Capital Gains Tax

Written by Patrick

Updated 12 March 2025

What is Capital Gains Tax?

Capital Gains Tax was introduced on 1 October 2001...

Read more →

How would SARS tax you if you win the Powerball?

Written by Alicia

Posted 21 May 2024

If I win the Powerball and decide to put all my winnings into a savings account and live off the interest, will I have to pay tax on my interest earned only, or am I supposed to pay tax on the total amount of winnings in the account?

Navigating around your Easy Equities tax certificate (IT3c)

Written by Nicci

Updated 29 April 2024

1. This is the gross base cost of all shares you bought through the institution. You must NOT use this value on your return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

3. This is the...

Read more →

Navigating around your Allan Gray tax certificate (IT3c)

Written by Nicci

Updated 20 March 2024

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

How home office deduction impacts Capital Gains Tax

Written by Nicci

Updated 19 March 2024

With “flexible” employment being the new buzzword, more and more people are working part or all of the week from an office in their home.

Read more →

Capital Gains and Losses: which source codes to use?

Written by Alicia

Posted 8 March 2024

In the Capital Gains section of the annual tax return (ITR12), SARS requires you to insert the relevant asset source code for the item you have sold. However, when you sell financial investments (e.g shares) the financial institution issues an IT3(c) which shows the profit/loss source code (i.e4250/4251) and not the asset source code. This causes confusion for taxpayers, who think th...

Read more →

Transfers from spouse & car sales

Written by Nicci

Updated 21 April 2022

I have 2 questions

Question 1: My wife sometimes transfers some money into my account to pay a certain bill. The amounts total less than R100,000, it is never anything above that. Do I need to declare this under the TaxTim section question "Did you earn or receive any other money that you think should NOT be taxed?"? Will I be taxed on that amount?

Question 2: I sold my car and bought another car. Do I need to declare the amount I received after settling the remaining insta...

Read more →

Are Share Options taxed on date of them vesting (eligible but not exercised) or only when exercised?

Written by Nicci

Updated 21 April 2022

I have the option to participate in an employee share option scheme, but I'm a little unclear on the tax implications. I high-level view is as follows:

Options will be granted at an agreed price (e.g. R1)

The options will vest over a four year period (annually)

Once vested, I would be able to exercise the right to purchase and retain shares or sell to a willing buyer because the company is private, it may not always be easy to find a willing buyer (e.g. At the end of each year), and I may also not have funds available to purchase the shares myself. My main question is around when would I become liable for tax?...

Read more →

Married in Community of Property

Written by Nicci

Updated 20 April 2022

My wife and I got married last year on the 26th of March 2018. We got married in community of property, so when it comes to tax what I would like to understand is whether we will both need to do our tax differently this year and also, I would like to find out what would the implications on our tax returns be like?

How is profit on sale of private vehicles taxed?

Written by Evan

Updated 6 April 2022

I bought a used bakkie from a friend at his book value and sold it soon after at a good profit. Will it be taxed under capital gain?

What happens once I've submitted my tax return form?

Written by Marc

Posted 6 April 2022

One of the questions most asked when it comes to tax season, is “what happens now that I’ve submitted my income tax return, when do I get my refund?”’

If you’re due a tax refund then you will probably get the money deposited into your account within a few days. SARS will also email or SMS you telling you that an IT34 (Summary of your return and refund) and ITSA (Income Tax Statement of Account) have been issued. They will detail your tax refund (tax back) if any. So look forward to that deposit into your account. ...

Read more →

Do I pay tax on profits from Forex trading?

Written by Marc

Posted 5 April 2022

Q: How do I pay Tax on Forex Trading?

I am a South African resident. I am a full-time forex trader (almost a year now). I trade via a broker overseas, I deposit funds into my trading account via their bank accounts here in South Africa. I would like to know if my profits from trading forex are taxed, how do I declare this and what forms should I fill from sars. Also, what can I expect in terms of what percentage of tax I will pay?

Capital Loss on the disposal of my Primary Residence

Written by Nicci

Posted 17 March 2022

I sold my property, which is my primary residence, for R9 million. The initial purchase price was R7 million and I spent R1 million on improvements - the total base cost was therefore R8 million. If I apply the R2 million exemption, does this put me in a capital loss position? (i.e R9m less R8m less R2m = -R1m)

If yes, can I use this capital loss to offset capital gains in the same tax year, or carry it forward to the next tax year?

