Navigating around your Allan Gray tax certificate (IT3c)

Updated 20 March 2024

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

How home office deduction impacts Capital Gains Tax

Updated 19 March 2024

With “flexible” employment being the new buzzword, more and more people are working part or all of the week from an office in their home.

Read more →

Capital Gains and Losses: which source codes to use?

Posted 8 March 2024

In the Capital Gains section of the annual tax return (ITR12), SARS requires you to insert the relevant asset source code for the item you have sold. However, when you sell financial investments (e.g shares) the financial institution issues an IT3(c) which shows the profit/loss source code (i.e4250/4251) and not the asset source code. This causes confusion for taxpayers, who think th...

Read more →

Navigating around your Capital gains tax certificate (IT3C)

Posted 15 May 2020

If you have shares (financial instruments) , there is important information on your

IT3C tax certificate which needs to be included in your tax return.

This will ensure your taxable

income is calculated accurately with the correct capital gain or loss included.

Do you have shares at any of the following institutions?...

Read more →

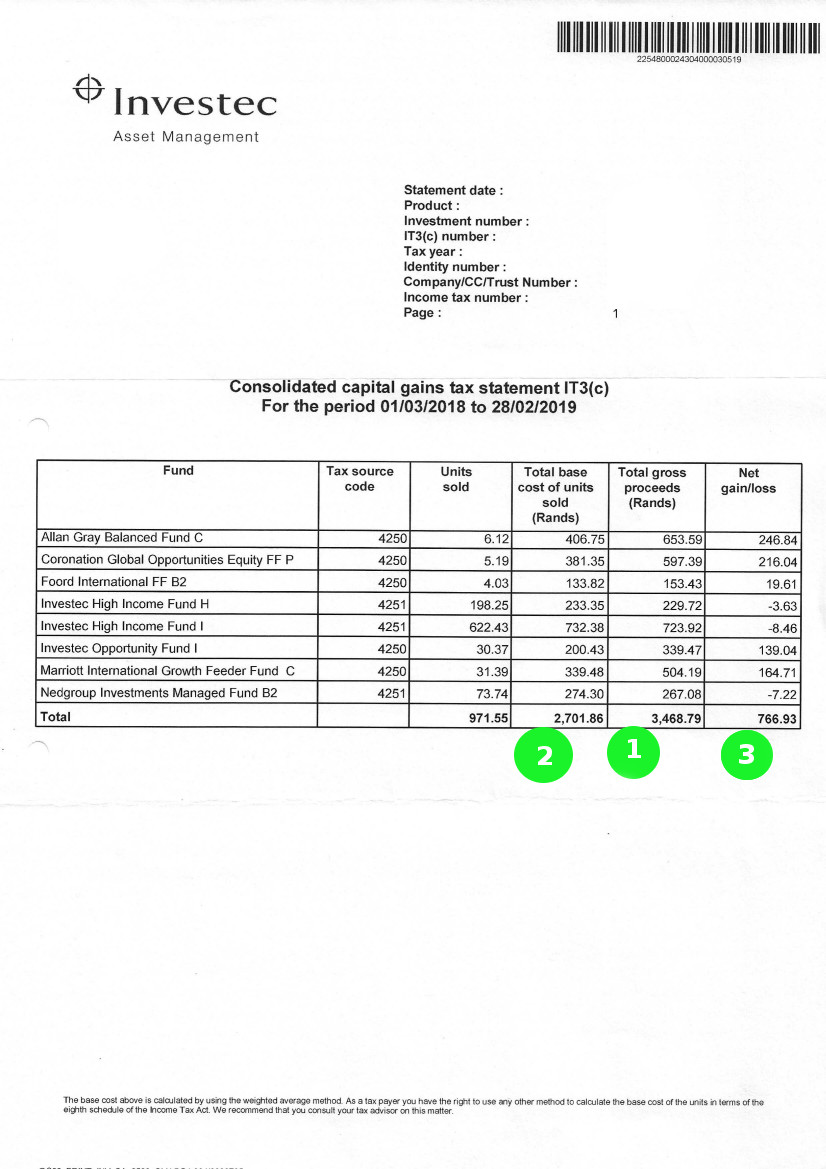

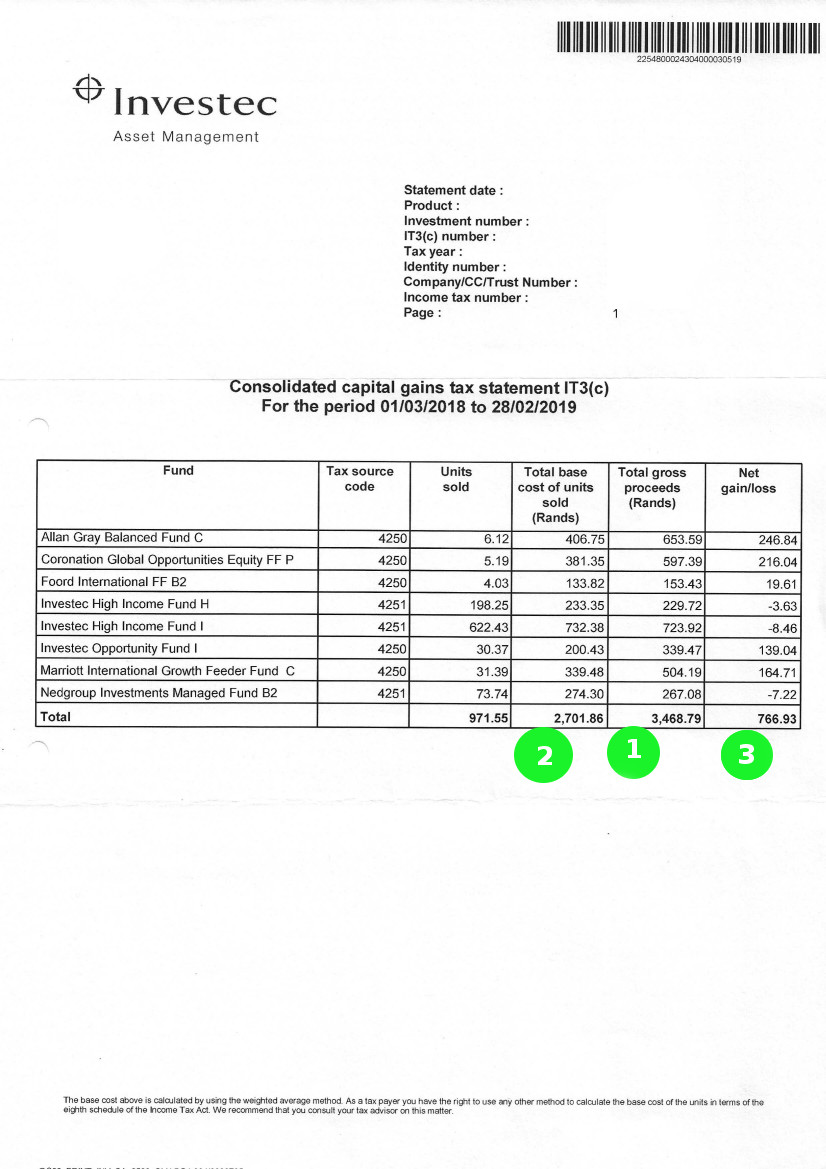

Navigating around your Investec investment tax certificate (IT3c)

