How to Submit a Request for Reduced Assessment via SARS eFiling

Written by Alicia

Posted 6 November 2023

If your 2023 individual income tax return was auto-assessed by SARS earlier this year, and you intended to include extra income or expenses/ deductions but missed the deadline, don't be dismayed, there might still be a way to fix things!

Is SARS rejecting your tax return submission and your dispute too?

Have you requested an extension, but SARS granted it for a day before they replied to you? i.e, you asked for an extension till 10 November 2023, but SARS gave you an extension...

Read more →

Here is the process to follow if you have a dormant company

Written by Alicia

Updated 11 August 2023

It seems that dormant companies are on SARS' radar.

If you registered a company with CIPC some time ago and forgot about it, that company could land you in hot water with SARS. Read more to find out what the financial repercussions could be and why you should get a hold on the situation.

What is a dormant company?

A dormant company is classified as a company that has not actively traded for the full year of assessment. Because there is no activity in the compan...

Read more →

How to set up a payment arrangement with SARS

Written by Alicia

Updated 2 August 2023

With the end of the tax year looming, SARS tax collectors are on high alert to collect taxes and meet their revenue targets.

If you owe SARS, you should be receiving constant reminders to pay your debt. This may be in the form of SMS's, phone calls or even posted letters.

If the debt is unfamiliar or if you are not in agreement with the debt, you can File a dispute with SARS , howe...

Read more →

Track your tax return on the SARS website

Written by Alicia

Posted 20 July 2023

SARS have recently introduced a new way to track your tax return online via the SARS website.

See TaxTim's step-by-step guide to help you nagivate this new process:

