Steps to obtain your Tax Compliance Status

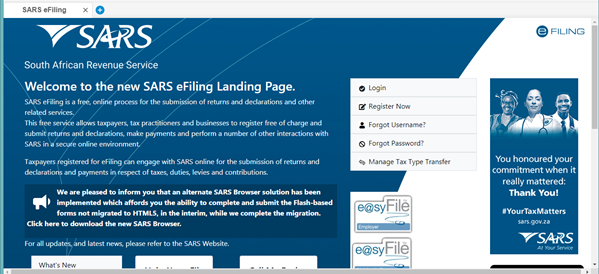

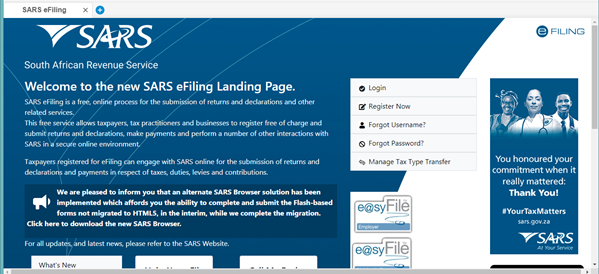

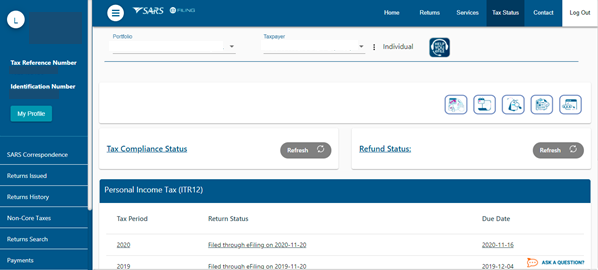

Step 1

Login to your SARS eFiling profile:

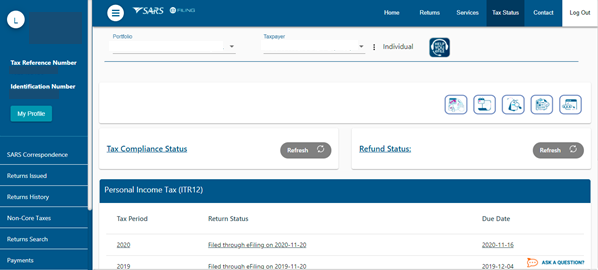

Step 2

Select the Tax Status option at the top right-hand side of the screen:

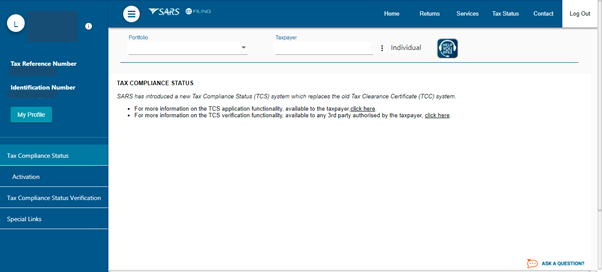

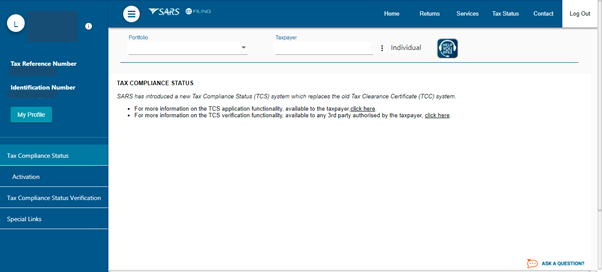

Step 3

Select the tax compliance status button on your left:

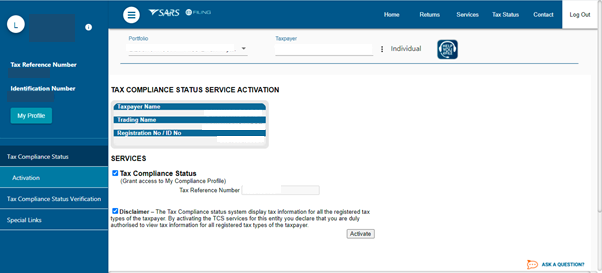

Step 4

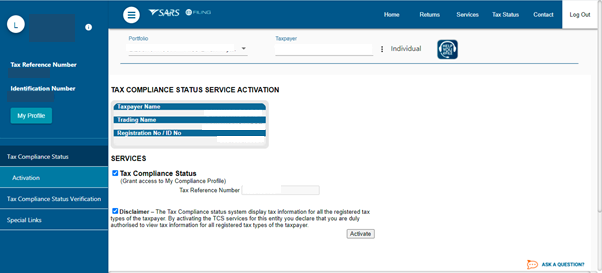

Select the Activation option on the dropdown, tick the Tax Compliance Status and Disclaimer box, then click Activate:

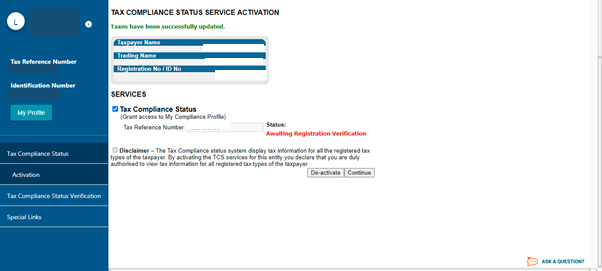

Step 5

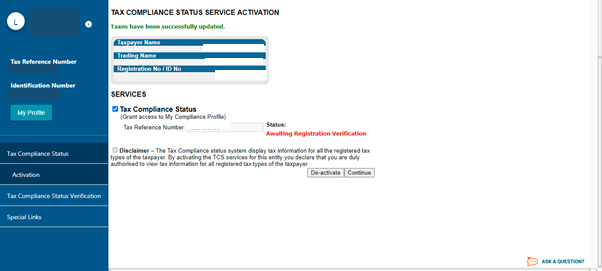

Your request status will then show “Awaiting verification” and you might need to wait up to 20 minutes before you can complete the next step:

Step 6

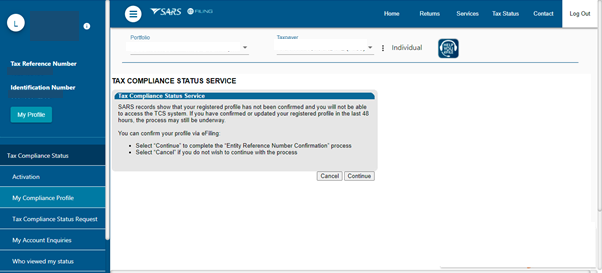

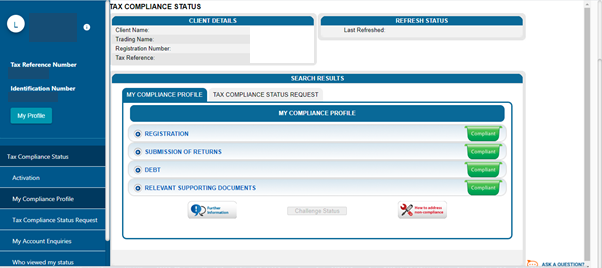

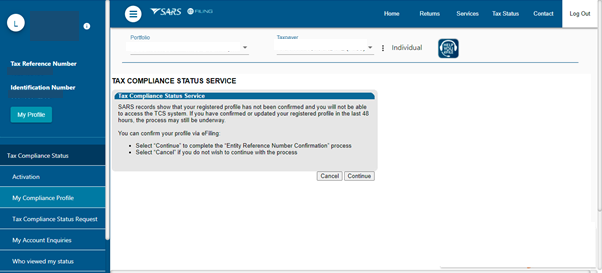

Please select “my compliance profile” on your left:

Step 7

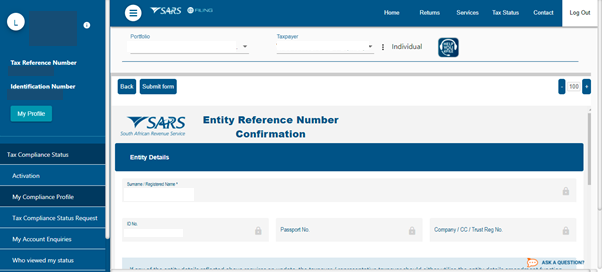

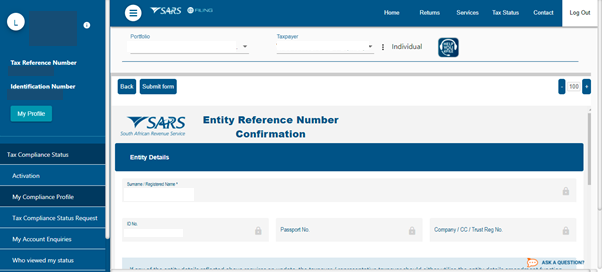

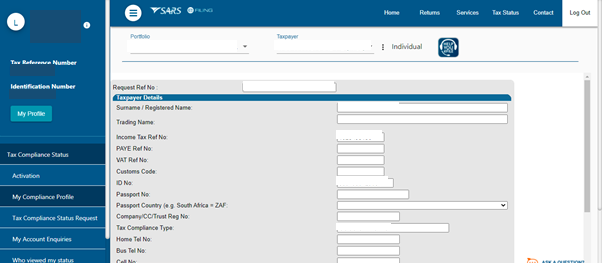

Select continue and complete the form with your details and submit the form:

Step 8

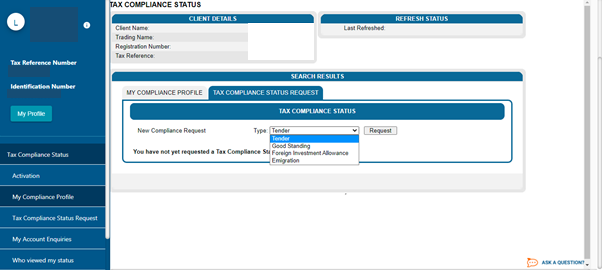

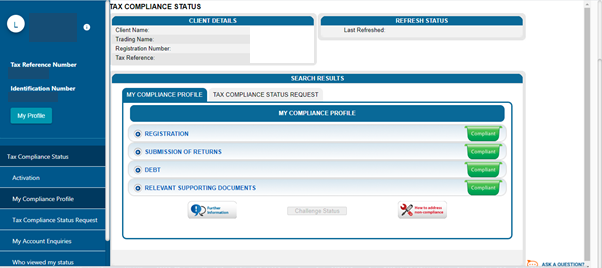

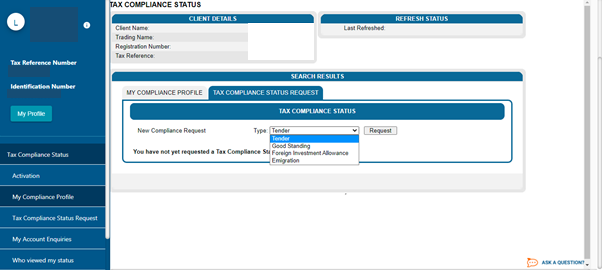

You will then need to select the Tax compliance status request:

Step 9

Select the dropdown on Type of request, then Good standing then request:

Step 10

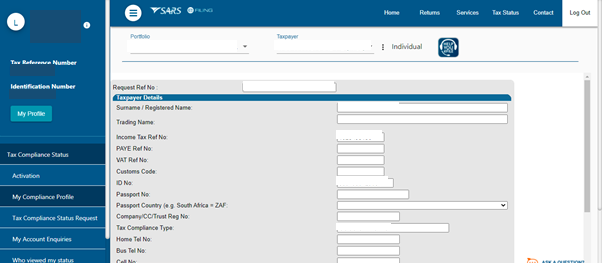

Complete the form with your information and select submit:

Step 11

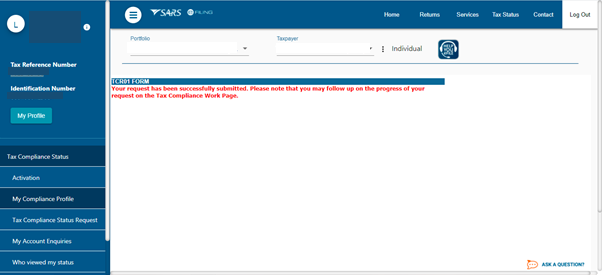

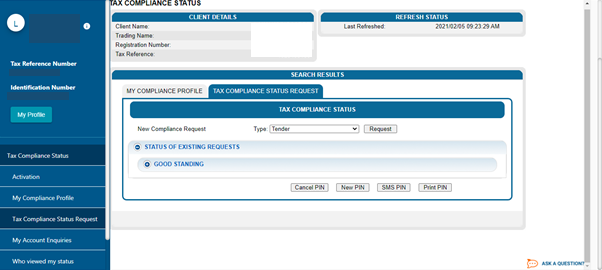

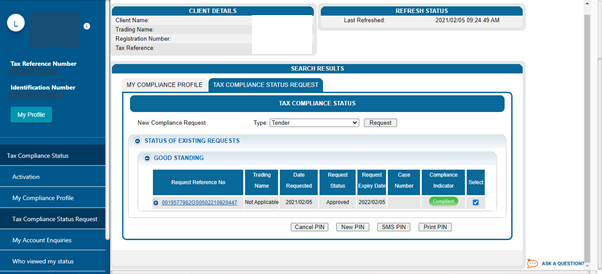

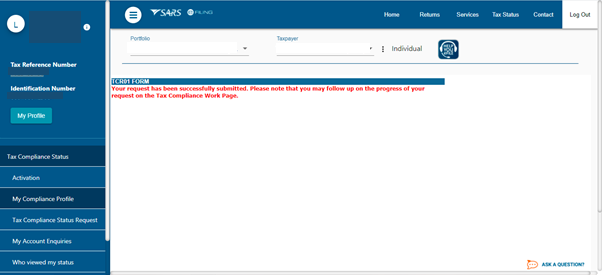

Your request has been successfully submitted. Please note that you may follow up on the progress of your request on the Tax Compliance Work Page. Go to the Tax compliance status request on the left of the page:

Step 12

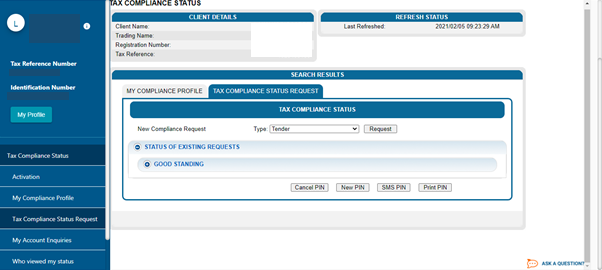

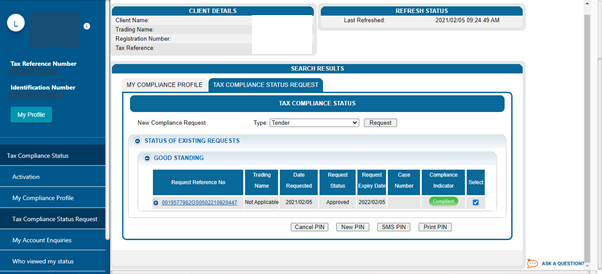

When you select the “Good Standing” option it will show either compliant or not:

Step 13

You will be able to print the letter by selecting the tick box next to form and then the “Print Pin” button:

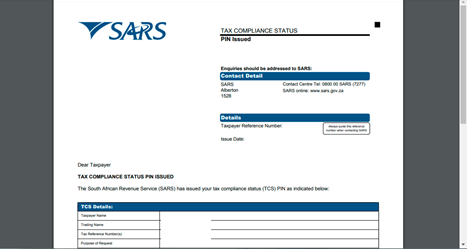

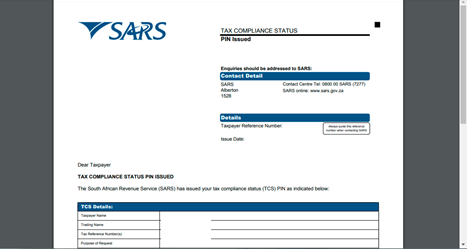

Step 14:

You can save the document as your Tax compliance status certificate: