Navigating around your Allan Gray tax certificate (IT3c)

Updated 20 March 2024

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

How to add your Company Tax Number to your eFiling profile

Updated 7 March 2024

As part of SARS’ mission to simplify the eFiling system, the Tax Type Transfer process was updated in 2020 for all Tax products in a bid to offer users complete control of their eFiling profiles.

What's new on eFiling?

Overall, you can expect to see the following key changes introduced to eFiling from the end of April 2021:

- Changes to adding taxpayers to a profile (Organisations, Practitioners & individuals)

- The removal of multiple capture fields to simplify the process

- Validation requirements for captured information to ensure alignment to SARS records, e.g...

Read more →

How to set up a payment arrangement with SARS

Updated 2 August 2023

With the end of the tax year looming, SARS tax collectors are on high alert to collect taxes and meet their revenue targets.

If you owe SARS, you should be receiving constant reminders to pay your debt. This may be in the form of SMS's, phone calls or even posted letters.

If the debt is unfamiliar or if you are not in agreement with the debt, you can File a dispute with SARS , howe...

Read more →

Don't file on SARS eFiling before 7 July

Updated 14 June 2023

Last year, we noticed that many taxpayers filed their tax returns before the tax season officially began (i.e July). However, doing so caused delays and problems with their tax refunds.

There are only three specific instances where you can file your tax return (ITR12) directly on eFiling before tax season starts:

- If you have been declared insolvent / sequestrated or,

- If you need to file a tax return for a deceased estate or,

- If you are em...

Read more →

9 Steps to File an Objection to Your Tax Assessment

Updated 30 May 2023

You’ve been diligent with your tax obligations, you’ve paid your PAYE (employees tax) each month without fail, you’ve kept all the supporting documents for your deduction claims and you’ve carefully filled out your tax return, making sure you’ve put all the right amounts in all the right places, against all the right codes. (Pssst, if you used TaxTim to help you complete your tax return, you wouldn’t have had to worry about all the right places and codes because that’s all automated for you)...