Posted 12 May 2020

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

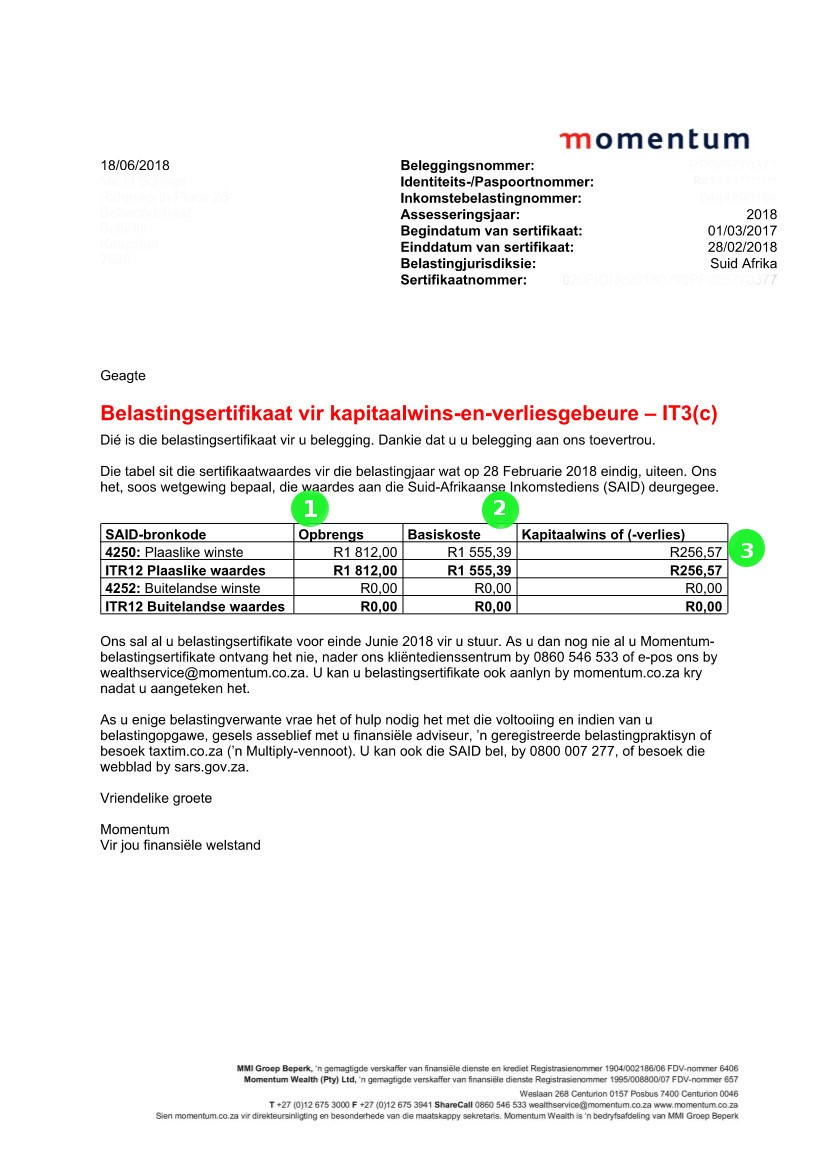

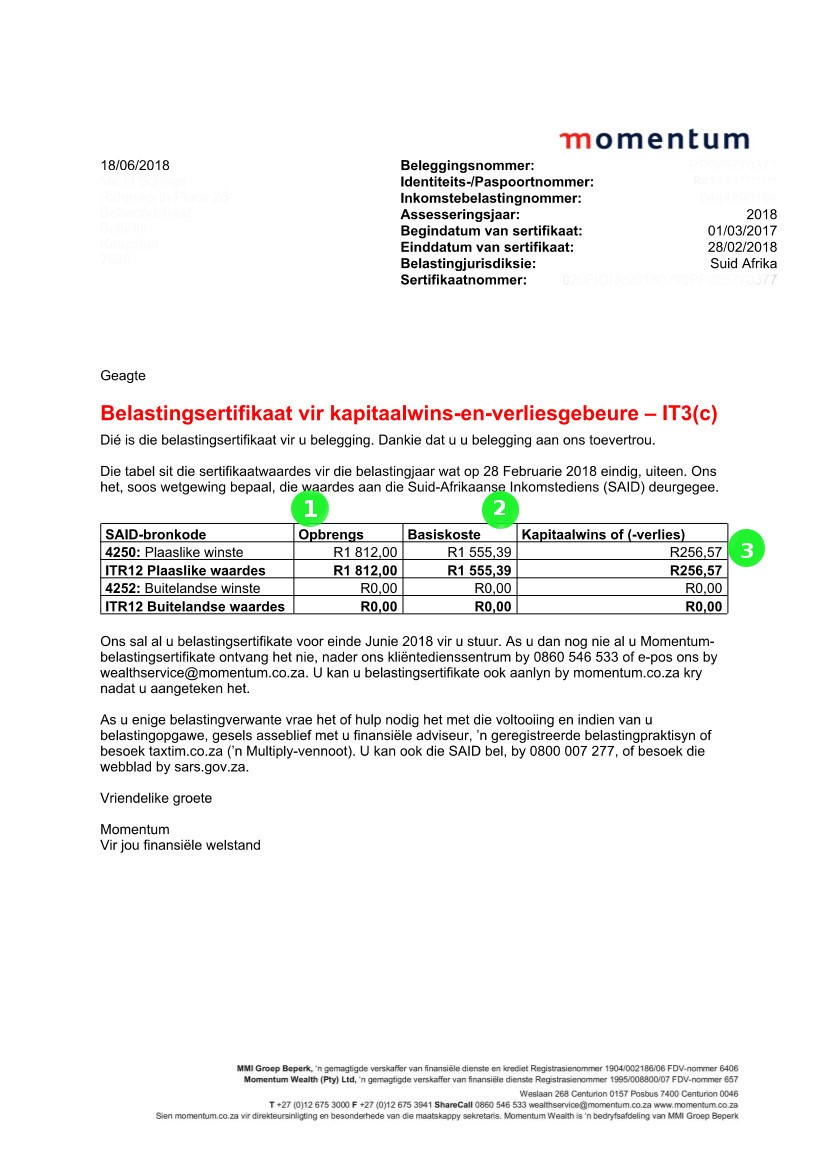

Navigating around your Momentum tax certificate (IT3c)

Posted 12 May 2020

1. Opbrengs/Proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. Basiskoste/Base Cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return.

...

Read more →

Do I earn enough to have to pay tax?

Posted 23 April 2020

Why must I pay tax, I don’t earn enough! Will I get a penalty if I don’t disclose all my income to SARS?