Is CGT applicable to Share Option vesting?

Written by Nicci

Posted 15 March 2022

I've received 1000 share options that vest over 4 years at 25% per year. After the initial vesting on 1 Jan 2022 I have the right to exercise the options, it's likely I will only exercise the options at company exit a few years later. When will I be liable for CGT?

Navigating around your Capital gains tax certificate (IT3C)

Written by Alicia

Posted 15 May 2020

If you have shares (financial instruments) , there is important information on your IT3C tax certificate which needs to be included in your tax return.

This will ensure your taxable income is calculated accurately with the correct capital gain or loss included.

Do you have shares at any of the following institutions?...

Read more →

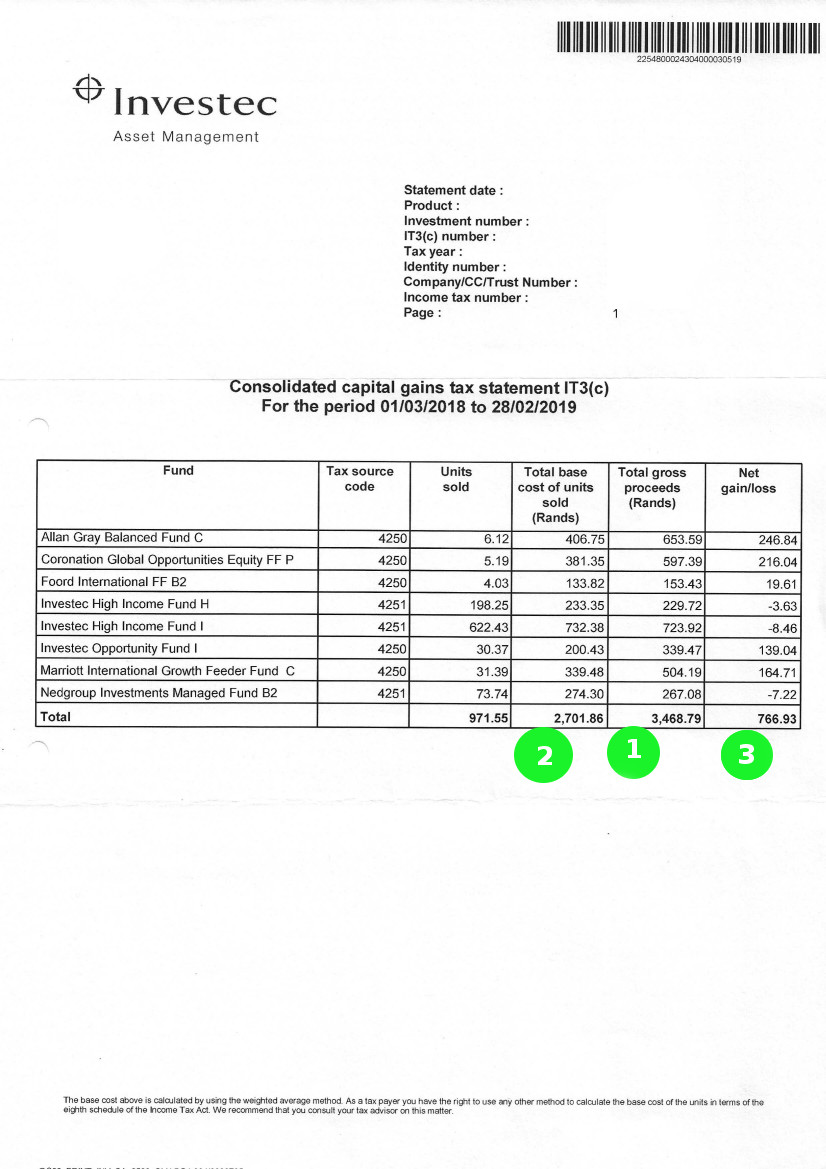

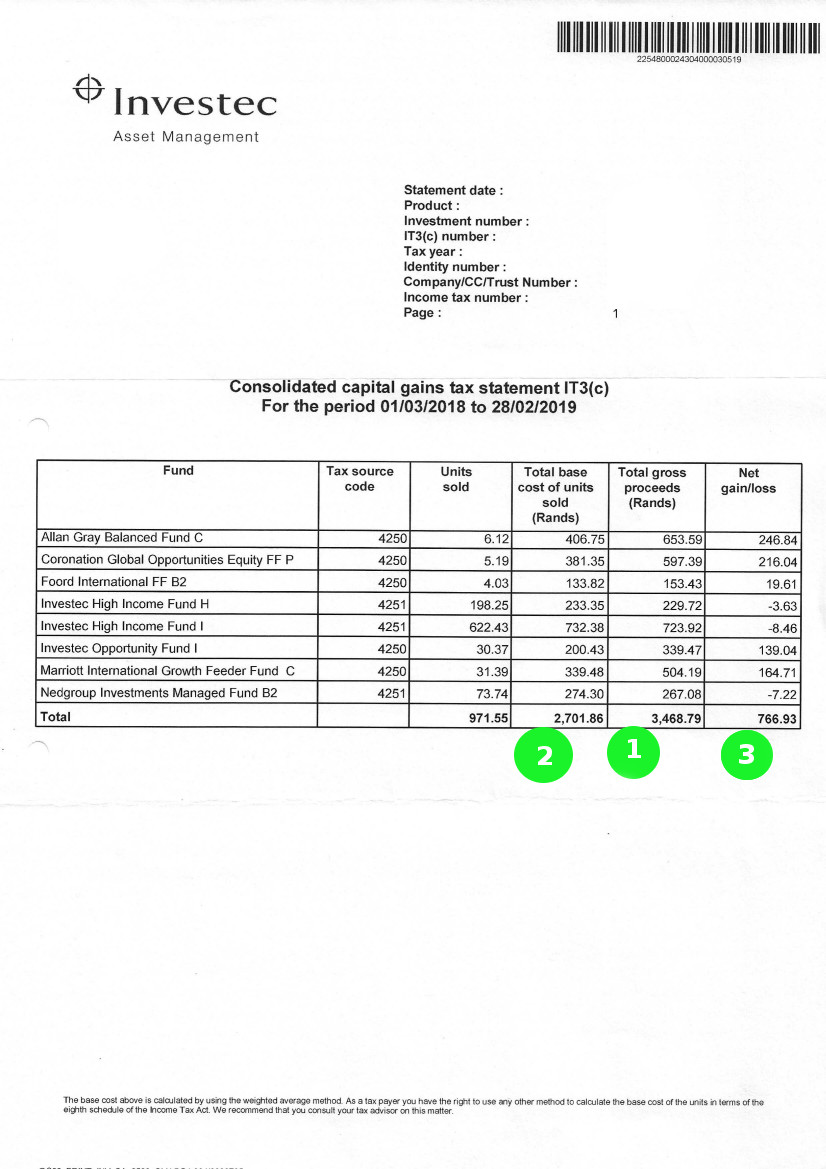

Navigating around your Investec investment tax certificate (IT3c)

Written by Nicci

Posted 12 May 2020

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

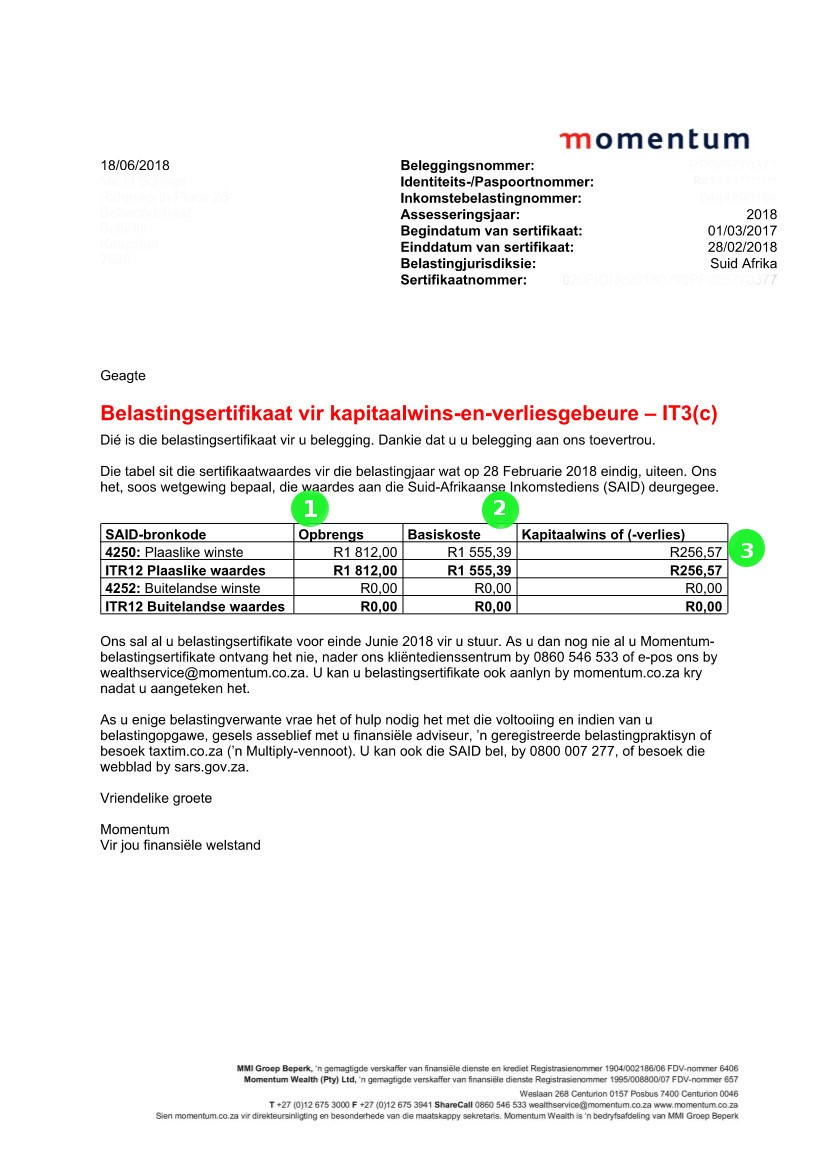

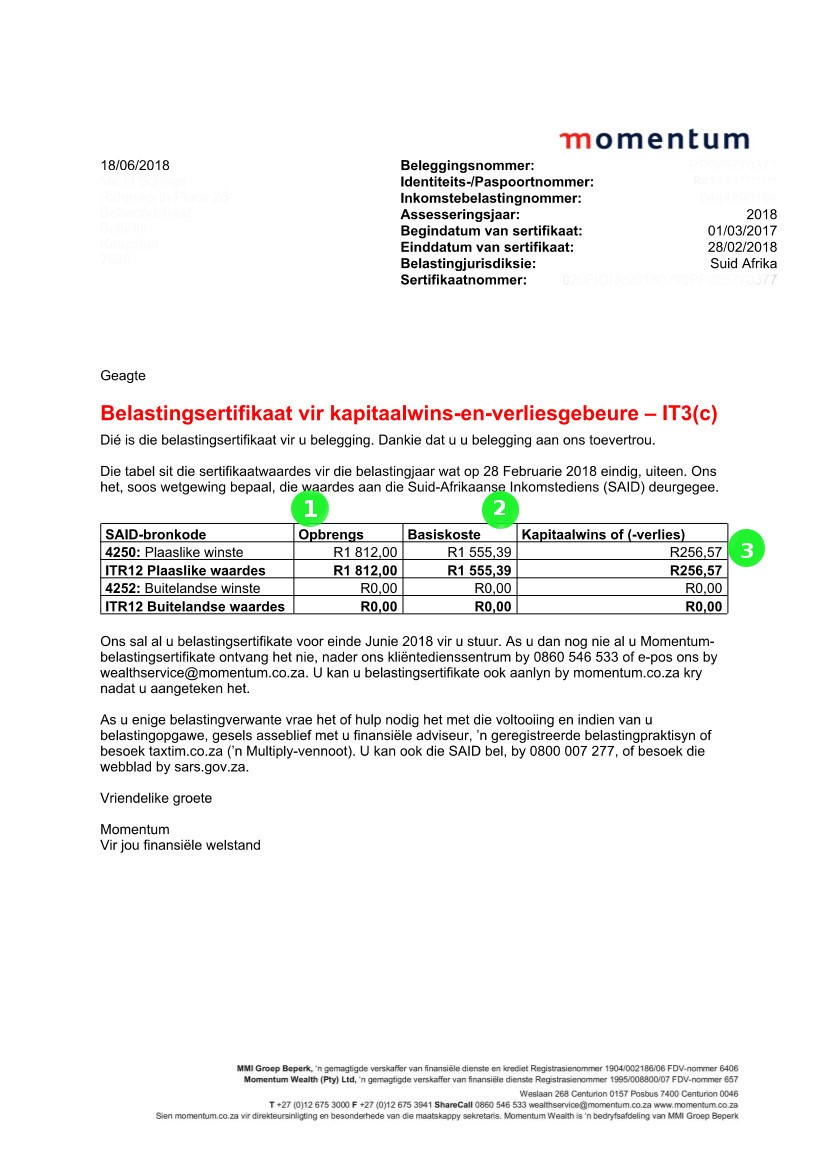

Navigating around your Momentum tax certificate (IT3c)

Written by Nicci

Posted 12 May 2020

1. Opbrengs/Proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. Basiskoste/Base Cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

...

Read more →

Do I earn enough to have to pay tax?

Written by Marc

Posted 23 April 2020

Why must I pay tax, I don’t earn enough! Will I get a penalty if I don’t disclose all my income to SARS?

Read more →

Declaring the cost of building a rental property

Written by Nicci

Posted 27 March 2020

I had rental income in the 2019 tax year, I converted part of my house into a 1 bedroom apartment as well as converting my old garage into another, so I currently have 2 flats now on the property. The apartments represent around 34% of the squares of the buildings on the property. Should I then declare 30% of the costs of the property (I.e.: Interest, Rates & Taxes etc as the costs) as the costs?

Also, where do I declare the cost I had incurred in building the units? (Does it come und...

Read more →

Tax on shares

Written by Nicci

Posted 19 September 2019

I received a once-off payment for shares in November 2018. I then opted to pay tax on the shares before the payments was made to me. Therefore the tax was already deducted before any monies were paid to me. I am now uncertain how to enter this in my 2019 tax return. Can you please advise %u2013 do I need to submit this income in my 2019 tax return and if I must, what figures must I submit in terms of the share payment made to me in this tax year?

CGT for Companies

Written by Nicci

Posted 26 May 2019

Is it correct that for private individuals Capital Gains Tax (CGT) is levied on net gain and of that, 40% is taken into account and that amount is added to individual's taxable income for that specific tax year. How does it work for companies or Trusts, is 100% of net CGT taken into account or what?

Capital Gains Tax (CGT) Top Questions

Written by Nicci

Posted 16 April 2019

Below we take a look at Capital Gains Tax, particularly relating to the primary residence exclusion. What we’ve covered are some of the most pressing questions asked by our users on our help-desk. Take a few minutes to read the Q&As. Hopefully what has been unpacked in these Q&As will benefit and assist you with any uncertainties you might have experienced regarding this topic.

Read more →

Tax when selling the shares

Written by Nicci

Posted 17 February 2019

I previously received an opportunity to invest in shares through my company. I invested a portion of my income every month and every six months shares were purchased on my behalf at a 14% discount. The shares are US based and tax was deducted locally off my payslip. I would now like to sell off my shares, but I don't fully understand how I'd be liable for tax. We were able to sell them as soon as we had them. They were part of an ESPP (Employee Stock Purchase Plan) and were purchased by deduction from salary and taxed (nothing given out-right). On the platform, they do seem to be classified as short/long term but I think this is geared up for US rules of capital gains....

Read more →

Budget Speech: VAT rises by 1%, predictions were correct!

Written by Nicci

Posted 21 February 2018

Taxpayers should breathe a sigh of relief as a much lower than expected R36bn in increased taxes was announced by the once-off Minister of Finance. The biggest news amongst the increases was the VAT rise of 1%. For the first time in 25 years, all South Africans will see most goods and services become a little bit more expensive thanks to the Value Added Tax rise. Although controversial, a VAT rise was much needed and will bring in almost R23...

Read more →

Bitcoin and Tax

Written by Nicci

Posted 8 January 2018

Are the earnings from Bitcoin taxable?

Older posts →

Written by Patrick

Written by Patrick

Written by Alicia

Written by Alicia

Written by Nicci

Written by Nicci

Written by Evan

Written by Evan

Written by Marc

Written by Marc