Written by Elani

Updated 11 November 2025

Written by Elani

Updated 11 November 2025

Step 1: Please log into your SARS eFiling profile

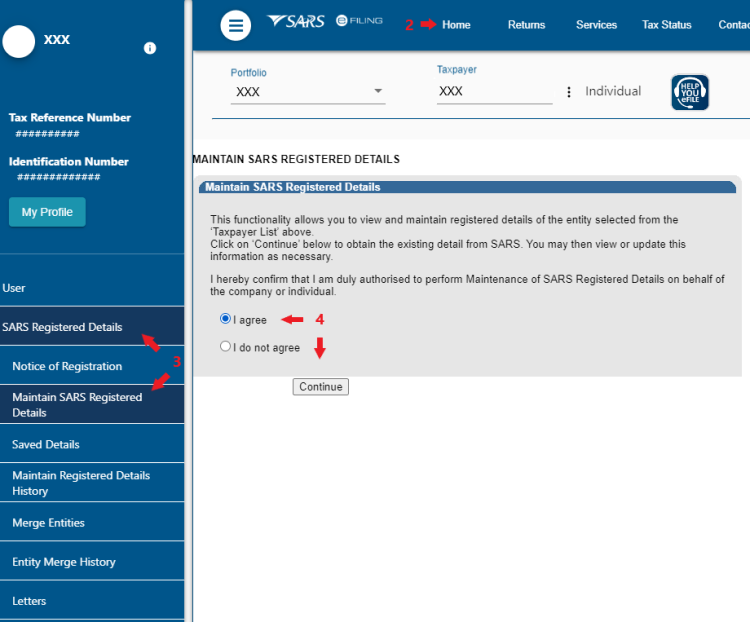

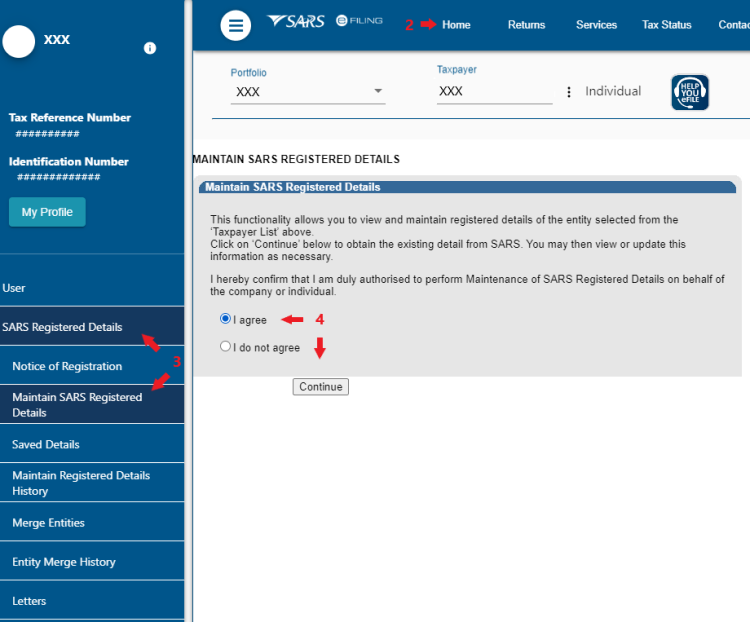

Step 2: Click on "Home" on the top menu

Step 3: Click on "SARS Registered Details" and then on "Maintain SARS Registered Details" on the left menu

Step 4: Tick the "I agree" option and then click on "Continue"

You should see the following message pop up. Choose your "Option" and click "Continue".

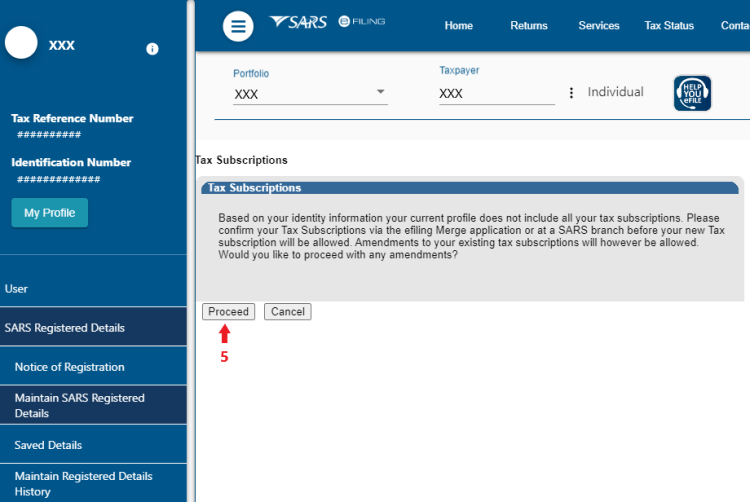

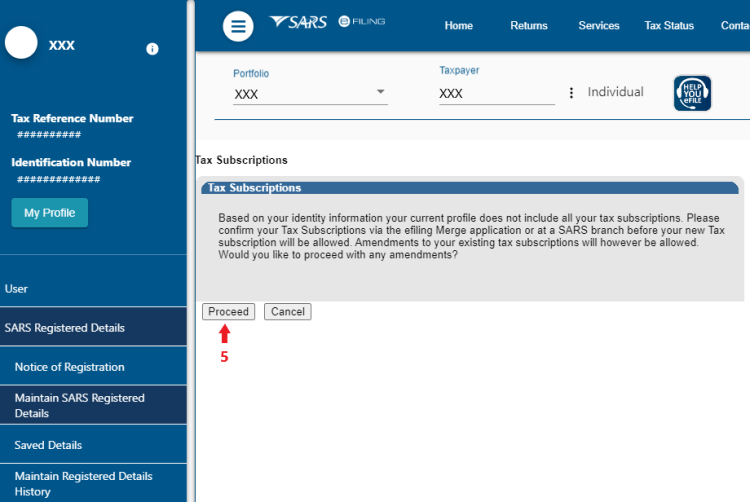

Step 5: Click on the "Proceed" option

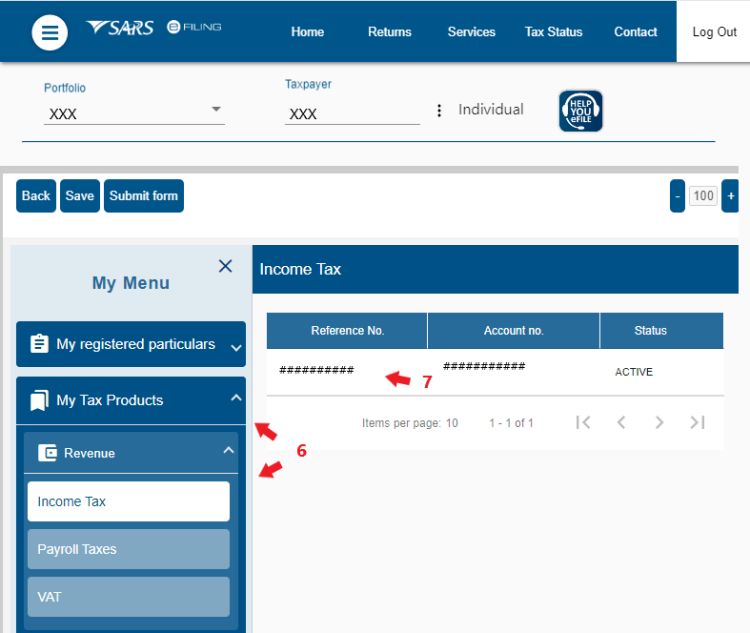

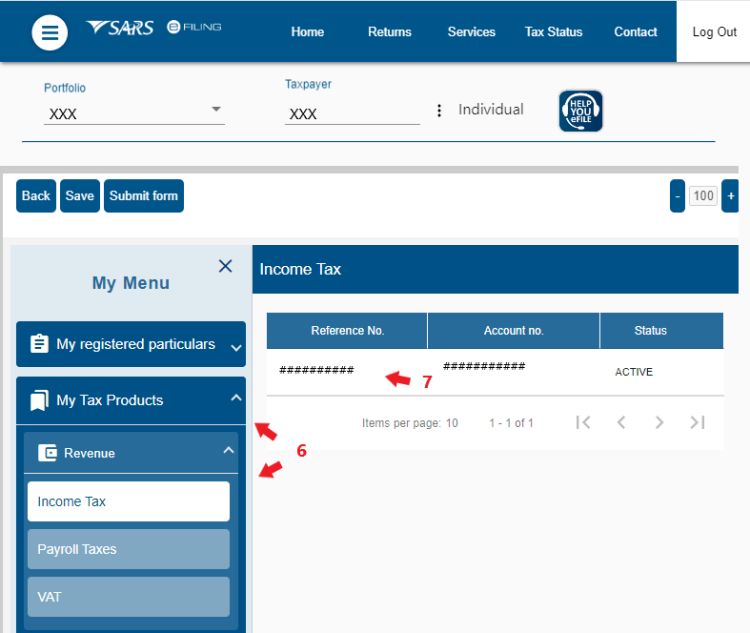

Step 6: Click on "My Tax Products" under the "My Menu" option and then on "Income Tax" under the "Revenue" option

