I have received a SARS admin penalty - what do I do now?

Updated 18 April 2024

SARS have recently become a lot stricter about levying administrative penalties. These are penalties for missing the deadline to submit your tax return. You can read about these recent changes in the law here.

2023 tax season:

Non-Provisional Taxpayers: your deadline to submit your 2023 tax return was 23 October 2023. If you missed this deadline, it is very likely that SARS would have issued you an administrative penalty for every month that you are late...

Read more →

Tax on Pension Annuities

Updated 17 April 2024

Taking a closer look at why taxpayers may be required to pay in tax on pensions or annuities on assessment and how they can avoid a repetition of this each year.

Read more →

Navigating Tax Consequences for Social Media Influencers

Posted 10 April 2024

In today's digital age, social media influencers wield significant influence and often enjoy lucrative partnerships with brands. However, amidst the glitz and glam, it's crucial for influencers to be aware of their tax obligations. In this blog post, we'll explore the tax consequences that social media influencers need to consider in South Africa.

Understanding Tax Obligations

As a social media influencer in South Africa, it's essential to recognize that...

Read more →

How to Change/Verify Your Bank Details at SARS

Updated 10 April 2024

SARS has recently issued a new guide with regards to updating your banking details with them. This was done in order to reduce the risk of refunds being paid into the wrong accounts and also to streamline the process, which has tended to be an onerous one in the past.

Change of bank details can be done:

- in person at a SARS branch (During the pandemic, it would be best to make a telephonic appointment with SARS and then send them your supporting documents, SARS will cont...

Read more →

Top Questions on Income that is not taxed

Updated 20 March 2024

Exempt or non-taxable income refers to certain types of income, which is not subject to income tax.

Read more →

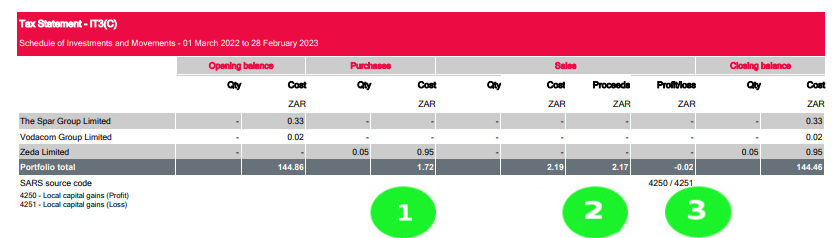

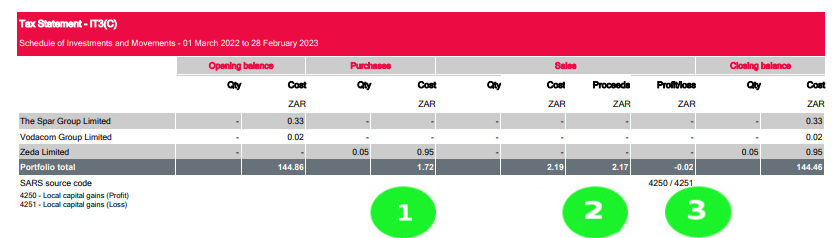

Navigating around your Allan Gray tax certificate (IT3c)

Updated 20 March 2024

1. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return.

2. This is the base cost i.e the costs attached to the sale of your shares. This amount needs to be entered as the base cost in the capital gains section of your tax return....

Read more →

How home office deduction impacts Capital Gains Tax

Updated 19 March 2024

With “flexible” employment being the new buzzword, more and more people are working part or all of the week from an office in their home.

Read more →

The Ins and Outs of Donations Tax

Updated 19 March 2024

Have you been the lucky recipient of a gift or donation from a generous family member or friend? Perhaps they struck it lucky on the Lotto and decided to share their winnings with you!

Or maybe you're the giving type and have donated cash, shares or even property to someone you felt deserved a little boost.

Irrespective of whether you're the giver or receiver of a donation or gift, it's good to understand donations from a tax perspective, and how to declare these to SARS.

Ready to find out?

Let's get started.

Read more →

4 Common Provisional Tax Penalties And How to Avoid Them

Updated 19 March 2024

Seasoned provisional taxpayers – those people who earn income from sources other than, or in addition to a regular ol' salary or traditional payment from an employer - are all too familiar with the process of estimating taxable income and submitting provisional tax returns. Not once - but twice a year!

Yes, it's a bit painful (although TaxTim makes it super easy) but entirely necessary if you don't want to be lumped with penalties from SARS...

Read more →

Tax Free Savings Accounts: Everything You Need to Know

Updated 19 March 2024

As a nation, South Africa does rather poorly on the savings front. With the majority living near or below the breadline, there’s not much to save when you’re more concerned with just getting through the month. Our high levels of consumer-debt, combined with little in the way of personal savings, means we become financial burdens on the government in the long-run...

Read more →

Do You Need to Ring-Fence Your Business or Rental Losses for Tax?

Updated 19 March 2024

When pursuing a business activity, trade or renting out a property, you’re no doubt doing so to make some money, but the reality for self-starters

Read more →

Food for Thought on Subsistence Allowances

Updated 19 March 2024

You’ve been up since 4am in order to catch yet another red-eye flight for a 9am business meeting - 1,400km away - and you’re already onto your third coffee by the time you board the plane.

Read more →

I forgot to submit some documents to SARS - what must I do now?

Updated 14 March 2024

If you left out some documents in your original submission to SARS, don’t panic.

SARS has recently implemented a new process

Read more →

Navigating around your Easy Equities tax certificate (IT3c)

Updated 12 March 2024

1. This is the gross base cost of all shares you bought through the institution. You must NOT use this value on your return.

To calculate the base cost of the shares that you sold, you will have to deduct the profit / loss from the proceeds and then enter this amount in the base cost field on your return.

2. This is the proceeds i.e the value that your shares were sold for. This amount needs to be entered as proceeds in the capital gains section of your tax return....

Read more →

Capital Gains and Losses: which source codes to use?

Posted 8 March 2024

In the Capital Gains section of the annual tax return (ITR12), SARS requires you to insert the relevant asset source code for the item you have sold. However, when you sell financial investments (e.g shares) the financial institution issues an IT3(c) which shows the profit/loss source code (i.e4250/4251) and not the asset source code. This causes confusion for taxpayers, who think th...

Read more →

How to add your Company Tax Number to your eFiling profile

Updated 7 March 2024

As part of SARS’ mission to simplify the eFiling system, the Tax Type Transfer process was updated in 2020 for all Tax products in a bid to offer users complete control of their eFiling profiles.

What's new on eFiling?

Overall, you can expect to see the following key changes introduced to eFiling from the end of April 2021:

- Changes to adding taxpayers to a profile (Organisations, Practitioners & individuals)

- The removal of multiple capture fields to simplify the process

- Validation requirements for captured information to ensure alignment to SARS records, e.g...

Read more →

Individual Tax Rate Tables

Updated 23 February 2024

RATES OF TAX FOR INDIVIDUALS

2024 tax year (1 March 2023 - 28 February 2024) - see changes from last year

Read more →

Budget 2024: No Major Tax Hikes

Posted 21 February 2024

South Africans were bracing themselves for bad news when Finance Minister Enoch Godongwana delivered his budget speech yesterday. However, in line with expectations during an election year, he delivered the reassuring news that there would be no significant tax hikes, no VAT increase, and no introduction of a new wealth tax. Contrary to earlier speculation, the medical tax rebate is also set to stay for a while longer.

However, this positive news is not without consequences. As South ...

Read more →

WIN up to R10,000 with TaxTim in 2024

Updated 13 February 2024

TaxTim has TWO exciting competitions in 2024!

COMPETITION 1: Win R10,000 in cash by filing your tax return with TaxTim

How to enter:

Read more →

Navigating around your Medical Aid Tax Certificate

Updated 5 February 2024

If you belong to a Medical Aid, there is important information on your medical aid tax certificate which needs to be included in your tax return.

This will ensure you receive the medical aid tax credit that is due to you.

Do you belong to any of the below medical aids?

- Bankmed

- Bonitas...

Read more →

What to do if your tax return was rejected by SARS

Updated 22 November 2023

If you've received a letter from SARS saying that your tax return has been rejected and you're not sure why, there could be a few reasons why this has happened. Here are some of the most common reasons, along with the corrective steps you need to take:

Reason 1: You were auto-assessed by SARS for the 2020, 2021 or 2022 tax year, but you submitted your tax return after the 40-day period SARS gave you, and you failed to request an extension in time. Please click

here to read more about auto-assessments. ...

What is Beneficial Ownership?

Updated 21 November 2023

The CIPC recently (1 April 2023) implemented a new register called the Beneficial Ownership (BO) register in an attempt to establish who owns or exercise control over which companies.

In layman’s terms, BO in respect of a company means, an individual who, directly or indirectly, ultimately owns that company or exercises effective control over that company for tax or financial purposes.

This new register is to assist law enforcement with relevant information when it comes...

Read more →

Why does SARS require manual intervention to finalise my return?

Updated 21 November 2023

When a Tax Return is filed usually SARS issues an immediate assessment (ITA34), however sometimes they do need to do a further manual check on their side.

Read more →

TaxTim Refund Policy Explained

Updated 21 November 2023

Each time SARS makes changes on eFiling or with their standard operating procedures, TaxTim has to adjust its systems and processes. We usually receive no warning of these technical changes. During this time, some of our users might feel a need to abandon our service and either seek help elsewhere or go and queue at SARS.

We understand this may cause frustration, however we will not refund you in cases where you have worked your way through every section of the TaxTim dialogue a...

Read more →

How do I know if I was auto-assessed?

Posted 17 November 2023

During the tax year, SARS issued SMS's to taxpayer whom they chose to auto-assess.

Those selected individuals would typically be taxpayers earning fixed salaries without additional allowances. If they did have medical aid and retirement annuity fund contributions, these details would have already been sent to SARS by their service providers, and SARS should have automatically included them in the assessment.

We've received many questions on our help desk where users say that t...

Read more →

Older posts →