1. Please go to the SARS website www.sars.gov.za click on "Contact Us"

2. Scroll down the page then click o...

Read more →

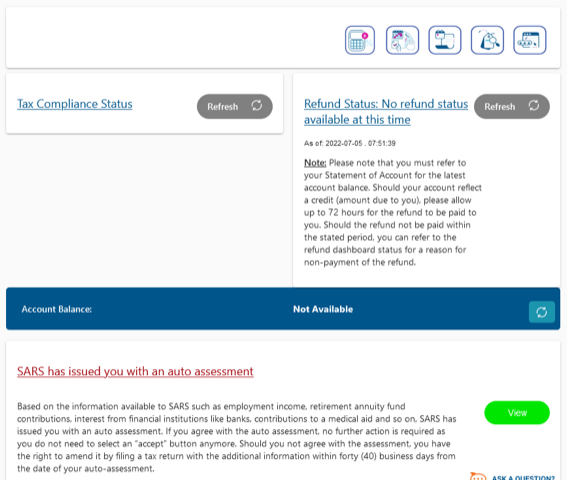

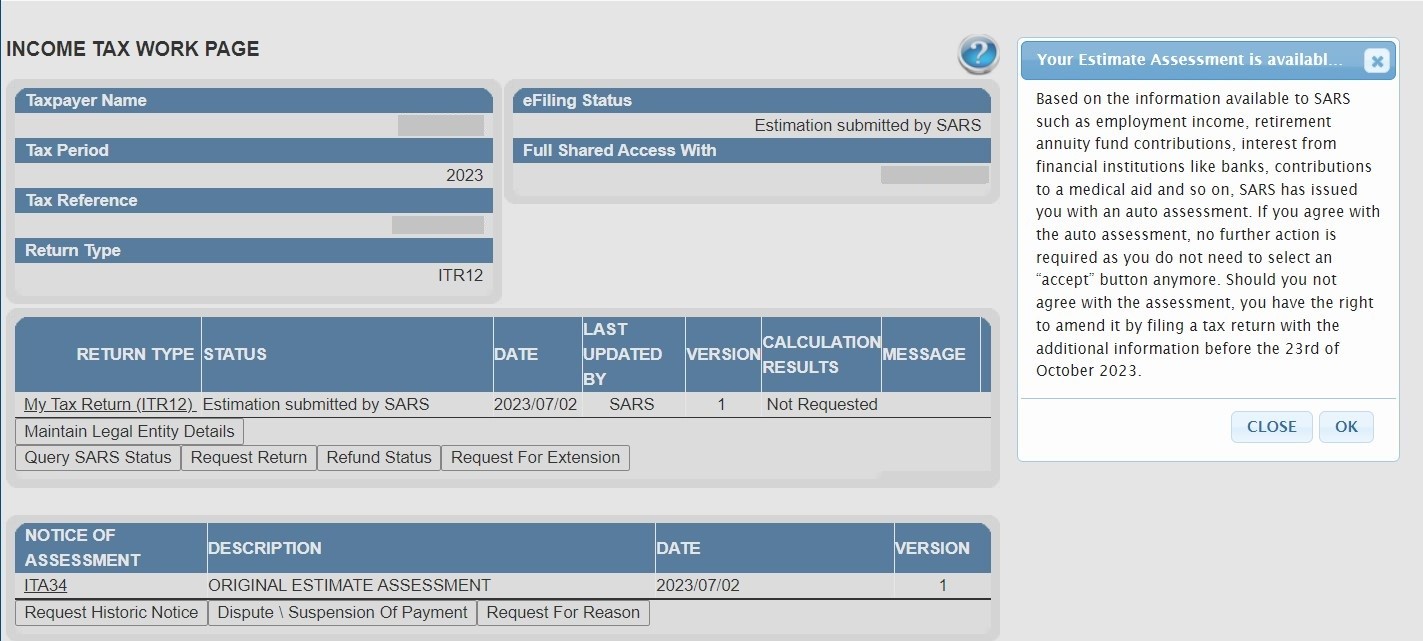

The new SARS auto-assessment

Written by Alicia

Updated 10 July 2023

Step 1:

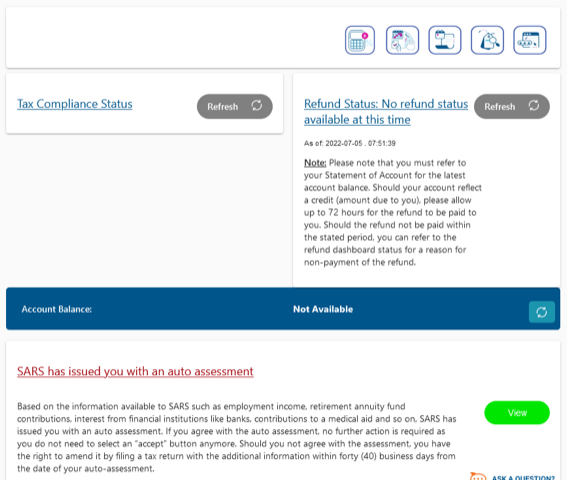

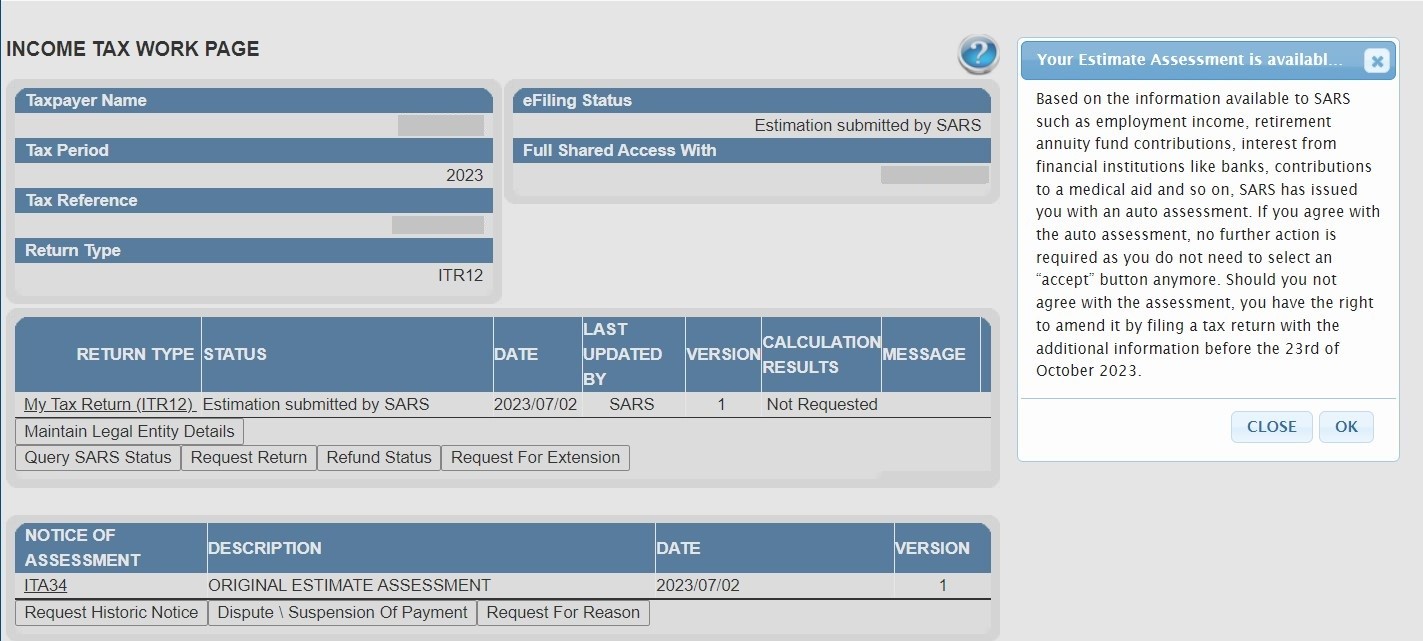

If you have been auto-assessed by SARS, you may see the screen below when you log into SARS eFiling.