Step 7: Click on your Income Tax profile

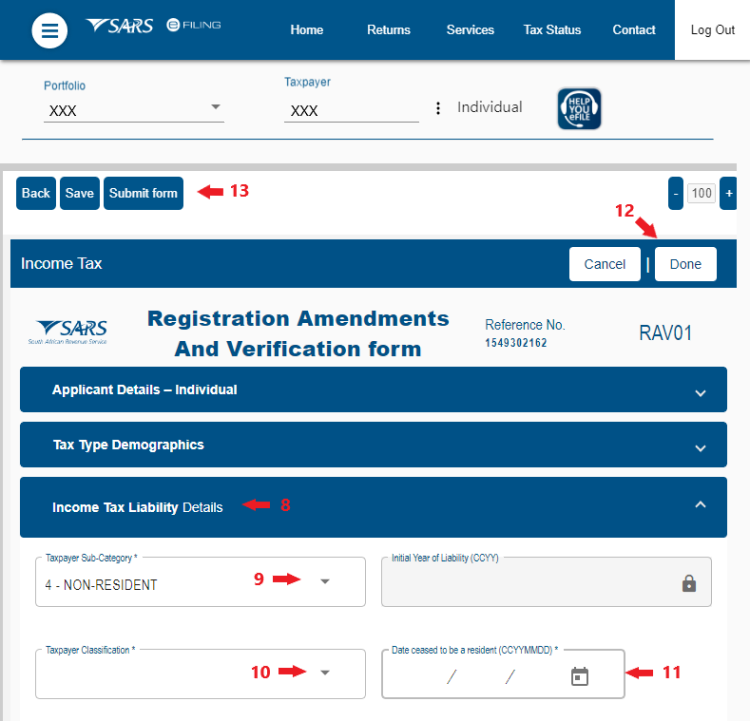

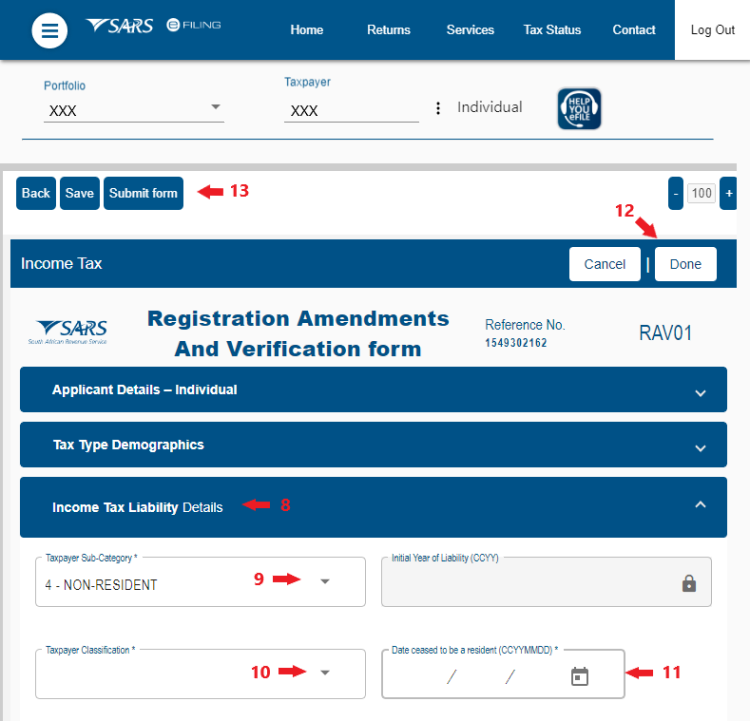

Step 8: Click on the "Income Tax Liability Details" option

Step 9: Choose the "Non Resident" option under the "Taxpayer Sub-Category" section

Step 10: Choose the applicable option that describes your income under the "Taxpayer Classification"

Step 11: Enter the date you ceased to be a South African Tax Resident

Step 12: Click on the "Done" option

Step 13: Click on the "Submit form" option

Step 14: Submit the applicable supporting documents to SARS as per their supporting documents request letter that SARS will submit after the update.

Please refer to our Tax Residency blog for more information.

This entry was posted in TaxTim's Blog

and tagged Residency.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Elani

Written by Elani