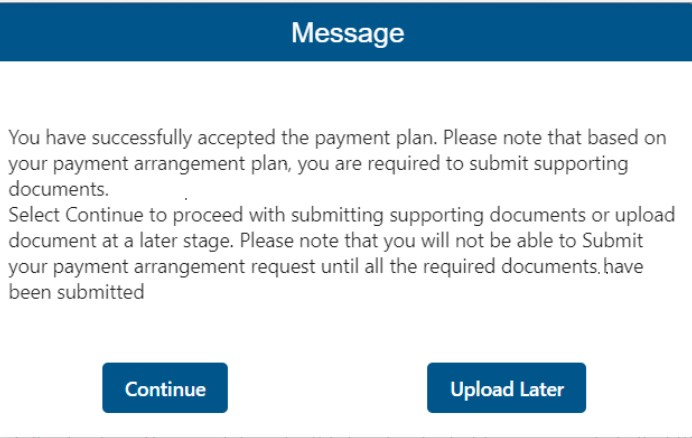

5. You should then see this message, click on "OK".

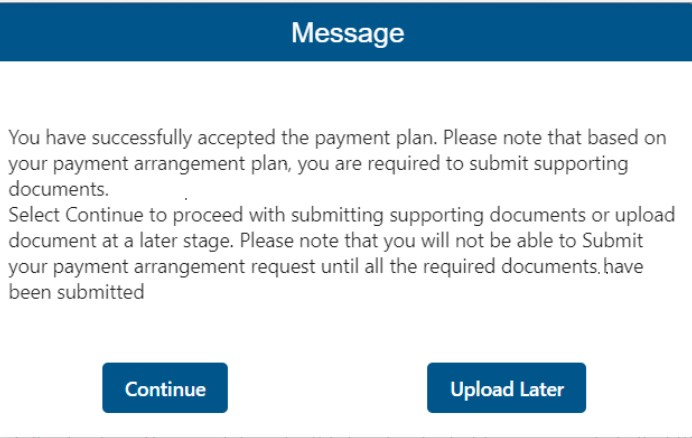

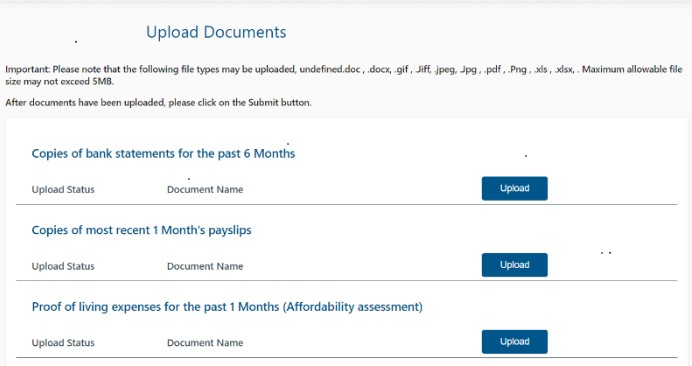

PS: If your arrangement is for longer than 12 months, SARS is at liberty to request some supporting documents from you, so once you've clicked OK, you might see this message:

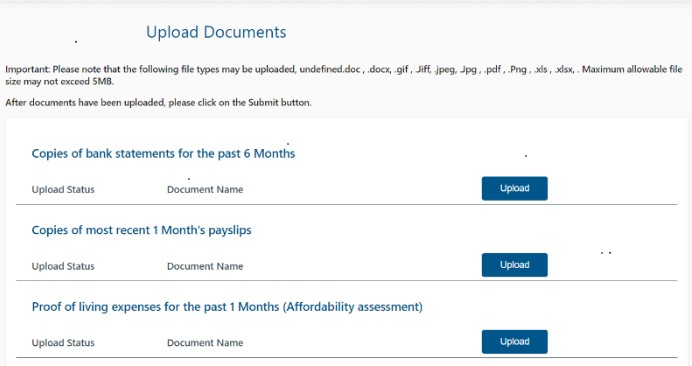

Please click on "Continue" then upload the listed documents, it should be similar to this:

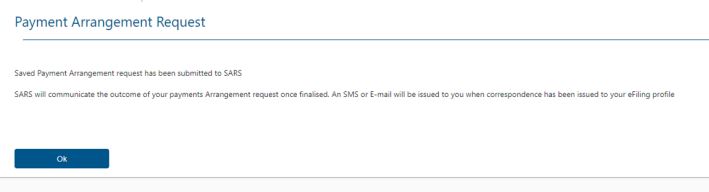

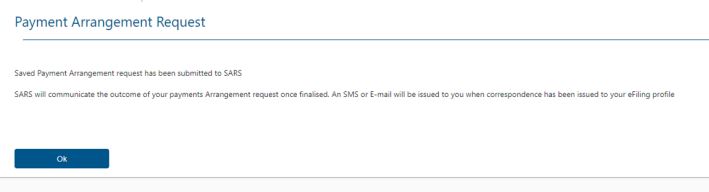

6. After this SARS will allow you to decide how you wish to make the payment each month i.e via EFT, Debit Order or a garnish on your salary. All you need to do is complete the form and then send SARS any documents they may request. Once finished, you should see this message:

SARS will communicate with you once they have reviewed your request. If it is approved, you can make your first payment as suggested on your Payment Deferment application.

This entry was posted in TaxTim's Blog

and tagged Penalties, SARS & eFiling.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Alicia

Written by Alicia