Please click on "View".

You may also see this screen:

If you ...

Read more →

After all my documents submissions to SARS, they disallowed my expenses, why?

Written by Nicci

Updated 4 July 2023

We are starting to see some common trends whereby taxpayers’ expenses are disallowed because the documents submitted are falling short of SARS’s requirements. To avoid unnecessary frustration and time wasted in raising disputes, read on to see if any of these areas apply to you.

Travel deduction

In prior years, the submission of a logbook detailing your business mileage used to be sufficient to justify your travel claim. In recent years howev...

Read more →

Tax Season 2023

Written by Nicci

Posted 14 June 2023

The 2023 filing season opens this year at 8pm on Friday, 7 July. The countdown's on, it's almost here!

It is important to be aware that the season is shorter than prior years. This means that SARS are giving you less time to file your return.

Important Filing Deadlines

23 October 2023: non-provisional taxpayer (i.e. salaried employees)

24 January 2024: provisional taxpayer (i.e self-employed, rental earners, freelancers, ...

Read more →

Don't file on SARS eFiling before 7 July

Written by Alicia

Updated 14 June 2023

Last year, we noticed that many taxpayers filed their tax returns before the tax season officially began (i.e July). However, doing so caused delays and problems with their tax refunds.

There are only three specific instances where you can file your tax return (ITR12) directly on eFiling before tax season starts:

- If you have been declared insolvent / sequestrated or,

- If you need to file a tax return for a deceased estate or,

- If you are em...

Read more →

Why refund/tax liability estimations may differ from the SARS calculator and final SARS ITA34 assessment

Written by Evan

Updated 8 June 2023

TaxTim and SARS use all the financial information you provide to work out the most accurate estimate of your potential refund (or tax liability) for the current tax season. However, there may be some information we don’t have access to that won’t be included in the estimate of your tax refund or tax liability.

Information from previous tax seasons

Just like the SARS eFiling tax calculator, TaxTim doesn’t take into account provisional tax ...

Read more →

9 Steps to File an Objection to Your Tax Assessment

Written by Vee

Updated 30 May 2023

You’ve been diligent with your tax obligations, you’ve paid your PAYE (employees tax) each month without fail, you’ve kept all the supporting documents for your deduction claims and you’ve carefully filled out your tax return, making sure you’ve put all the right amounts in all the right places, against all the right codes. (Pssst, if you used TaxTim to help you complete your tax return, you wouldn’t have had to worry about all the right places and codes because that’s all automated for you)...

Read more →

Auto-Assessed Taxpayers Alert

Written by Nicci

Updated 22 May 2023

SARS has given you just 40 working days to submit your tax return. If you received your auto-assessment at the beginning of July, your time to submit has already expired. Auto-assessments issued on 4 July 2022, expired on 30 August 2022. Count your work days carefully. SARS is applying this rule very strictly. If you do nothing, your auto-assessment will very soon become FINAL.

For more on auto-assessments and their deadlines, please read

Read more →

SARS repeat reminders for supporting documents

Written by Alicia

Posted 27 October 2022

If you received another email from TaxTim requesting SARS supporting documents, but you already sent these to SARS more than 21 business days ago, one of these four scenarios might be the reason you are still waiting:

Scenario 1:

You submitted the documents directly on SARS eFiling yourself, but you did not inform TaxTim. In this case, our system needs to be updated to reflect that you already submitted your documents.

Please log into your TaxTim profi...

Read more →

SARS has introduced a new online travel declaration system for South Africans & its residents.

Written by Patrick

Posted 18 October 2022

The South African Revenue Service (SARS) says it will implement an "online traveller declaration system" that will go into effect on November 1, 2022. According to SARS, the new system will be applicable to all South Africans travelling abroad and says that it will simplify passenger movement at South African airports.

According to SARS, the system's goal is to collect travel information and in exchange, grant a traveller pass via email. It requires that all South Africans and residen...

Read more →

New SARS Deadlines for Auto-Assessments

Written by Nicci

Posted 24 June 2022

From 1 July to 4 July, SARS aims to issue auto-assessments to taxpayers who are due a refund.

The rest will be issued in batches up to 24 July.

Timing is Everything

If you receive an auto-assessment, you will have just 40 working days to request a tax return on TaxTim (or eFiling), complete and submit it. If you take no action within the ...

Read more →

Tax Season 2022

Written by Nicci

Posted 10 June 2022

The 2022 filing season opens on 1 July. Tick tock. That’s just around the corner.

It is important to be aware that the season is shorter than prior years. This means that SARS are giving you less time to file your return.

