What Are Shares?

Written by Nicci

Posted 30 April 2025

Shares represent ownership in a company. When you buy shares, you become a shareholder — meaning you own a small part of that company. Companies issue shares to raise money, and in return, investors get a chance to benefit from the company’s growth and profits.

There are two main ways to make money from shares:

Read more →

Investing 101: What is a Bond?

Written by Nicci

Posted 30 April 2025

A bond is essentially a loan you give to a company, a municipality, or the government. It is a type of investment. When you buy a bond, you are lending money—and in return, they pay you interest as income and promise to pay back the original amount (called the capital) at a fixed date in the future.

Important: an "investment bond" is not to be confused with a "mortgage bond", which you...

Read more →

How to start saving money

Written by Evan

Updated 11 September 2024

In these uncertain economic times, we all want to stretch our budgets a little further. With a few simple financial habits, anyone can save some extra cash each month. So, if you're ready to start saving but not sure where to begin, here are ten handy tips to get you started:

1) Track Your Spending

Keep an eye on where your money goes, and you'll naturally start spending less. Keep a record of your daily expenses and distinguish between needs and wants. Need...

Read more →

Getting your debt under control

Written by Evan

Updated 11 September 2024

Managing debt can be daunting, but it doesn't have to define or control your life. In South Africa, many individuals face the complex task of effectively handling their finances and debts.

Keep reading, and we’ll equip you with practical strategies and valuable insights to take control of your debt and financial future.

Let's delve into how you can regain control of your debt and finances and pave the way for a brighter future.

Understanding Debt Manageme...

Read more →

Navigating around your Easy Equities tax certificate (IT3c)

Written by Nicci

Updated 29 April 2024

1. This is the gross base cost of all shares you bought through the institution. You must NOT use this value on your return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

3. This is the...

Read more →

Navigating Tax Consequences for Social Media Influencers

Written by Alicia

Posted 10 April 2024

In today's digital age, social media influencers wield significant influence and often enjoy lucrative partnerships with brands. However, amidst the glitz and glam, it's crucial for influencers to be aware of their tax obligations. In this blog post, we'll explore the tax consequences that social media influencers need to consider in South Africa.

Understanding Tax Obligations

As a social media influencer in South Africa, it's essential to recognize that...

Read more →

Navigating around your Allan Gray tax certificate (IT3c)

Written by Nicci

Updated 20 March 2024

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

A beginner's guide to investing in South Africa

Written by Evan

Posted 5 July 2023

You are doing well. You are earning enough money to cover your monthly expenses, and have some extra cash remaining at the end of each month. You could keep that money in the bank for a rainy day, or you could invest it, with the hopes of growing your savings significantly. This guide aims to help you understand why investing is important, how investments differ and what options are available to you in South Africa.

Why investing is important

Your money does not keep it's va...

Read more →

How to buy your first property

Written by Nicci

Updated 3 July 2023

The thought of buying a house can be daunting. It might seem almost impossible when you are just getting started. But like any financial goal, you can achieve it if you understand what's involved, and break the process up into small, bite-size steps.

Buying your first home is also exciting! Choosing where you will live, how many rooms you need, what colour to paint the walls, and what furniture to fill it with are part of the fun. Use that excitement to get you through the admin involved....

Read more →

Tax and Marriage go together, like a horse and carriage

Written by Nicci

Posted 7 March 2022

When planning your wedding, it’s highly unlikely that anything related to tax features on your agenda. However, when saying “I do” it’s very important to understand the tax laws associated with marriage because SARS treats income differently according to the type of marriage contract that binds you and your spouse.

Marriage in Community of Property

If you marry without an antenuptial contract, you’ll by default be married in community of property...

Read more →

What is Gap Insurance & why is it so valuable to have?

Written by Nicci

Posted 7 October 2020

When you are in the process of selecting a medical aid, the question of adding gap cover to your plan is likely to come up. More than 1 million South African families understand the importance of gap cover, which is why they have opted in. But should you? First things first…

Read more →

Navigating around your Capital gains tax certificate (IT3C)

Written by Alicia

Posted 15 May 2020

If you have shares (financial instruments) , there is important information on your IT3C tax certificate which needs to be included in your tax return.

This will ensure your taxable income is calculated accurately with the correct capital gain or loss included.

Do you have shares at any of the following institutions?...