Read more →

Capital Gains Tax (CGT) Top Questions

Posted 16 April 2019

Below we take a look at Capital Gains Tax, particularly relating to the primary residence exclusion. What we’ve covered are some of the most pressing questions asked by our users on our help-desk. Take a few minutes to read the Q&As. Hopefully what has been unpacked in these Q&As will benefit and assist you with any uncertainties you might have experienced regarding this topic.

Read more →

Budget Speech: VAT rises by 1%, predictions were correct!

Posted 21 February 2018

Taxpayers should breathe a sigh of relief as a much lower than expected R36bn in increased taxes was announced by the once-off Minister of Finance. The biggest news amongst the increases was the VAT rise of 1%. For the first time in 25 years, all South Africans will see most goods and services become a little bit more expensive thanks to the Value Added Tax rise. Although controversial, a VAT rise was much needed and will bring in almost R23...

Read more →

2017/2018 Budget - The rich are going to pay more, but what does that mean for the rest of us?

Posted 22 February 2017

Personal Tax Rates (rates below)

Individuals across the country, those qualifying above the new tax threshold of R75 750 (previously R75 000) will be paying increased taxes of R16.5bn (previously R5.65bn in actual tax increase) for the next tax year, most of this will be for high income earners, however. Taxpayers generally across the board will be earning the tiniest bit more money each year as their tax brackets...

Read more →

2016 Budget Speech: Welcome Back, Minister! You Couldn't Have Returned Just for the Free Lunch?

Posted 25 February 2016

The 24th of February 2016 was supposed to be a watershed moment for the Economy of South Africa. The old-new Minister of Finance, Pravin Gordhan, was to deliver his budget for the 2016/2017 tax year and save South Africa from a financial pit-fall in the form of an International Ratings Agency downgrade. The jury is still out on whether or not this is possible. Immediately after the budget was revealed the Rand tumbled 2%, which doesn’t bode well for market sentiment. However, ...

Read more →

2016/2017 Tax Tables

Posted 24 February 2016

Income Tax Tables for the 2017 Tax Year - 1 March 2016 to 28 February 2017

Income Tax Thresholds

Read more →

SARS Tax Tables 2015

Posted 26 February 2015

Tax Thresholds:

Read more →

Thank you Minister - we expected worse! 2015 Budget

Posted 25 February 2015

New Finance Minister Nene delivers his first budget with some “better than expected” tax increases. The fight against corruption was highlighted with the minster announcing a series of reforms and procedures to be introduced both to curb corruption and make doing business with the state easier. The minister announced that R25bn would be saved in expenditure over the next two years, but R16.8bn is to be raised this year via tax increases and a remarkably large rise in the fuel and road accident fund levies. To be honest, we expected greater tax increases from the minister, thankfully he spared us some of the pain! ...

Read more →

2014 Budget - A move to economic transformation

Posted 26 February 2014

In delivering what could possibly be his last annual budget and perhaps in an election year a very pragmatic one, Minister Pravin Gordhan painted a rather positive picture for the future of South Africa, whilst at the same time warning of the impact the global economy is having on the South African economy. He too, had a “good story” to tell of how well managed the economy is and how we have survived the economic downturn of the last half decade. The minister, like his predecessors b...

Read more →

Garnishee orders explained: How SARS can deduct penalties directly from your pay cheque and how to stop it

Posted 14 November 2013

The last days of the month are often the most exciting for employees as they look forward to spending their monthly pay cheques. Unfortunately for many taxpayers anticipation quickly turns to grief when the money they receive in their bank account is suddenly less than they had expected. Stress and anxiety then result in light of impending debit orders and monthly expenses that need to be paid.

Apart from the ordinary deductions that your employer takes off your salary each month - expenses for your benefit such as medical aid or a retirement / pension plan - there is another deduction that can take place unexpectedly: a garnishee order...

Read more →

SARS is asking for more documents. Are they auditing me?

Posted 13 August 2012

For most people upon submission of their year-end income tax return, either nothing much will happen or a refund will be due, this being paid back within a matter of days. However in a small number of cases SARS requires extra documentation or proof to be submitted so that they can verify that everything you submitted in your tax return is correct. Don’t be afraid, although many people consider this an “audit” it isn’t nearly as frightening as that and doesn't mean you have done anything wrong. A true audit would be SARS requesting years of past documentation and opening up for examination all your tax affairs from previous years. ...

Read more →

South African budget 2012/2013 - "Tax by stealth"

Posted 23 February 2012

Eagerly anticipating the budget this year and forever the optimist, Finance Minister Pravin Gordhan started off well: R9.5bn of individual tax savings and revenue collection up by R10bn from the latest estimates. However, for the individual taxpayer, things went slightly downhill from there... Let’s unpack this a bit.

Not all Doom and Gloom

Ok, ok so maybe I have been too harsh as only certain individuals (the richer ones) will actually be subject to greater tax, the lower end income earners will benefit quite a bit from the new tax changes...

Read more →