Important Filing Deadlines

24 October 2022: non-provisional taxpayer (i.e. salaried employees)

23 January 2023: provisional taxpayer (i.e self-employed, rental earners, freelancers, etc)

Auto-Assess...

Read more →

SARS penalties: strict rules for 2022

Written by Nicci

Posted 10 June 2022

SARS is warning that those who fail to submit their tax return on time, will face harsh penalties. The period of leeway which applied to 2021 has now passed.

SARS announced a change to their legislation in December 2021 whereby they would levy administrative penalties to taxpayers who missed the filing deadline for one or more tax returns. Prior to this change, taxpayers only paid penalties when two or more returns were outstanding.

As a...

Read more →

The Public Servants Association (PSA) Notifies SARS of strike action

Written by Patrick

Posted 19 May 2022

The Public Servants Association (PSA) served SARS with a notice of strike action on Friday, 13 May 2022. The strike is due to take place on Wednesday, 25 May 2022.

The union is demanding a CPI plus 7% across the board, while the National Education, Health and Allied Workers’ Union (NEHAWU) demands an increase of 11.5%. The unions and SARS hit a deadlock as SARS unashamedly made a final offer of a 0% increase.

If there is no resolution at the Com...

Read more →

Your social media posts might flag you with SARS

Written by Patrick

Posted 16 May 2022

According to SARS commissioner Edward Kieswetter, some South Africans who came into money were eager to “display their wealth”, giving cause for SARS to look into the income of these individuals.

In many cases, SARS found that there was a major disconnect between the income that was being declared and the type of lifestyle that these individuals were leading, according to third-party data. These include social media platforms.

As we already know, people are often i...

Read more →

SARS clamps down on crypto investors

Written by Patrick

Posted 16 May 2022

For months, SARS has been clear about its plan to clamp down on crypto investors. While many may be under the impression that crypto is going under the radar, SARS is firmly taking the position that it is not.

With luxury audits being the order of the day, SARS is continuously looking into those who live luxurious lifestyles, particular those who own luxury cars and crypto assets, without declaring their income to the revenue service.

In many cases, this income pertains to the...

Read more →

Retrenched? Here’s how you will be taxed

Written by Patrick

Posted 23 February 2022

In 2020, about 2.2 million jobs were lost in South Africa and in 2021, that number is expected to double as a result of Covid-19. With that, we have found that there are many questions surrounding the subject of taxes and severance packages. Here’s everything you need to know.

The Basic Conditions of Employment Act states that your severance pay should include at least one week’s worth of remuneration for every full year of work. Your severance package may consist of your ...

Read more →

When Will SARS Pay My Tax Refund?

Written by Vee

Posted 16 November 2021

Hundreds of thousands of South Africans are filing their annual tax returns and everyday people ask us “when will I get my refund from SARS?”.

Read more →

Important Notice: You Will Face New Penalties if You Miss the November Tax Deadline

Written by Patrick

Posted 12 November 2021

If you’re an individual non-provisional taxpayer, make sure you file your tax return before or on the deadline of 2 December 2021.

SARS is warning that those who fail to submit on time, will face penalties. Legislation has changed and you will have to pay penalties in January 2022 if you have not submitted one or more of your returns. This means that if you file your 2021 return after the deadline, SARS will levy an admin penalty.

Before, you only paid penalties when two...

Read more →

What is Identity Fraud?

Written by Patrick

Posted 20 October 2021

Identity fraud happens when someone uses your personal information, such as your name and identity number, without your permission.

Criminals steal your identifying information from your home, car or wallet and even your rubbish bins and use your details to commit crime. Con artists can also get your personal and confidential information from the internet, social networking sites, emails, spoofed websites, Short Message Services (SMS) and unsolicited telephone calls.

It’...

Read more →

SARS can now fine you or take you to jail for these tax mistakes

Written by Patrick

Posted 18 June 2021

In the past SARS needed to prove that a taxpayer had committed a tax crime “willfully and without just cause” but the legislation has just been changed. The court can now find you guilty of a tax crime even in cases of negligence or even in a case where the taxpayer may have made a mistake.

The amended law separates non-compliance into two groups: the first is where the taxpayer’s intention is not considered, and the other group is where the taxpayer’s intentio...

Read more →

How to reject the SARS Auto Assessment

Written by Nicci

Posted 14 June 2021

If SARS have issued you an Auto Assessment, you will need to follow these steps to reject it so that we can help you to complete and submit your return to SARS.

Read more →

Older posts →← Newer posts

1 2 3 4 5

Written by Alicia

Written by Alicia

Written by Nicci

Written by Nicci

Written by Evan

Written by Evan

Written by Vee

Written by Vee

Written by Patrick

Written by Patrick