Read more →

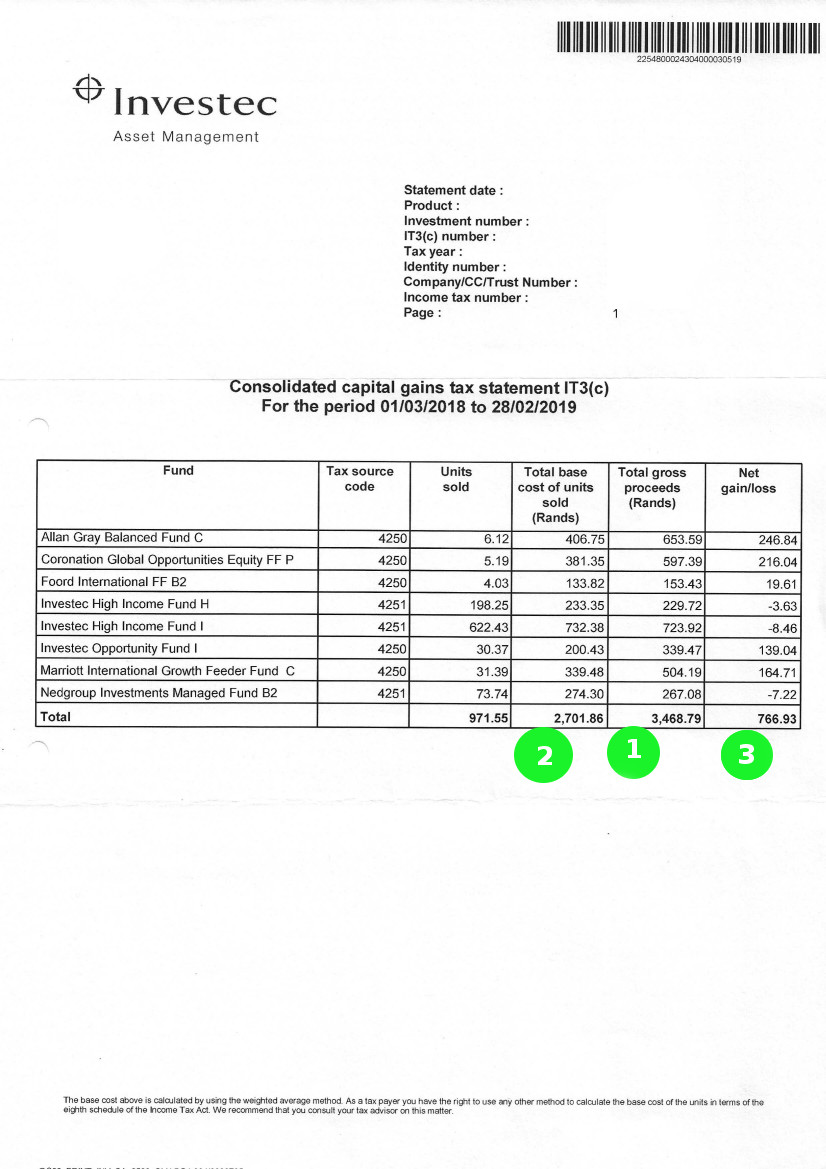

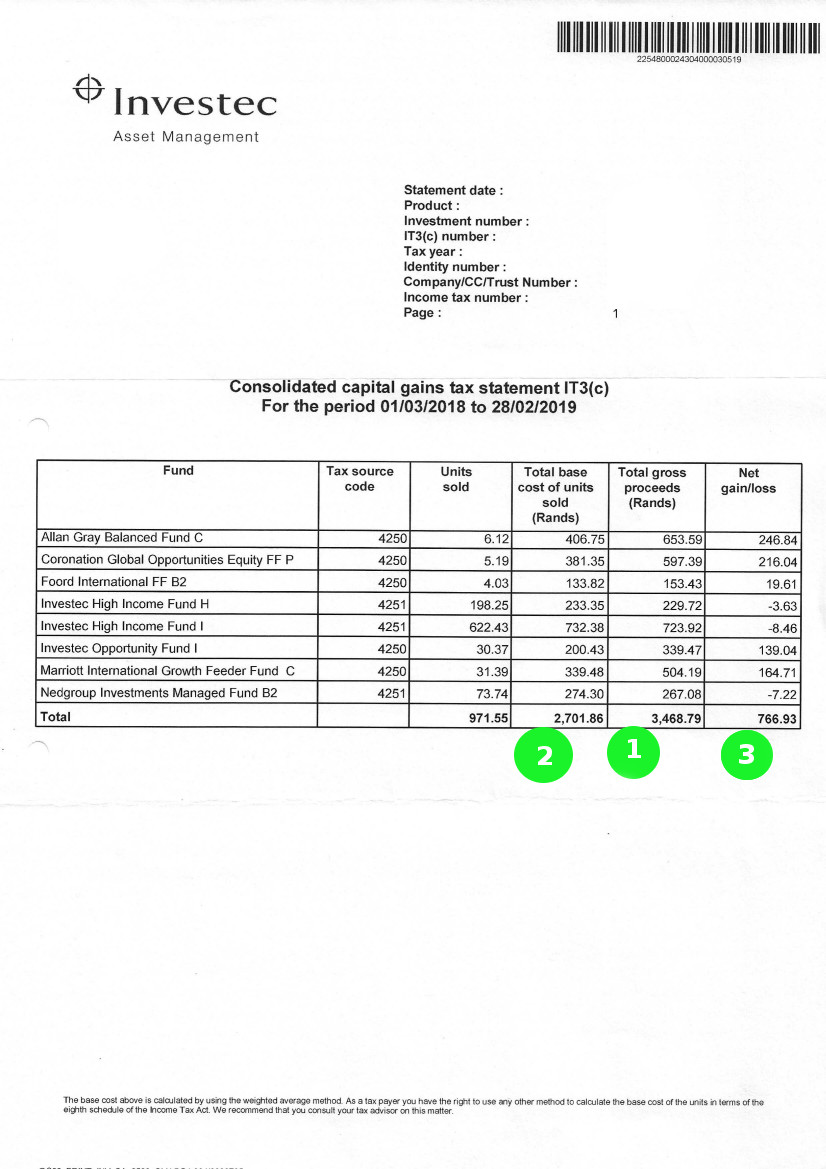

Navigating around your Investec investment tax certificate (IT3c)