Read more →

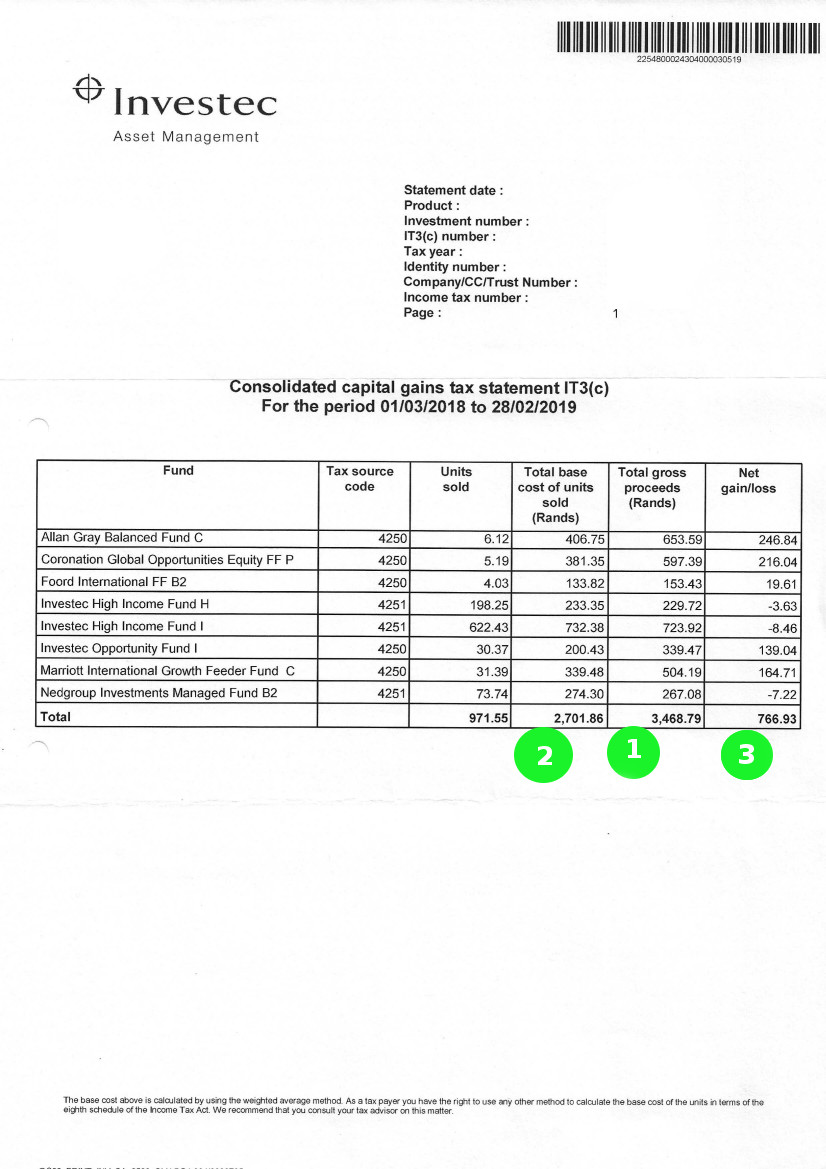

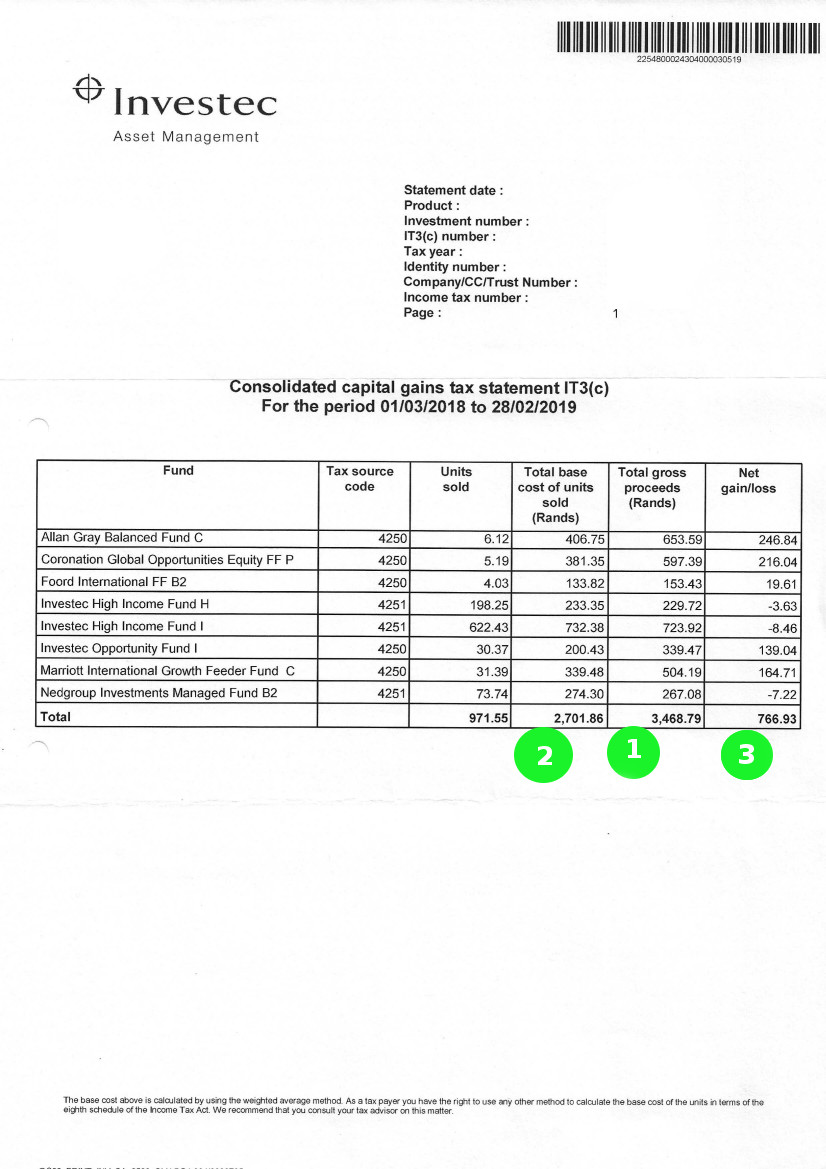

Navigating around your Investec investment tax certificate (IT3c)

