Written by Nicci

Posted 13 September 2019

Written by Nicci

Posted 13 September 2019

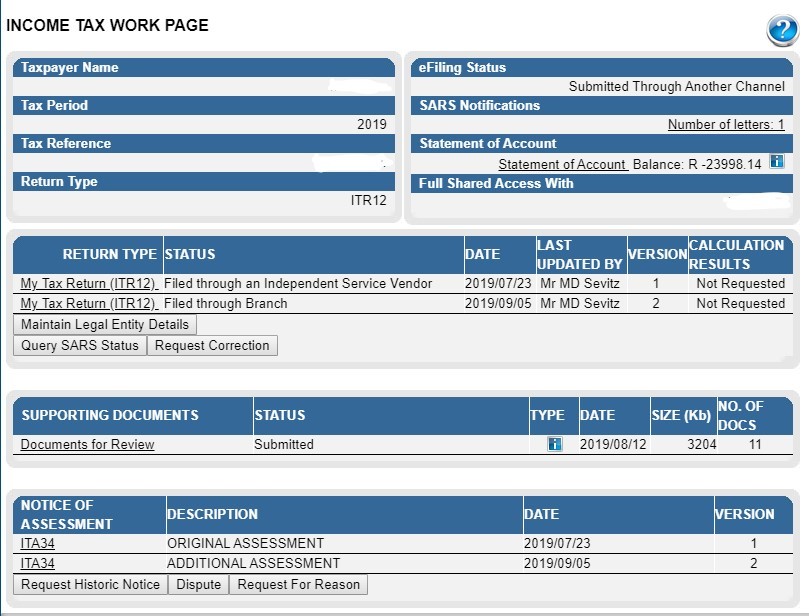

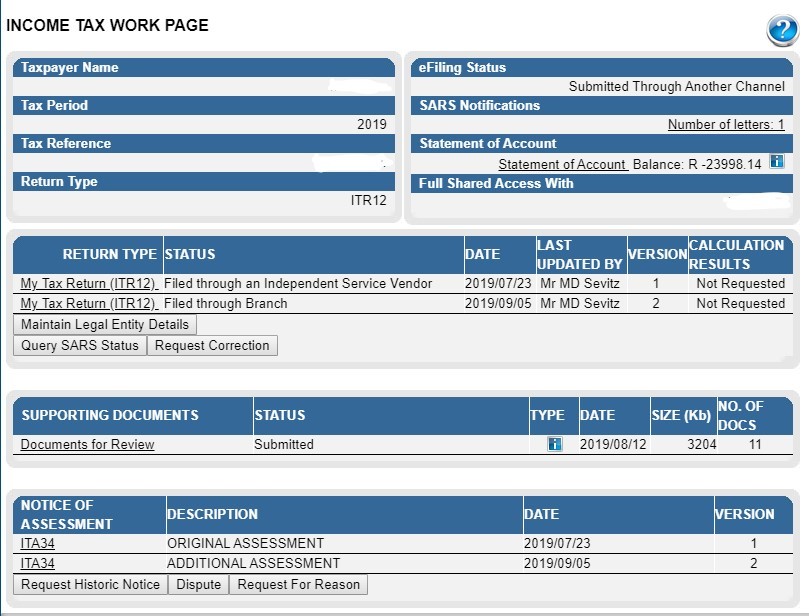

We’ve recently received many questions from taxpayers asking us if we physically went into a SARS office to submit their returns manually. This is because they have logged into their eFiling profile to see that a new return has been submitted with the status ‘Filed through Branch’. The new return appears under the original submission and looks like it was submitted by MD Sevitz (the tax practitioner for TaxTim) as per the screenshot below:

After doing some investigation, we discovered that the SARS system creates a return and then gives it the status “Filed through Branch” at the same time that they issue a new assessment (i.e. 5 September in above screenshot). The new return that they issue is based on their new assessment. For example, if they have disallowed your travel expenses, the new SARS return won’t reflect a travel claim.

This has resulted in much confusion for taxpayers as well as tax practitioners, who feel that it is misleading to reflect a return as being updated by the tax practitioner, which in fact has been generated by SARS. TaxTim has raised this issue with relevant regulatory bodies who are taking the matter further with SARS.

This entry was posted in TaxTim's Blog

and tagged SARS & eFiling.

Bookmark the permalink.

10 most popular Q&A in this category

Written by Nicci

Written by Nicci