Posted 12 May 2020

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

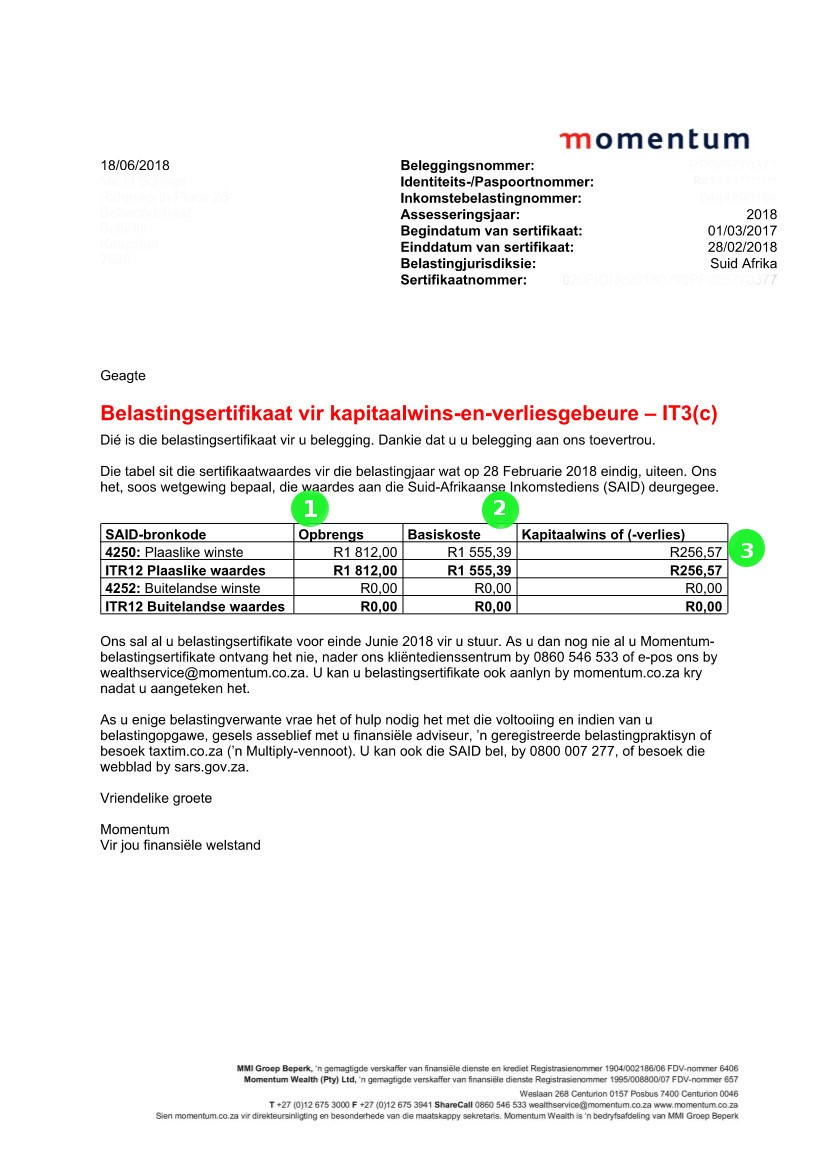

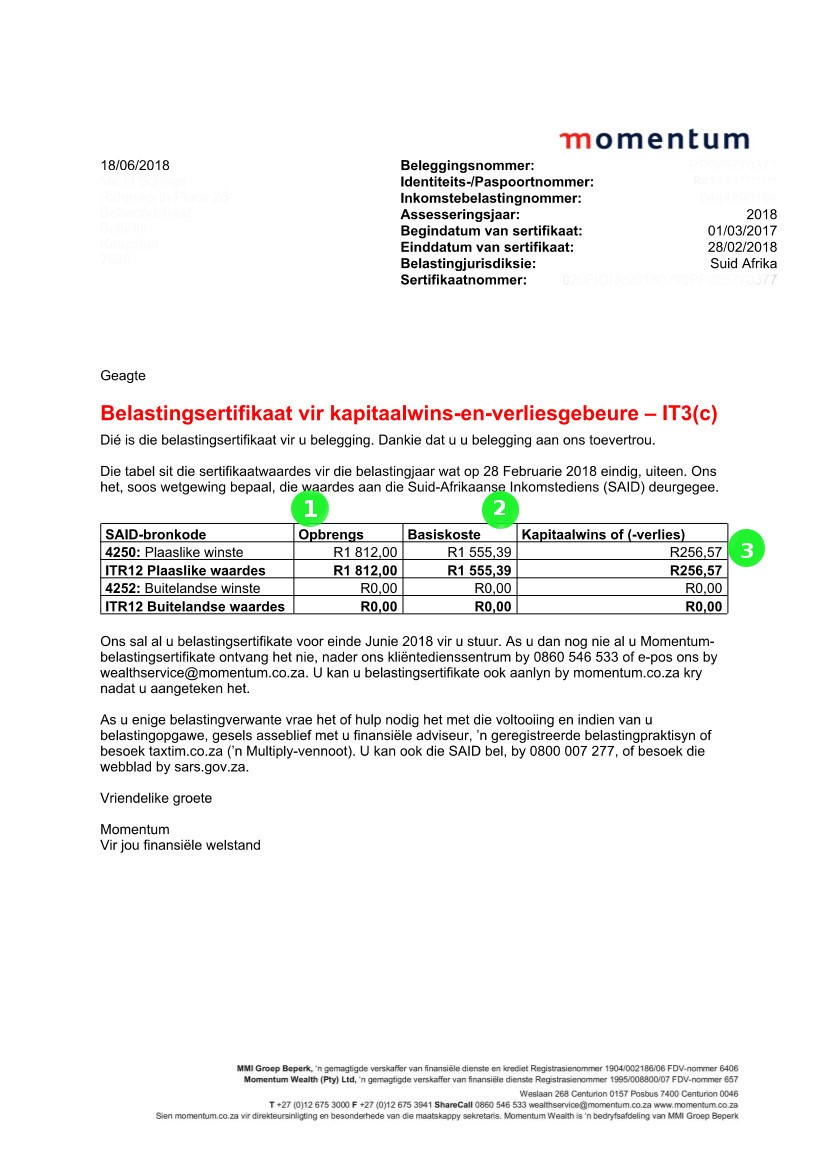

Navigating around your Momentum tax certificate (IT3c)

Posted 12 May 2020

1. Opbrengs/Proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. Basiskoste/Base Cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

...

Read more →

'Rejection of Revised ITR12' - but my return is already finalised!

Posted 28 November 2019

There seem to be many confused taxpayers who have received a letter from SARS titled ‘Rejection of Revised ITR12’ which goes on to say that their revised return cannot be finalised because their assessment has already been finalised.

Read more →

Why is SARS requesting my supporting documents again?

Posted 15 July 2019

TaxTim is seeing cases where taxpayers who had already submitted their documents in early July to SARS are, around ten days to two weeks later, receiving a further two letters from SARS requesting documents again. The one letter is the generic letter with the long list of documents, which was originally issued, while the second, contains a more specific request relating to the taxpayer’s tax return.

Read more →