Written by Nicci

Posted 12 May 2020

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

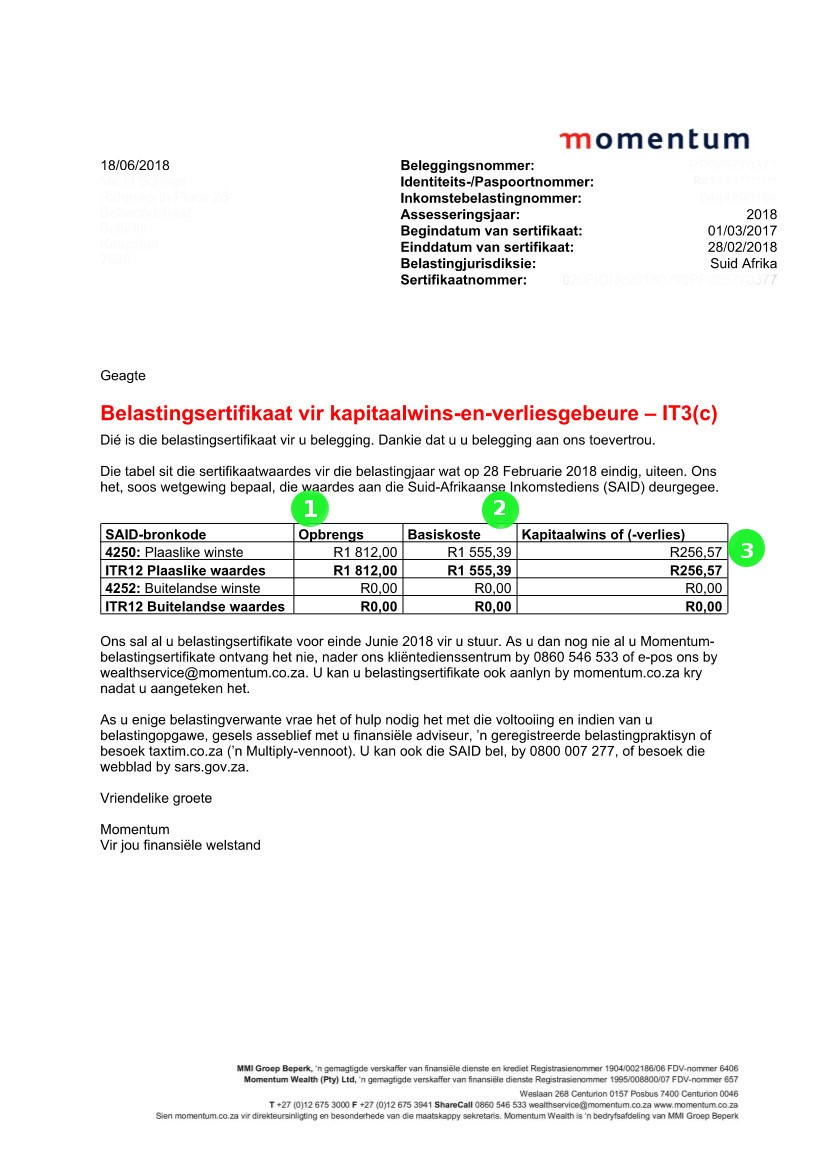

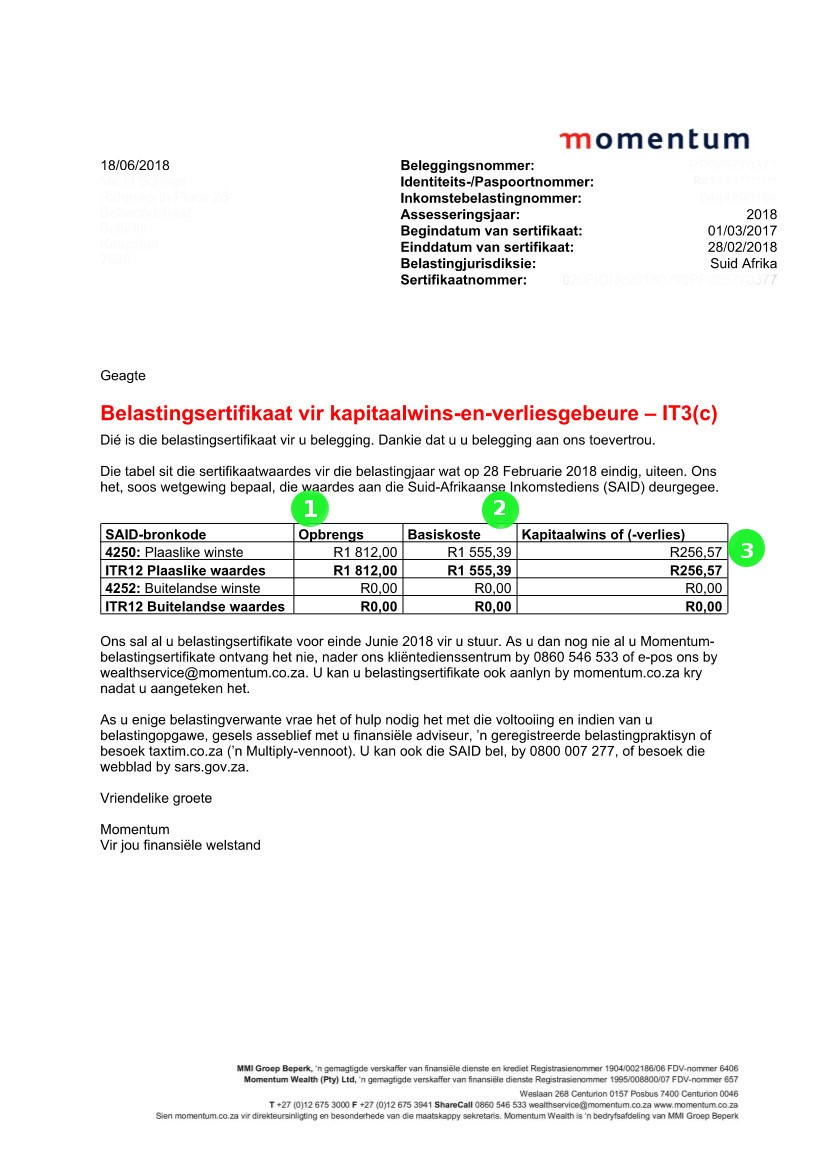

Navigating around your Momentum tax certificate (IT3c)

Written by Nicci

Posted 12 May 2020

1. Opbrengs/Proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. Basiskoste/Base Cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

...

Read more →

Black Friday Survival Tips

Written by Nicci

Posted 22 November 2018

It's that time of the year again - Black Friday!

We'd like to assume that you've probably been inundated with nothing but sale specials in your inbox . While others have managed to plan ahead to ensure a pleasant shopping experience, other consumers will shop wildly and randomly during this highly anticipated sale bonanza. With so little time to spare we've put together 3 important things to remember this Black Friday:

1. Compare your options

Sometimes brand loyalism should be left at home...

Read more →

Written by Nicci

Written by Nicci

Written by Evan

Written by Evan

Written by Alicia

Written by Alicia